Theta surges 24% in 24 hours, hits 8-month high: Is $3.3 ahead?

- Theta has surged by 158.86% over the past month.

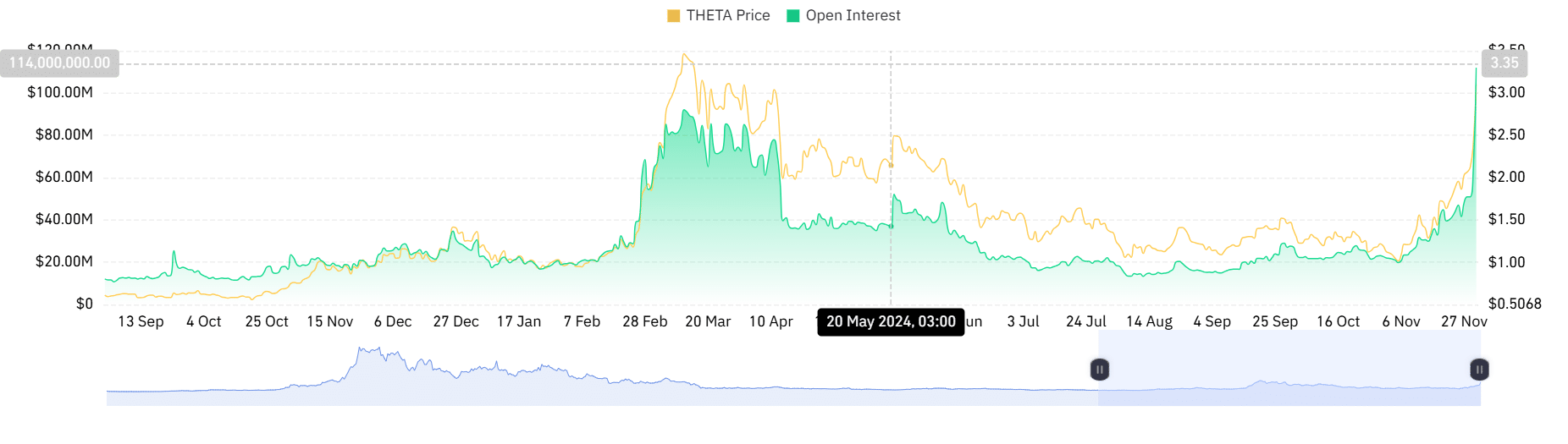

- The Futures Open Interest spiked over the past 24 hours to a new ATH of $111.9 million.

Over the past month, the Theta Network [THETA] has experienced a sustained uptrend. Since hitting a low of $1.25 earlier last month, the altcoin has surged to an 8-month of $3.1.

As of this writing, THETA was trading at $2.8. This marked a 24.67% increase over the past 24 hours. Equally, the altcoin has spiked on weekly and monthly charts, hiking by 45.62% and 158.86% respectively.

But despite the recent price pump, THETA remains 81.91% below its ATH of $15.90. However, the current market condition points towards rising demand and positive sentiment.

What THETA’s charts say

According to AMBCrypto’s analysis, THETA was experiencing strong demand and bullish sentiment at press time.

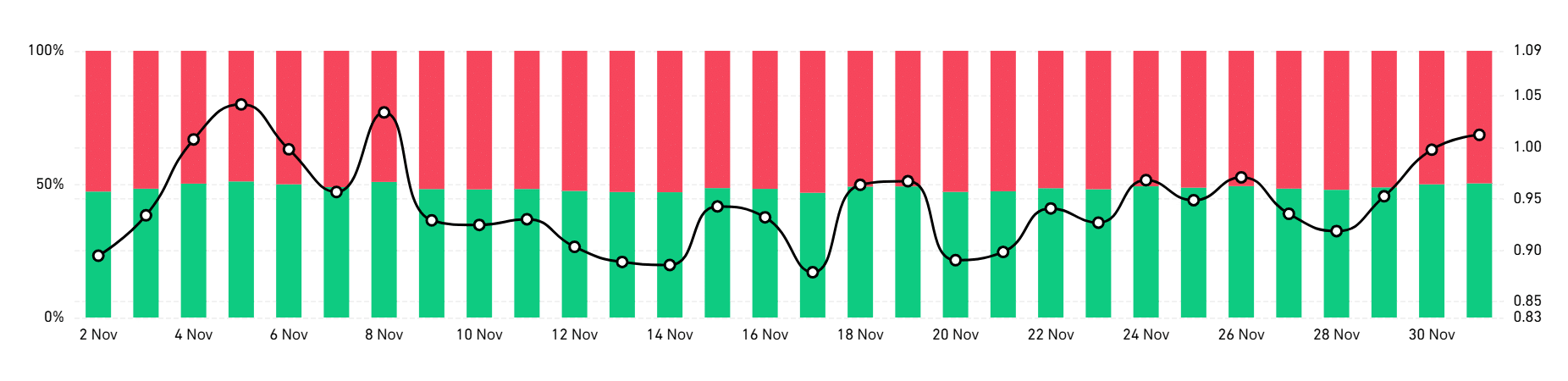

Per Santiment’s data, the Weighted Sentiment spiked to 0.7 from a low of -0.1. This suggested that most investors were positively inclined, compared to those with negative sentiment.

When positive sentiment is higher, it implies that most investors are betting on prices to rise.

Additionally, AMBCrypto’s observation of increased demand was evidenced by the rising trading activities. As such, over the past 24 hours, trading volume has spiked by 442% to $682.33 million.

This demand is shown by the rising Open Interest. Over the past 24 hours, Futures Open Interest has spiked to hit a new all-time high of $111.99 million.

Such a surge in Open Interest suggests that investors are actively opening new positions while existing ones hold their trades.

Significantly, these open positions are mostly long, according to Coinglass. THETA’s Long/Short Ratio shows that long position holders were dominating the market.

This implied that most traders were betting on prices to rise.

This bullishness is prevalent among buyers, as evidenced by THETA’s Advance Decline Ratio (ADR), which had increased to 1.9. So, buyers were dominant, which pushed prices to make more gains.

This dominance among buyers has created a strong upward momentum, as evidenced by a rising RVGI.

Read Theta Network’s [THETA] Price Prediction 2024–2025

What’s the next move?

Simply put, THETA was experiencing a strong upward momentum at press time. As such, buyers have dominated the market, creating a sustained bullish wave.

With the prevailing market conditions, THETA could find the next significant resistance around $3.3. Subsequently, a market correction will see the altcoin retrace to $2.6.

![Sui [SUI]](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-77-1-400x240.png)