Institutional Bitcoin sales loom large: $90K to be the next local bottom?

![Bitcoin [BTC] $90K](https://ambcrypto.com/wp-content/uploads/2024/12/NewsarticlesFIRitika-1-1200x686.webp)

- BTC’ biggest threat right now is a decline in institutional backing at a time when volatility is increasing.

- If this trend continues, $90K could serve as the local support level.

Bitcoin’s recent price action has demonstrated resilience, with the market staying bullish despite Bitcoin [BTC] entering the last month of the year without breaking through the $100K barrier. Strong demand continues to absorb sell-side pressure, reinforcing this optimism.

Additionally, while countless weak hands have exited the cycle after securing massive profits, absence of a solid pullback highlights a robust sense of FOMO among investors.

However, even with metrics indicating a steady trajectory toward $100K and the anticipated Fed rate cut adding to the optimism, AMBCrypto delves into whether a potential retracement to $90K could act as the necessary catalyst for Bitcoin’s next major move.

Loss of institutional support could pose a major threat

Currently, Bitcoin stands at a critical crossroads, with its trajectory hinging on sustained support fueled by steady accumulation from both retail and institutional investors.

Microstrategy, being a company heavily invested in BTC, sees its stock [MSTR] react more dramatically to changes in Bitcoin’s value.

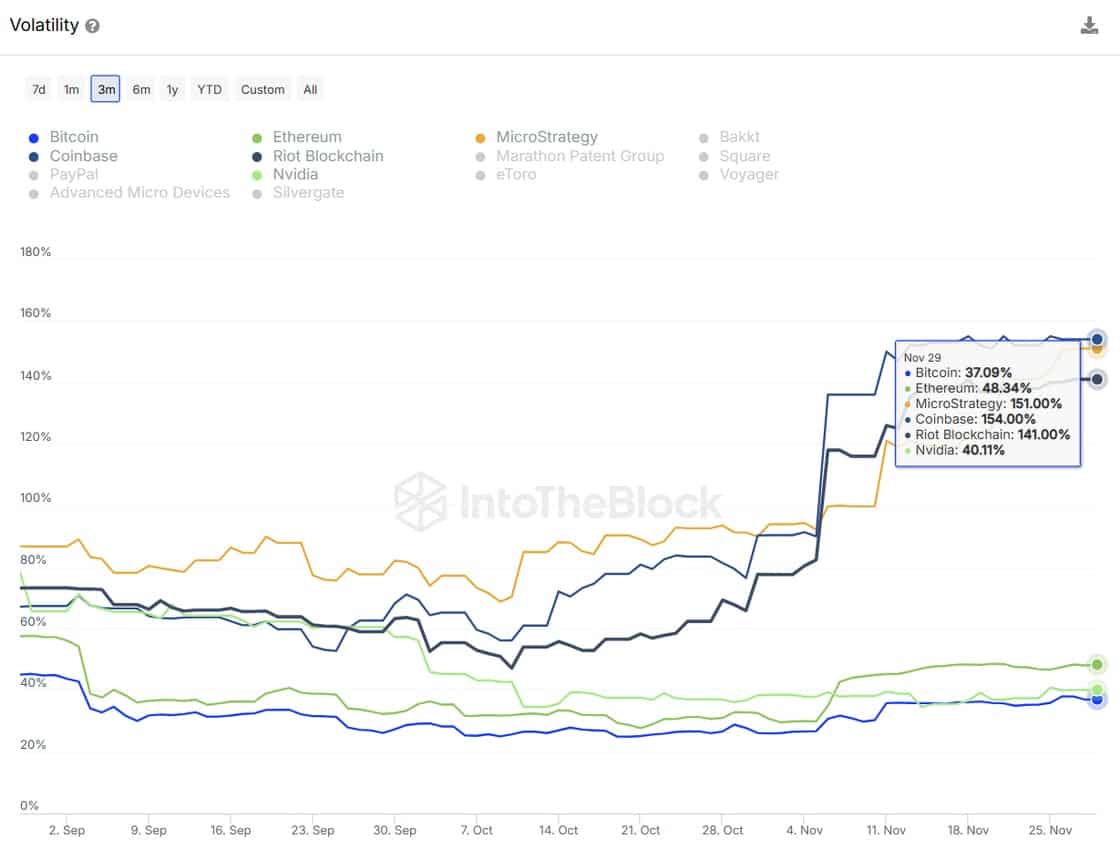

As highlighted in the chart below, MSTR’s volatility being four times that of BTC signifies that MicroStrategy’s stock price is expected to fluctuate approximately four times as much as Bitcoin’s, introducing a heightened and calculable risk for its investors.

In this climate, Bitcoin’s appeal as a store of value could weaken, potentially triggering institutional sell-offs and liquidations.

This comes as MicroStrategy’s stock becomes more volatile, prompting investors to reassess their exposure to BTC, particularly through MSTR, which could lead to a broader market correction.

As a result, MSTR’s premium BTC holdings have dropped from a peak of 240 on 20th November to 135 in just under seven trading days. If this selling pressure continues unchecked, it could trigger significant losses for Bitcoin holders, potentially driving the price into a deeper pullback.

So, keep the volatility in check

At 63, the crypto volatility index indicates noticeable, but not extreme, market volatility. However, this follows a rebound just two days ago from the 60 threshold, which has historically been a significant support level.

In simple terms, if the volatility index rebounds strongly, it could rise towards or above the previous rejection point of around 70. A CVI above 70 signals higher expected price fluctuations and greater market uncertainty.

While this could be either bullish or bearish, examining Bitcoin’s current price chart, which shows severe fluctuations over the past week, suggests that heightened volatility might undermine institutional confidence in a parabolic run.

Historically, a volatility index hitting a peak has coincided with Bitcoin reaching a bottom.

This further supports AMBCrypto’s earlier thesis that Bitcoin could hit a local bottom, leading to a healthy retracement, lower volatility, increased institutional FOMO, and a potential breakout from inconsistent price action.

Where could BTC see a healthy retracement?

In a recent report, $90K was identified as a key support level, marking a significant bottom formation, driven by robust retail accumulation and backing from ETFs.

This suggests that if volatility moves into the ‘high’ zone, where significant swings can occur in a short time, the likelihood of a pullback remains high.

In such a scenario, $90K could serve as a strong liquidity pool, attracting both swing traders and institutional activity, leading to a potential uptick in price.

Moreover, with the upcoming Fed meeting, traders are increasing their bets on a 25-basis point rate cut in December. The market is now pricing in a 64.7% chance of this happening, up from 55.7% just a week ago.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Certainly, this macroeconomic move is likely to trigger sudden swings in the derivative market, with the possibility of a short squeeze remaining high. A sharp uptick in price could force short-sellers to close their positions.

As a result, market volatility is likely to rise, creating favorable conditions for a healthy retracement as many institutions may pull back from accumulating Bitcoin in this ‘high-risk’ environment.

![Sui [SUI]](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-77-1-400x240.png)