Will CHZ’s 140% monthly gains be enough for a hike to $0.35?

- Technical analysis revealed that the token broke out of a bullish pattern, signaling potential upward movement

- Steady hike in addresses holding CHZ underlined growing investor participation

Chiliz [CHZ] has delivered strong market performance to its holders lately. In fact, at the time of writing, the token had recorded gains of over 12.34% in the the last 24 hours alone. These gains only contributed to the altcoin’s cumulative monthly gains of 145.3%.

The scale of these gains highlighted rising market confidence and stronger participation from bullish traders.

AMBCrypto’s analysis revealed that CHZ could continue its rally in the next trading sessions. If its press time momentum holds, the token may approach its $0.35 target, further strengthening its position in the market.

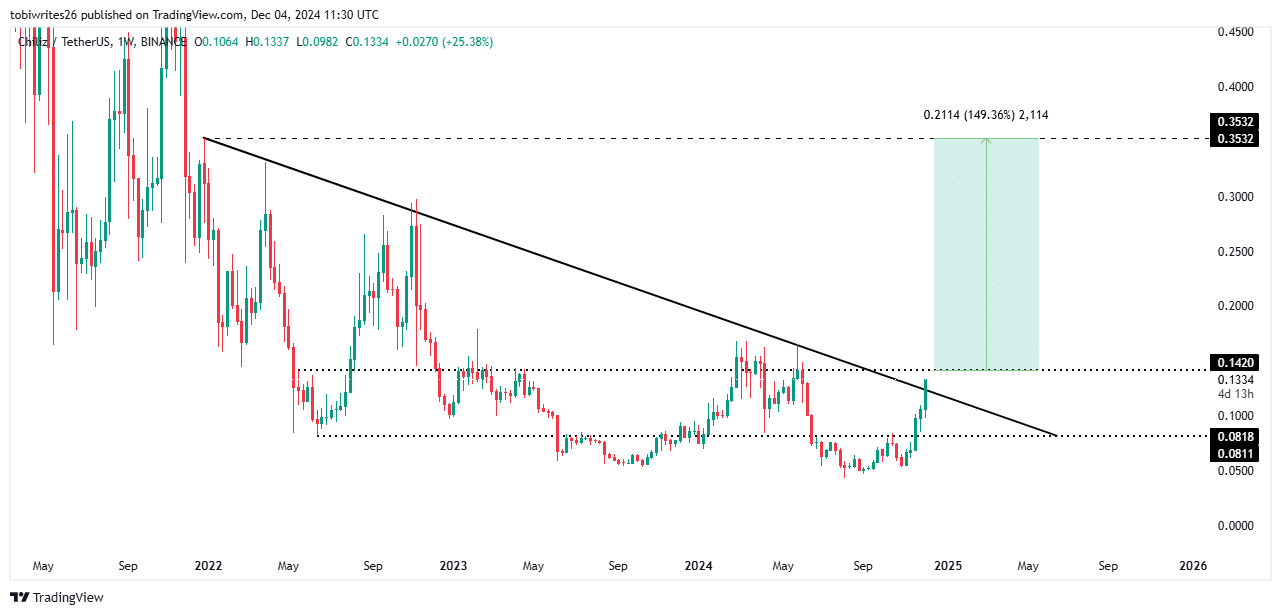

A path to a 149% gains for CHZ

At the time of writing, CHZ had broken through a bullish triangle pattern after months of consolidation. This pattern saw the asset oscillate between a descending resistance line and a horizontal support level. Based on the chart, CHZ can be expected to target the start of the descending channel at $0.35. Achieving this level would represent a 149.33% hike from its press time price of $0.1382 – Nearly doubling its value.

Despite the bullish outlook, however, CHZ may encounter resistance at $0.1420. Overcoming this level will be crucial for the token to extend its upward movement.

Market sentiment highlighted some level of optimism too, with participants likely to provide the momentum required to sustain CHZ’s hike.

Rise in wallet activity

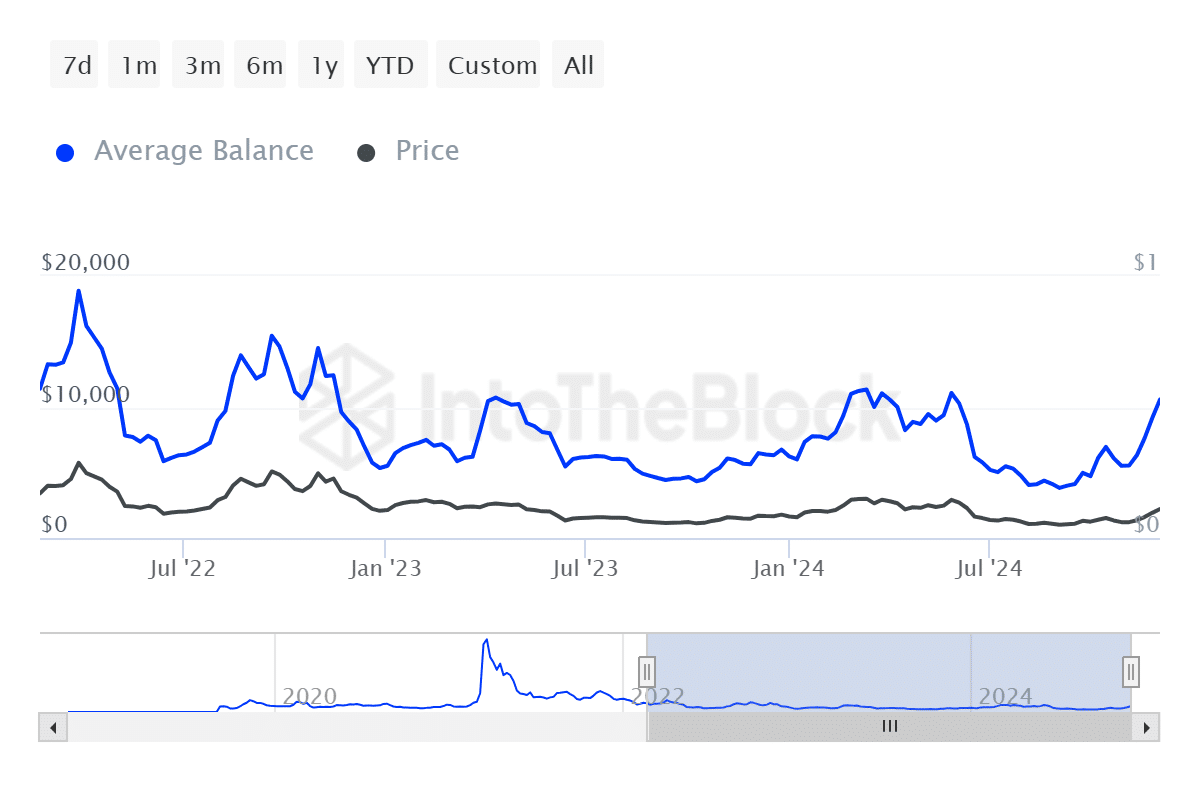

Additionally, data from IntoTheBlock highlighted a significant hike in metrics pointing to stronger buyer action in the market.

The average balance of wallets holding CHZ surged, reaching $10,569.93 in the last 24 hours—One of its highest levels this week. This alluded to a notable jump from its weekly average of $9,670.27.

An increase in the average balance often means heightened buyer interest and rising demand, especially as traders show greater confidence in the asset’s potential.

Another key metric seemed to be the coin holding period, with the same having steadily grown in December. The average holding time has now reached three months too. This shift could point to a longer-term commitment from CHZ holders, contrasting with the shorter-term patterns seen previously.

Investor funds flowing into CHZ

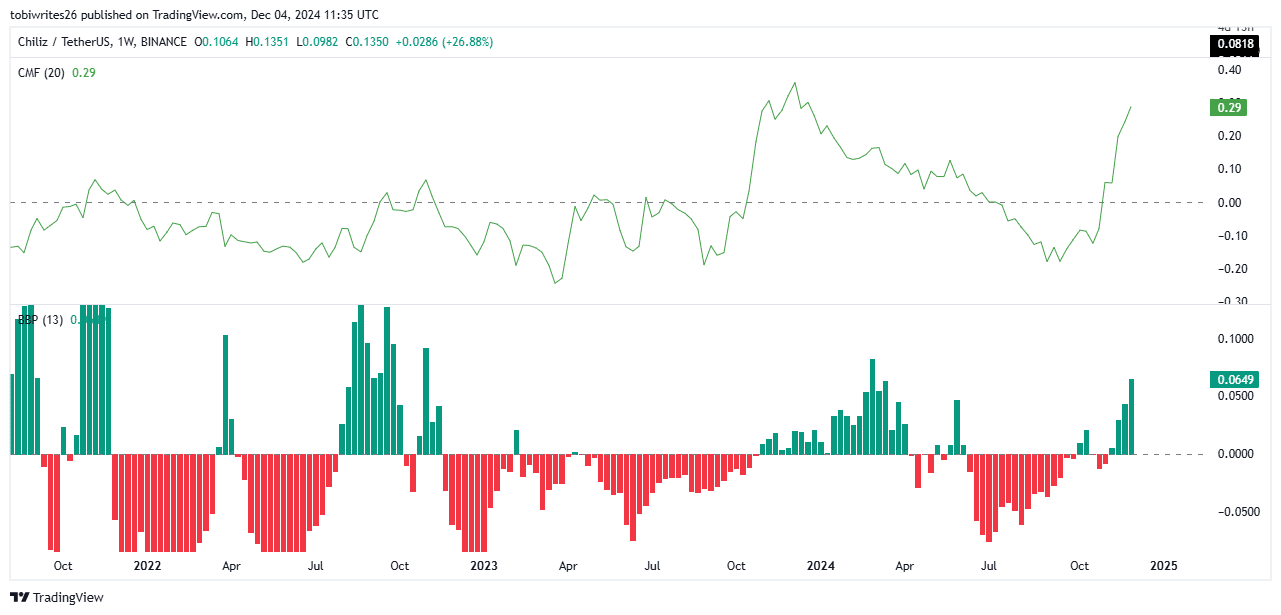

Finally, market data indicated a growing influx of investor funds into CHZ.

The Chaikin Money Flow (CMF), a key metric for tracking capital inflows, saw a significant surge. At the time of writing, the CMF had a value of 0.28, suggesting that the ongoing rally may be far from over.

Also, the Bull Bear Power indicator, which measures market dominance between bulls and bears, revealed that bulls had gained control of the market. This was evidenced by the strengthening bullish momentum bars, reinforcing the upward trend for CHZ.