Is Polygon set for a historic hike above $2.9? New data suggests…

- POL seemed to be mimicking a pattern last seen in 2021

- Altcoin’s trading volume declined last week, indicating low trading activity

Polygon [POL] has been moving in investors’ favor over the past few weeks, allowing it to regain some amount of its lost market capitalization.

In the meantime, however, a bullish divergence appeared on the token’s chart, indicating the possibility of a massive rally. If that’s true, then POL might retest its all-time high.

Is Polygon ready to recover?

Like most cryptos, POL bulls also dominated the previous week by pushing the token’s price up by over 18%. Thanks to its latest pump, POL’s market capitalization reached $5.9 billion, making it the 27th largest crypto on the charts.

At the time of writing, the altcoin was trading at $0.7063, way lower than its all-time high of nearly $2.9—A level last reached on 27 December 2021.

However, a recent analysis revealed that the trend might change and POL might begin its journey towards its ATH and beyond. Javon Marks, a popular crypto analyst, posted a tweet highlighting a few developments related to POL.

According to the same, a bullish divergence appeared on POL’s chart. A similar incident happened back in 2021, which resulted in a rally, allowing Polygon to hit an ATH.

If history repeats itself, then it won’t be surprising to see POL exceeding its current ATH. The tweet also mentioned that POL’s price may be set to break out from a pattern, further increasing the chances of a massive bull rally ahead.

To be precise, a breakout could trigger a 300% bull run.

POL’s short-term targets

Since POL’s press time price was considerably lower than its ATH, it won’t be wise to expect the token retesting that high in the near-term. Therefore, AMBCrypto checked POL’s on-chain data to find out what to expect in the short-term.

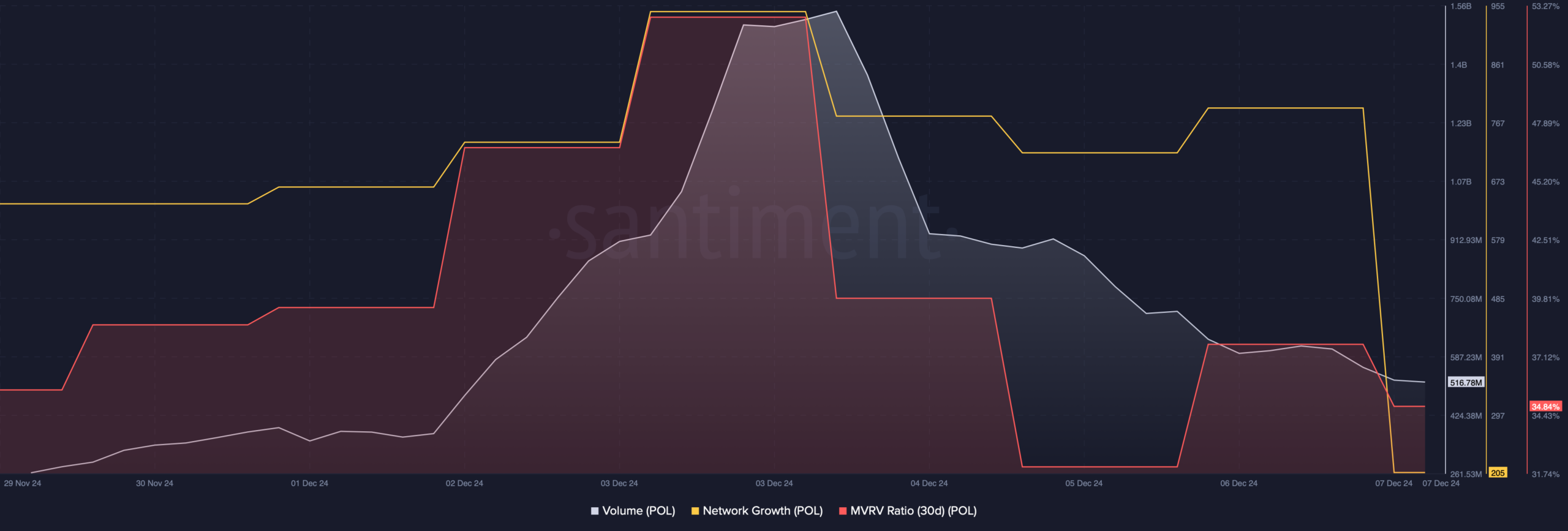

Santiment’s data revealed that while POL’s price climbed, its trading volume dropped – A sign of low trading. Its MVRV ratio also plummeted and at press time, had a value of 37.7%. Apart from this, Glassnode’s data pointed out that despite the latest price hike, POL’s realized losses rose across the board.

Nonetheless, Polygon’s velocity has remained relatively high. This meant that POL was used more often in transactions within a set timeframe.

Is your portfolio green? Check out the POL Profit Calculator

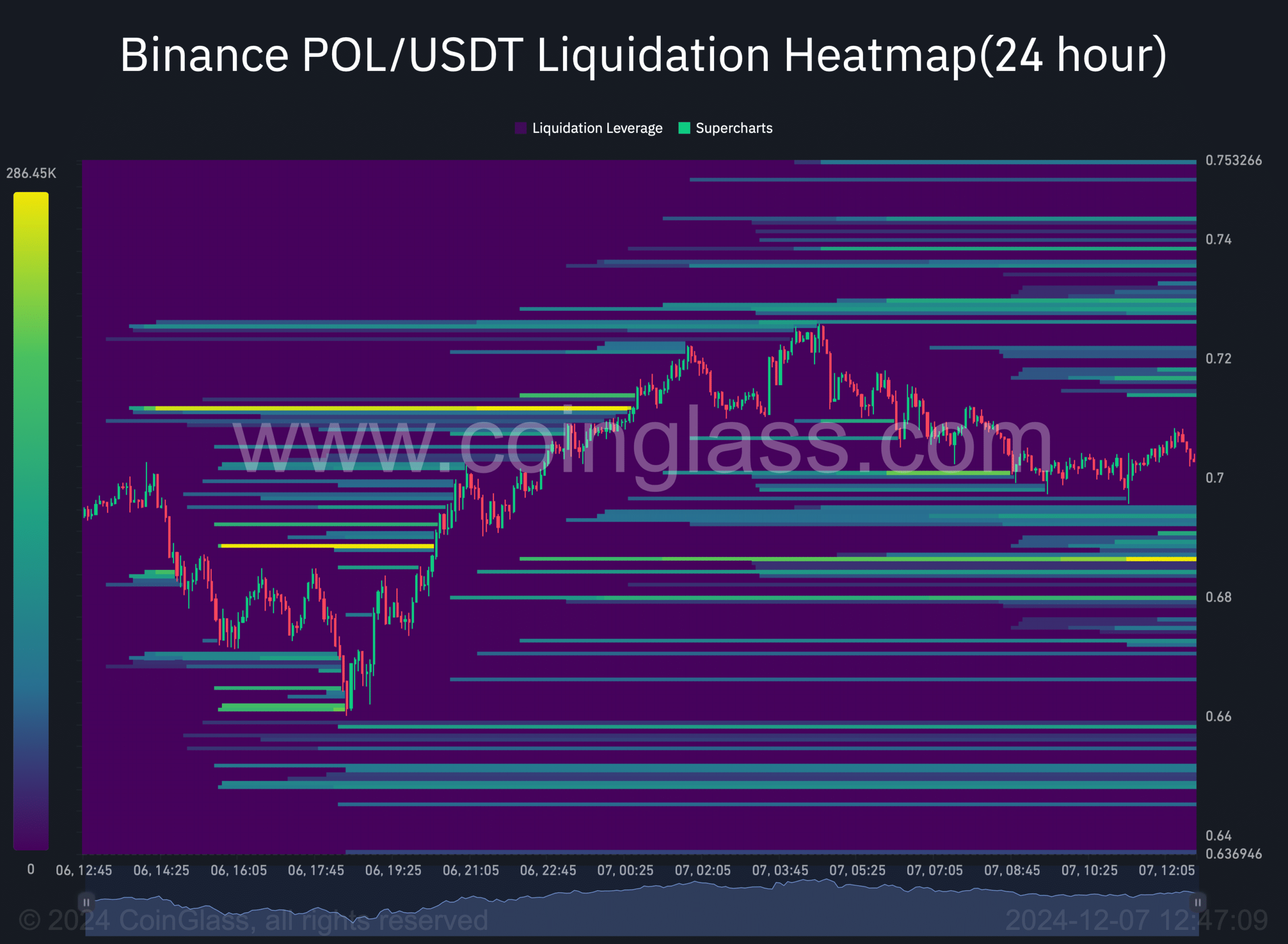

In the short term, if POL bulls dominate, then the first target the token might reach is $0.73, as a liquidation barrier lies there. However, in case of a correction, POL might drop to $0.68 soon.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)