Record losses in crypto: Traders liquidate over $1.7B in 24 hours

- Over the past 24 hours, the market recorded its largest single-day liquidation, with traders experiencing significant setbacks.

- ETH and DOGE holders were among the hardest hit, as prices tumbled during the sell-off.

The global cryptocurrency market cap dropped by 4.11%, falling to $3.47 trillion. Trading volume, however, surged by 114.40%, reaching $352.9 billion as investors reacted to the volatility.

Market analysts note that the long-anticipated altcoin rally may face delays, given the current shift in sentiment and uncertain market conditions.

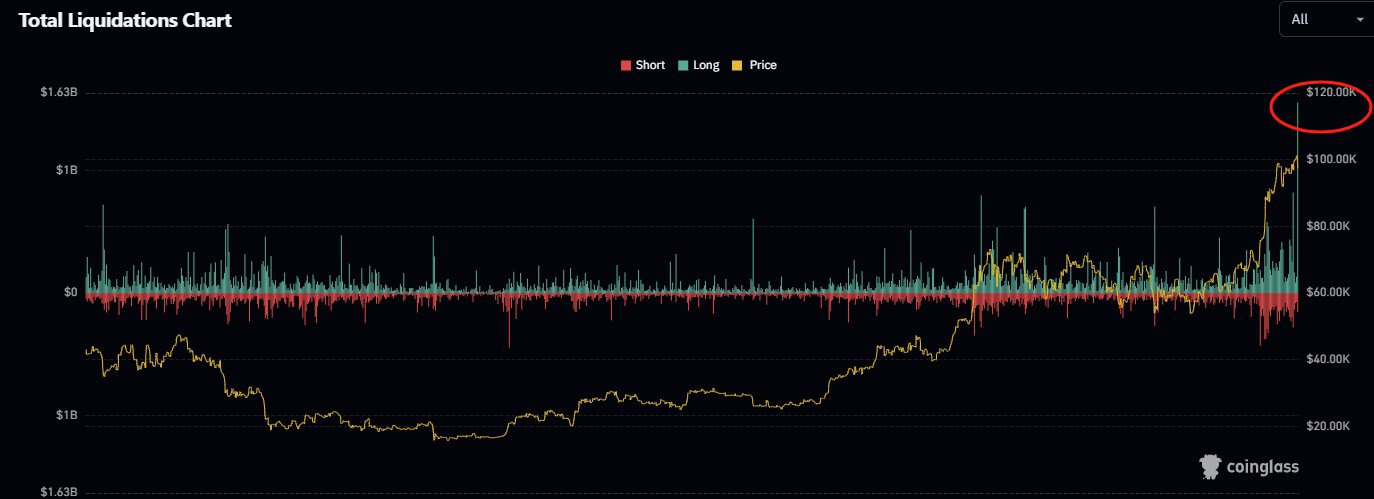

Market sweep: $1.71 billion liquidated

The crypto market’s latest downturn has triggered unprecedented losses, leaving traders in disarray.

Insights from Coinglass reveal that the past 24 hours marked the highest single-period liquidation and the largest number of affected traders since the start of the current market cycle.

Coinglass reported:

“In the past 24 hours, 569,214 traders were liquidated, with total liquidations amounting to $1.71 billion.”

This aggressive market reaction signals a potential for continued declines, especially among altcoins. The widespread panic selling has eroded market confidence as traders rush to preserve profits amid mounting volatility.

Analysts caution that altcoins may take time to regain momentum, as sentiment indicates the market is not yet primed for a recovery.

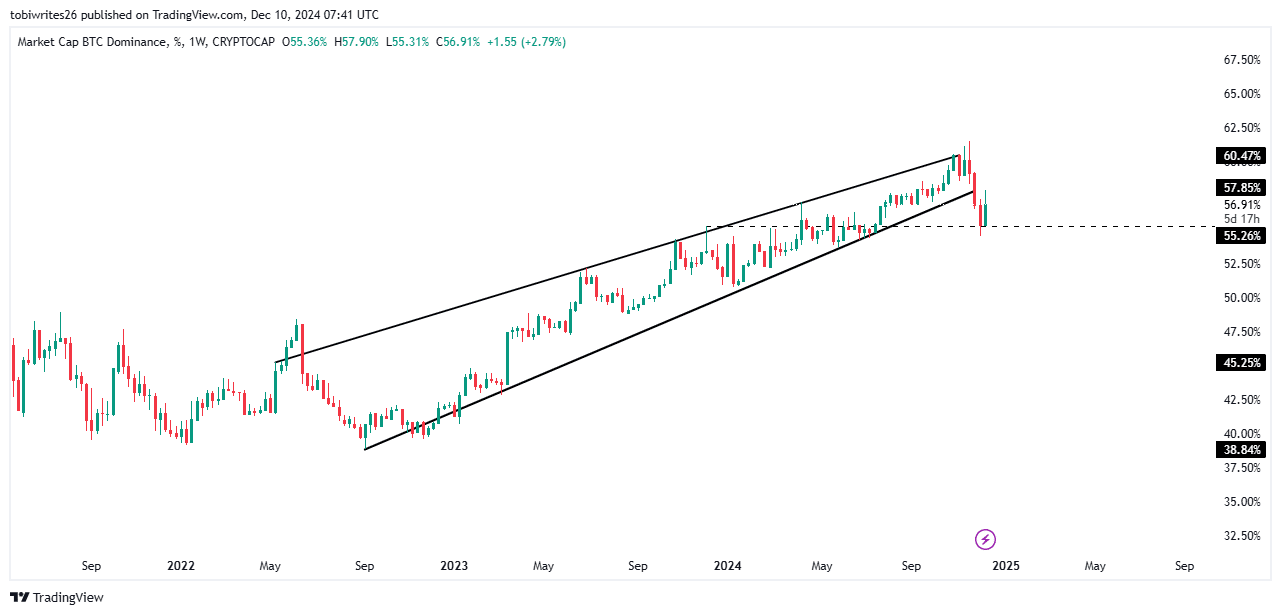

Altcoins weaken as Bitcoin dominance climbs

Bitcoin [BTC] dominance (BTC.D) has surged over the past 24 hours, reaching a high of 57.90%, up from 56.86%. This rise reflects a shift in market dynamics, with Bitcoin asserting greater control over the crypto market.

The increase in Bitcoin dominance was triggered by a bounce off the 55.26% support level, which held firm and acted as a catalyst for Bitcoin’s renewed strength.

Typically, a drop in BTC.D indicates altcoin strength, often leading to rallies. In contrast, a rising dominance chart indicates capital flowing back to Bitcoin, leaving altcoins struggling to maintain momentum.

If Bitcoin dominance continues its upward trend, altcoins are likely to face further losses, extending the current bearish outlook.

ETH, DOGE lead with $350 million liquidated

Ethereum [ETH] and Dogecoin [DOGE] bore the brunt of the recent market downturn, recording the highest liquidation losses among altcoins, according to data from Coinglass.

Combined, the two assets saw $350.56 million wiped out, with ETH accounting for $249.48 million and DOGE contributing $101.08 million. These liquidations occurred as the market moved sharply against trader expectations, forcing positions to close.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Long traders were the most affected, losing $213.28 million on ETH and $83.13 million on DOGE. This highlights a market heavily skewed in favor of bearish sentiment.

A potential recovery would require renewed demand for these assets, possibly driven by large investors (whales) seizing the opportunity to accumulate at lower prices. If such activity materializes, a rebound could occur sooner than anticipated.