Cardano drops 17%: Here’s how reduced network usage stalled ADA’s rally

- Cardano has dropped by 17% in 7 days as bearish trends intensify.

- The network has recorded a drop in DeFi TVL & active addresses, which has fueled the downtrend.

Earlier this month, Cardano [ADA] saw its market capitalization surpass $40 billion for the first since since 2022. This growth came amid a massive rally that pushed ADA to a multi-year high of $1.32.

Cardano’s rally has since cooled, given that at press time, it traded at $1.02, marking a 17% decline in seven days. Its market capitalization has also dropped to $35 billion. This bearish reversal could be attributed to several factors.

Cardano’s DeFi TVL drops from record highs

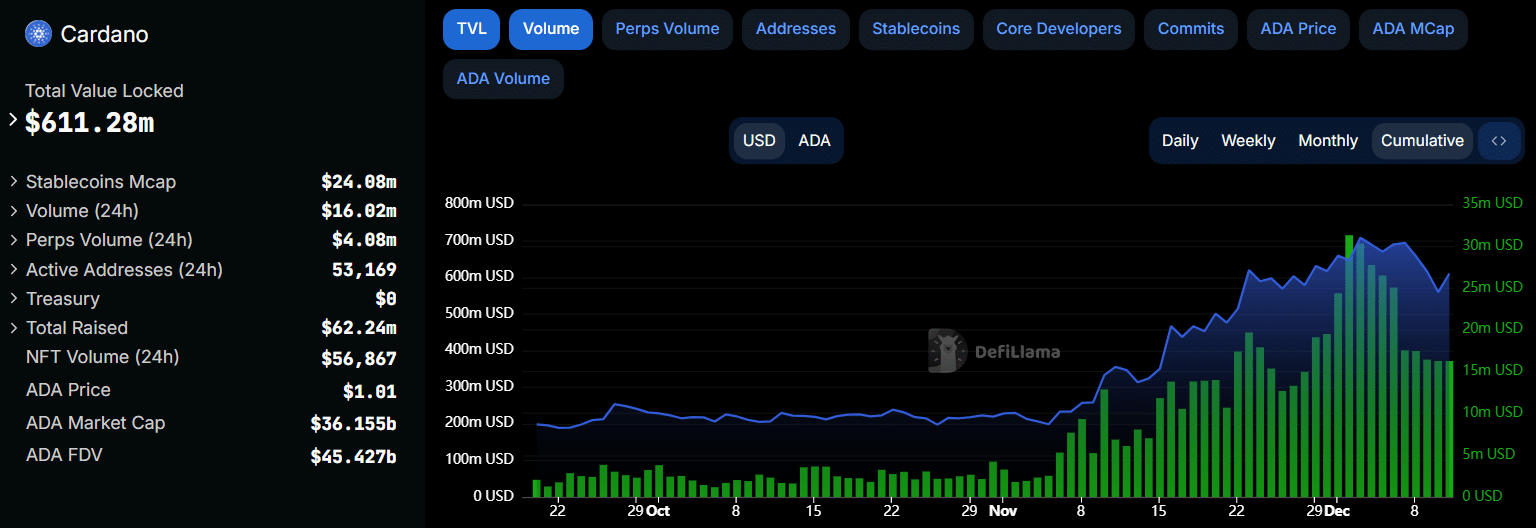

Cardano’s decentralized finance (DeFi) Total Value Locked (TVL) reached an all-time high of $708 million on 3rd December, coinciding with ADA’s rally to a multi-year high. Per DeFiLlama, this TVL has since declined sharply, alongside the price to $611 million.

Cardano’s DeFi volumes have also dropped from a peak of $31 million to $16 million, highlighting the network’s reduced usage in the DeFi sector.

The largest DeFi protocol on Cardano is the Liqwid lending platform, whose TVL has dropped by 16% in one week. The Minswap decentralized exchange (DEX) has also recorded a similar decline.

Going by past trends, ADA’s rally tends to coincide with rising DeFi activity. Therefore, if there is reduced usage, it could continue dampening the price outlook.

Active addresses hit a weekly low

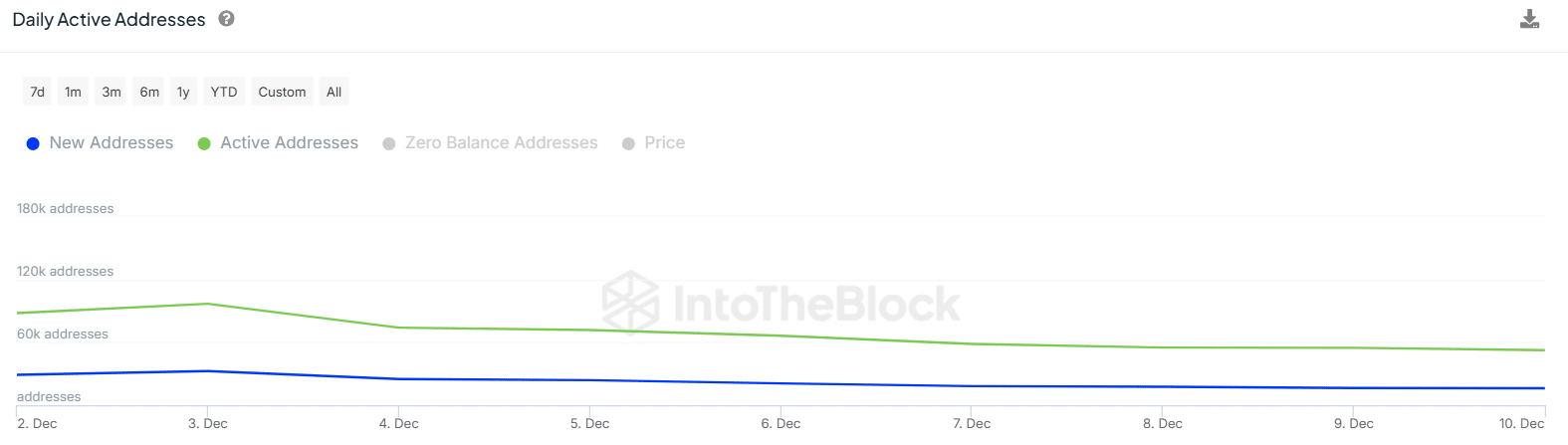

Usage on the Cardano network has also recorded a notable decline, with the number of daily active addresses dropping to the lowest level in seven days.

Data from IntoTheBlock shows that in just one week, Cardano’s active addresses have dropped by 45% from 96,740 to 52,380. The new addresses created on the network have registered a similar drop from 32,590 to 16,190.

The decline in active addresses signals reduced interest and weak demand for ADA. It also points towards reduced investor confidence, which could result in bearish sentiment.

Cardano whale balances drop

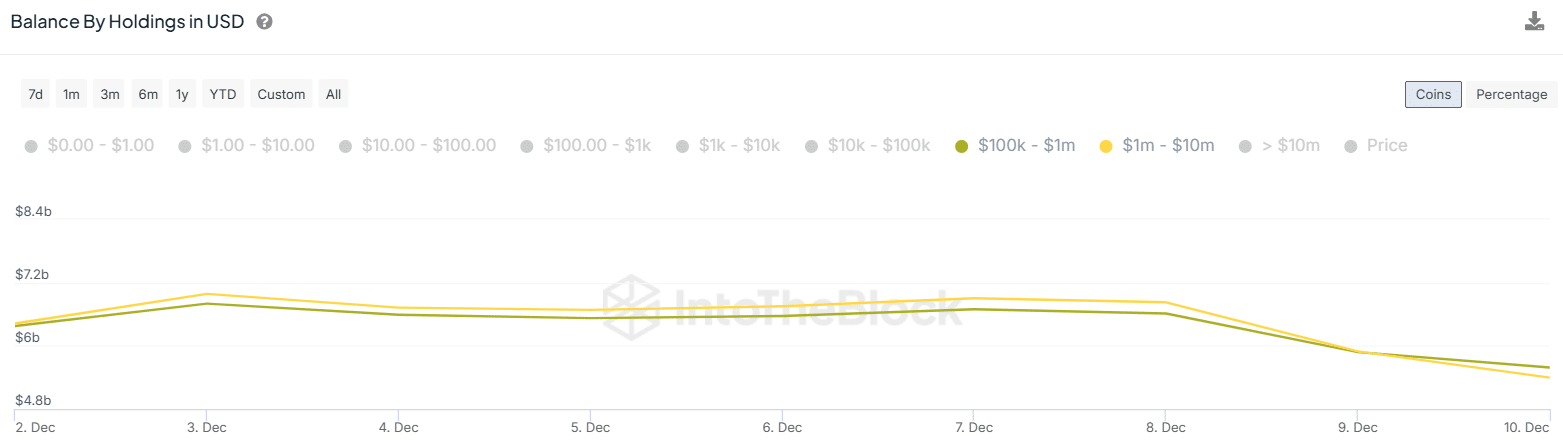

Large Cardano addresses have recorded a significant drop in their holdings per IntoTheBlock, which could push whales toward a distribution phase.

The addresses holding between $100,000 and $1 million worth of ADA have seen their balances drop from $6.61 billion to $5.59 billion.

At the same time, the addresses holding between $1 million and $10 million tokens have also seen a drop of more than $1 billion in their holdings.

This drop does not necessarily suggest that whales are selling. Instead, it indicates that the value of their holdings has dropped, which could lead to profit-taking activity.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Will ADA break free from these bearish trends?

ADA could continue with the bearish trends if the Cardano network fails to record an uptick in activity. Moreover, a lack of fresh demand to absorb the coins being sold by traders looking to minimize losses could fuel the downtrend.

Traders should watch out for an increase in the active addresses, DeFi activity, and whale accumulation, as that could precede an upward recovery. Moreover, a recovery across the broader market could also support ADA’s bullish reversal.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)