XLM’s price may be poised for a 30% rally – All you need to know!

- Over $3.05 million worth of XLM tokens have been withdrawn from exchanges in the last 24 hours

- XLM’s Open Interest has surged by 27%, with a long/short ratio of 1.13

XLM, Stellar’s native token, appeared promising on the price charts and seemed poised for significant upside momentum, at press time. It formed a bullish price action pattern on its daily time frame too. On 12 January, the larger cryptocurrency market showed signs of recovery, with assets such as XRP, Dogecoin (DOGE), Cardano (ADA), and many others recording notable rallies.

Did XLM follow suit though?

Why is XLM rallying?

Well, this potential market shift has started to push XLM towards a positive trajectory after a prolonged struggle throughout December 2024.

Right now, the factors supporting XLM’s bullish outlook include its price action and potential breakout, accumulation by long-term holders, traders’ bets on the long side, and improving market sentiment.

XLM technical analysis and key levels

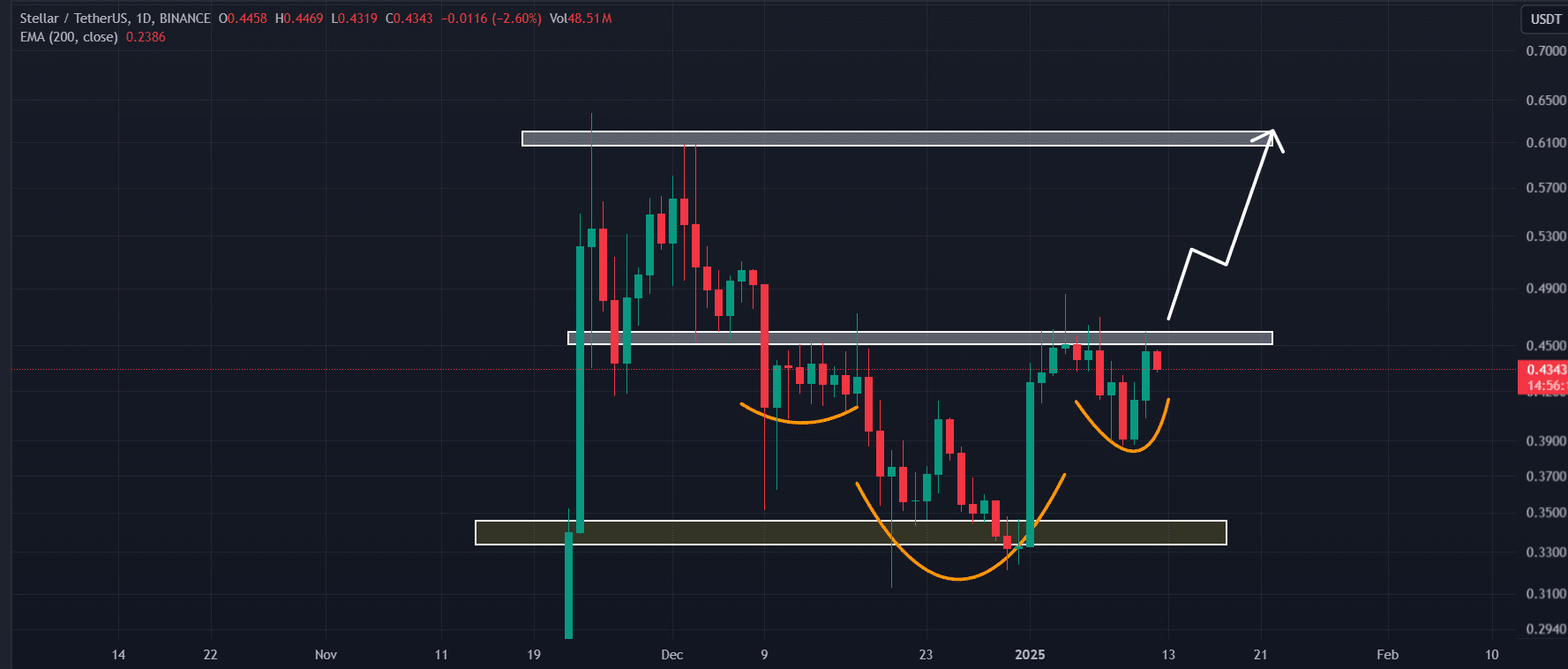

According to AMBCrypto’s analysis, XLM appeared bullish on the charts, with the altcoin on the verge of breaking out from a bullish head and shoulders price action pattern on the daily timeframe.

XLM price prediction

The daily chart revealed that the neckline of this bullish pattern was at $0.456 – A level which has acted as a strong resistance level for the altcoin since the beginning of December 2024.

Based on the altcoin’s recent price action, if XLM breaches this resistance or neckline and closes a daily candle above the $0.47-level, there is a strong possibility it could soar by 30% to hit the $0.60-level in the future. Market sentiment and upcoming political events further supported this bullish outlook.

Long-term holders and traders bet big

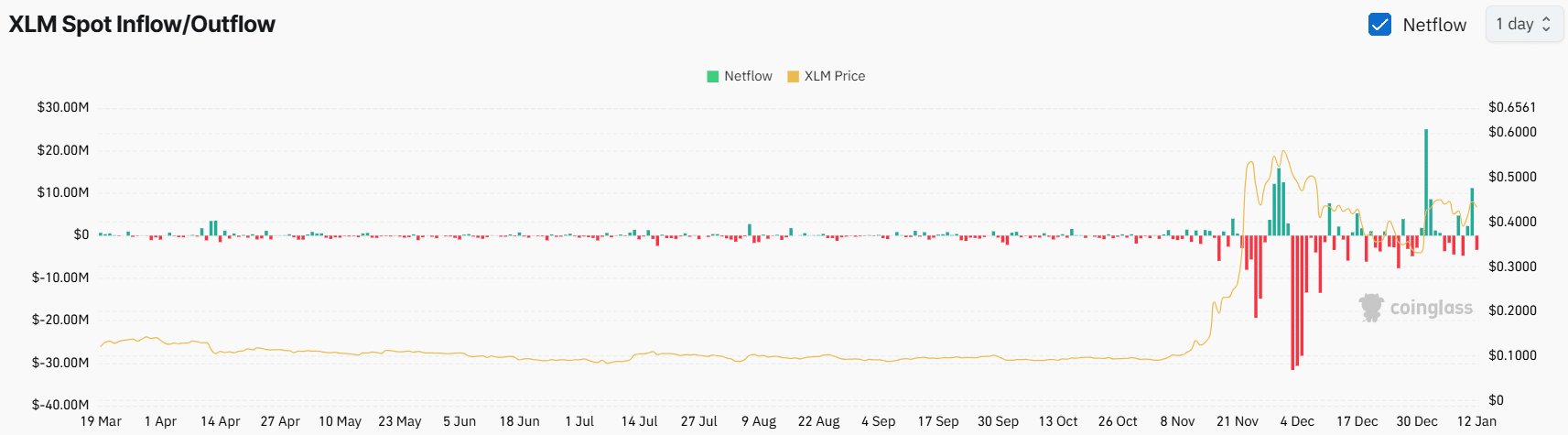

Given this bullish outlook, investors and long-term holders have demonstrated strong interest and confidence in the token, according to the on-chain analytics firm Coinglass. In fact, the Spot inflow/outflow metric highlighted figures of $3.05 million.

The aforementioned finding revealed that long-term holders have potentially accumulated a significant $3.05 million worth of XLM tokens from exchanges in the last 24 hours. Additionally, it alludes to an ideal buying opportunity and has the potential to create buying pressure.

Besides long-term holders, traders are also showing strong interest in XLM and have been continuously forming new positions. Data revealed that XLM’s Open Interest surged by 27% over the same period. At the time of writing, the long/short ratio had a reading of 1.13 – Indicating strong bullish sentiment among traders.

At the time, 53.21% of top traders held long positions while 46.79% held short positions.

![Decentraland [MANA] vs FET - Active addresses, dev. activity, and more](https://ambcrypto.com/wp-content/uploads/2025/01/MANA-Featured-400x240.webp)