XRP drops below $2 as THIS pattern signals a potential crash

- XRP Ledger’s performance thrives despite the decline in on-chain activity from traders amidst rising fear across the crypto markets.

- XRP’s charts showed a head and shoulders pattern, signaling a potential drop.

As the U.S. SEC continues to ease the regulations and drop lawsuits for the crypto community, Ripple[XRP] continues to benefit as an ecosystem.

The XRP Ledger showed impressive performance metrics, underlining its efficiency as a blockchain ecosystem despite the recent price drop.

With an average transaction fee of 0.0011 XRP and a nominal load fee of 0.00001 XRP, the platform ensures affordability and accessibility. The average ledger interval stands at 3.861 seconds, indicating rapid transaction processing and ledger finality.

Each ledger handles approximately 102.56 transactions, and the system can process 27.37 transactions per second.

The statistics reflected a highly scalable and cost-effective environment, fostering quicker adoption and potentially influencing XRP price.

XRP forming heads and shoulders pattern

The daily chart of Ripple shows a potential head and shoulders pattern, indicating a bearish reversal. The neckline is around $2.00, a pivotal level for XRP’s short-term price trajectory.

As of press time, the price was slightly below this threshold at $1.98, after a recent peak of around $3.50.

As XRP broke below $2.00, it could potentially decline toward the $1.63 support area, a significant level from previous price consolidations.

Alternatively, if XRP pushes above $2.00, it might negate the bearish pattern, signaling strong support. This could propel prices toward previous highs around $3.00, reflecting renewed bullish sentiment.

The immediate future of XRP hinges on its ability to uphold or breach this crucial support level.

Meanwhile, XRP network activity declined by 50%. Active addresses dropped from 202,250 in December to 101,169 as of press time.

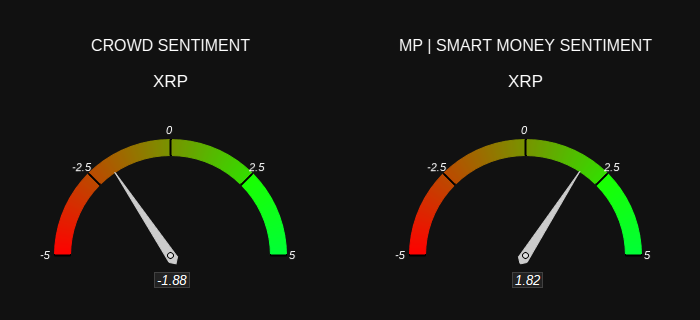

Market participants sentiment

Meanwhile, the sentiment for Ripple showed contrasting views between the public and informed investors.

The Crowd Sentiment was significantly negative at -1.88, indicating widespread pessimism or lack of confidence among the general holders and retail investors.

In contrast, the Smart Money Sentiment for XRP was positive at 1.82, reflecting optimism from institutions and informed market players.

This divergence suggests a potential conflict in market dynamics. If institutional sentiment leads to substantial buying activity, XRP’s price could rise, countering the bearish sentiment from the general crowd.

Conversely, if negative public sentiment dampens Ripple’s market enthusiasm, it may inhibit any significant bullish momentum. This could stabilize or push prices down despite optimistic institutional expectations.