Bitcoin whales are buying while weak hands panic – Is a market bottom near?

- Bitcoin whales are buying while smaller investors panic and sell, similar to the 2020 bull cycle

- Data hinted at the growing probability of a potential bottom.

A Bitcoin [BTC] bottom typically forms when several key conditions align. First, it establishes a critical accumulation zone where sell-side liquidity is absorbed by strong hands. This phase often signals a supply squeeze, setting the stage for a powerful rally as demand begins to outpace available supply.

At the time of writing, on-chain data from CryptoQuant seemed to reveal a familiar pattern – Bitcoin whales are aggressively accumulating while smaller investors capitulate.

Does this mean the bottom is in?

$407 billion in sell-off risk – The STH dilemma

Three weeks ago, Bitcoin sent the market into a tailspin as it retraced to its pre-election low of $77k. Despite the broader sentiment swinging between extremes of fear, BTC’s ability to hold above $80k speaks volumes about its underlying strength.

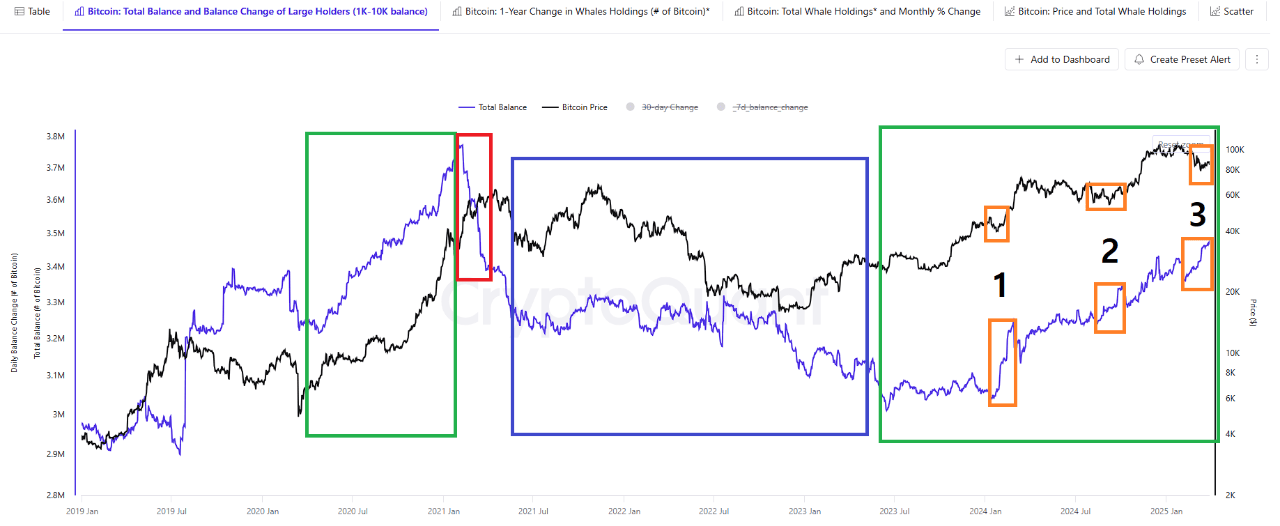

However, this wasn’t just a coincidence. Especially since there has been a sharp spike in the total balance of Bitcoin whales holding 1k–10k BTC (marked in orange).

This accumulation has been a key factor in preventing a deeper market correction, suggesting that whale activity is absorbing sell-side pressure and providing the support needed to stabilize prices.

As noted by AMBCrypto’s recent analysis, the SOPR (Spent Output Profit Ratio) remains below 1. This is a sign that short-term holders (STHs) with positions older than 155 days have been realizing losses.

Put simply, with Bitcoin down 23% from its all-time high of $109k, a significant pool of buyers’ acquisition value remains well above the press time market value of $83k.

AMBCrypto also found that $95,138 is the average acquisition price for these STHs, where roughly 4.28 million BTC were traded. This equates to approximately $407 billion in potential sell-off risk from these holders.

Should STHs capitulate, we could see a surge in sell pressure. Even so, the question remains – Will whales continue to absorb this pressure and confirm $80k as a strong bottom?

$80k at stake – Will Bitcoin whales confirm the bottom?

Notably, the pattern of Bitcoin whales accumulating while smaller investors panic-sell mirrors previous cycle bottoms, particularly the 2020 cycle.

During that phase, BTC broke above $10k for the first time by mid-Q3, kicking off what came to be known as the “breakout cycle.”

In a striking parallel, CryptoQuant data also showed no signs of Bitcoin whales exiting during the 2020 bull run. This implied that these whales may still be absorbing sell-side pressure. This could lay the groundwork for a major shift in the current cycle.

Right now, there is no significant distribution from these whales. In fact, instead of going dormant, they are actively accumulating. Hence, the chances of a collapse below $77k–$80k due to macroeconomic uncertainty or weak hands exiting are low.

Moreover, U.S. buy orders remain robust while Bitcoin exchange reserves continue to plunge.

If these dynamics align in the coming days, Bitcoin could be on the cusp of confirming a market bottom.