Volume of BNB, HT, OKB Perpetual Contracts reached 1 billion USD only 1 week after launch on BaseFEX

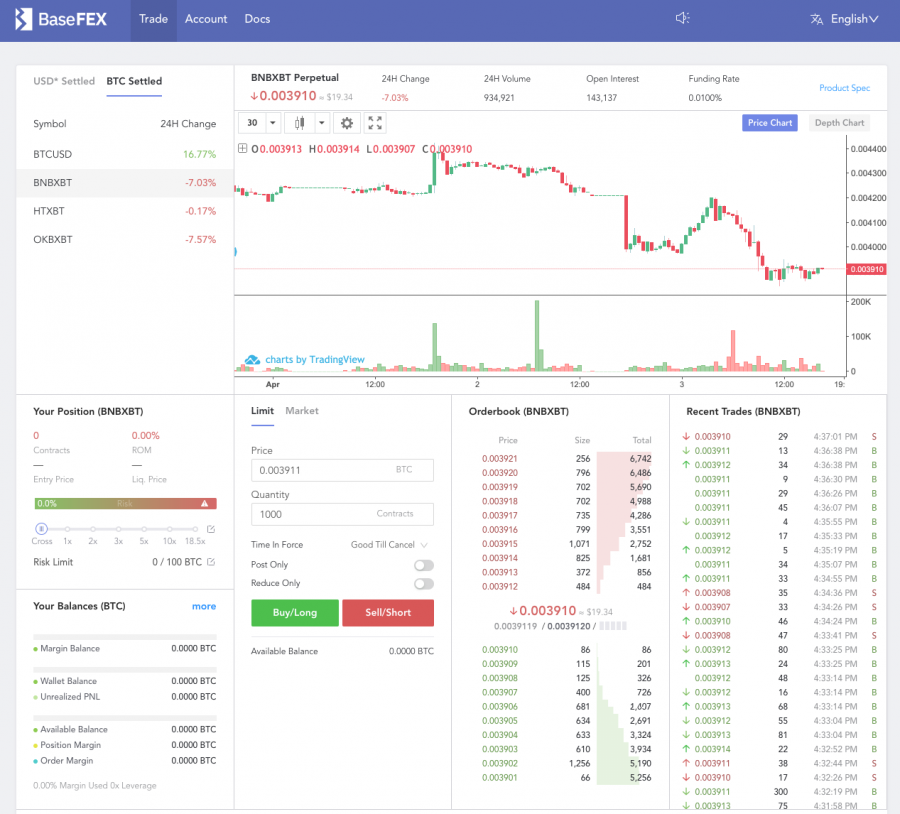

The cryptocurrency derivative exchange BaseFEX has launched BNB, HT, OKB perpetual contracts on March 28th, last Thursday, with the support of up to 20x leverage. Over 2,500 users have already traded these new contracts in the first week alone, driving the total trading volume of the 3 altcoin contracts combined to over 1 billion USD.

BaseFEX’s 24-hour trading volume has made a 60% growth from 240 million USD to about 390 million USD.

There is more to it. The utility token platform of OKEx, OK Jumpstart, has announced its first IEO project: Blockcloud, alone with detailed token sale rules on Monday, April 1st, the price of OKB surged 30% from $1.8 in reaction.

Over 1,400 traders longed OKB this week using 5x to 20x leverages on BaseFEX, making even bigger profits than Bitcoin contracts.

Binance announced its new IEO rules, too. A user of Binance can claim up to 5 tickets for a lottery according to the amount of BNB she/he holds, in order to get a chance to participate in a new token sale.

Is it necessary to make it so difficult to buy an altcoin that previous unknown to the public?

Check the 7-second-sold-out project Huobi had just a few days ago. These new IEO policies require traders to hold the platform tokens for a considerable duration, which means an IEO participant faces not only the risk of failing to get a ticket for the IEO but also the risk of price volatility of the platform token she/he has to hold to get the ticket first.

Take HT, for example, HT price surged about 10% right before the sale of Huobi’s first IEO project, TOP Network then fell for 11% in a few minutes right after less than 3% of over 130,000 participants actually purchased TOP Network successfully. This is due to a drastic yet logical change of supply and demand during the IEO.

BaseFEX designed the perpetual futures contracts of the platform tokens to provide a risk hedge for IEO participants. A crypto investor can always protect himself from the multiple risks during an IEO using such contracts, especially the panic selling after a sold out.

According to BaseFEX, more perpetual contracts of platform tokens are to be launched in the near future due to the high demand. BaseFEX will continue to provide the fast and reliable service with the lowest commission fee rate [0% for makers, 0.05% for takers], up to 100x leverage and minimum server overload.

All traders enjoy a 20% rebate before June 30th, 2019, and another 50% rebate for clients with trading volume over 35,000,000 in 7 days.

Official Website

WeChat: BaseFEX

Telegram Group