A banking crisis will have these effects on Bitcoin, Ethereum investors

Over the last few months, there have been multiple cases of banks and financial institutions collapsing. Needless to say, this has contributed to FUD in traditional and crypto-markets.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Can you bank on the Banks?

The most recent additions to the ongoing FUD around traditional banking have been caused by Capital One and Key Bank.

On 25 May, the New York City Banking Commission made the decision to suspend the acceptance of deposits into bank accounts held by Capital One and KeyBank within the city. This action followed the banks’ failure to submit comprehensive plans detailing their initiatives aimed at addressing and eliminating discriminatory practices.

City Comptroller Brad Lander, in conjunction with Mayor Eric Adams and the Department of Finance, convened to officially declare that the city will cease depositing funds into accounts held at these two banks. This announcement was conveyed through a statement issued by Lander on Thursday.

According to the Comptroller’s spokesperson, existing accounts on these banks can be used for payments. However, no additional deposits will be made and new accounts will not be opened at KeyBank or Capital One.

Raising the debt ceiling

Coupled with these factors, the fears surrounding U.S government’s debt ceiling have also fueled FUD among people. According to the BBC’s report the ongoing discussions aimed at averting a financial crisis in the United States government have reached a critical stage. The Treasury has emphasized the necessity for Congress to reach a consensus on raising the debt ceiling by 1 June. Especially as failure to do so would result in a detrimental inability to meet financial obligations, leading to severe economic consequences.

Gen Z in a frenzy

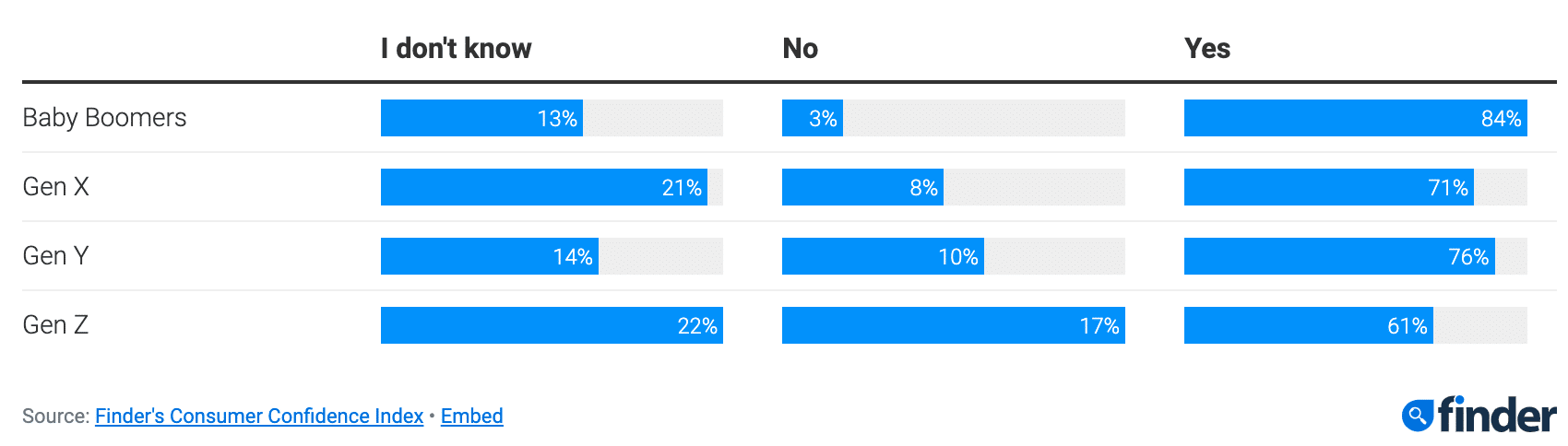

Due to these factors, it has been observed that Gen Z has started to lose faith in traditional banking. According to Finder’s data, younger Americans now exhibit a significantly higher level of skepticism towards financial institutions in comparison to their older counterparts.

Specifically, only 61% of Generation Z has expressed confidence in the security of their funds within their respective banks, while 84% of baby boomers hold such trust. Notably, nearly one-fifth (17%) of Generation Z individuals question the safety of their money, in contrast to a mere 3% of baby boomers.

A blast from the past

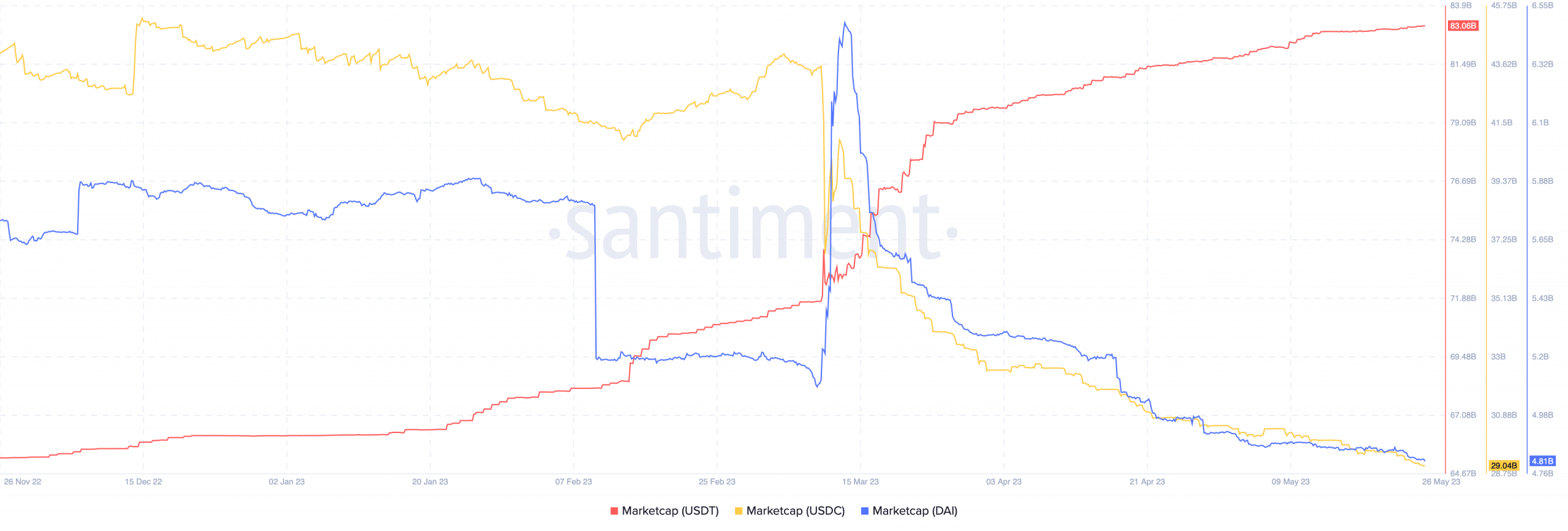

Disruptions in the banking sector usually have an impact on the crypto-space. For instance, earlier this year, Silicon Valley Bank (SVB) collapsed. A part of Circle’s (USDC’s issuer) reserves were stored in that bank. This caused a furore in the crypto-market, leading many holders of USDC to sell their holdings. There was also a momentary dip in USDC’s peg to the U.S dollar.

Due to these events, USDT gained an advantage over its biggest competitor – USDC – in the stablecoin space. At press time, in terms of market cap, USDT had the largest stablecoin share in the crypto-markets.

This also proved to be positive news for Bitcoin. Tether, the company that issues USDT, recently announced its intention to allocate a consistent portion of its monthly earnings, specifically up to 15%, beginning in May. This allocation equates to approximately $75 million and will be directed towards the purchase of BTC.

The dominance of Tether in the stablecoin sector due to the collapse of SVB may impact BTC positively in the long run.

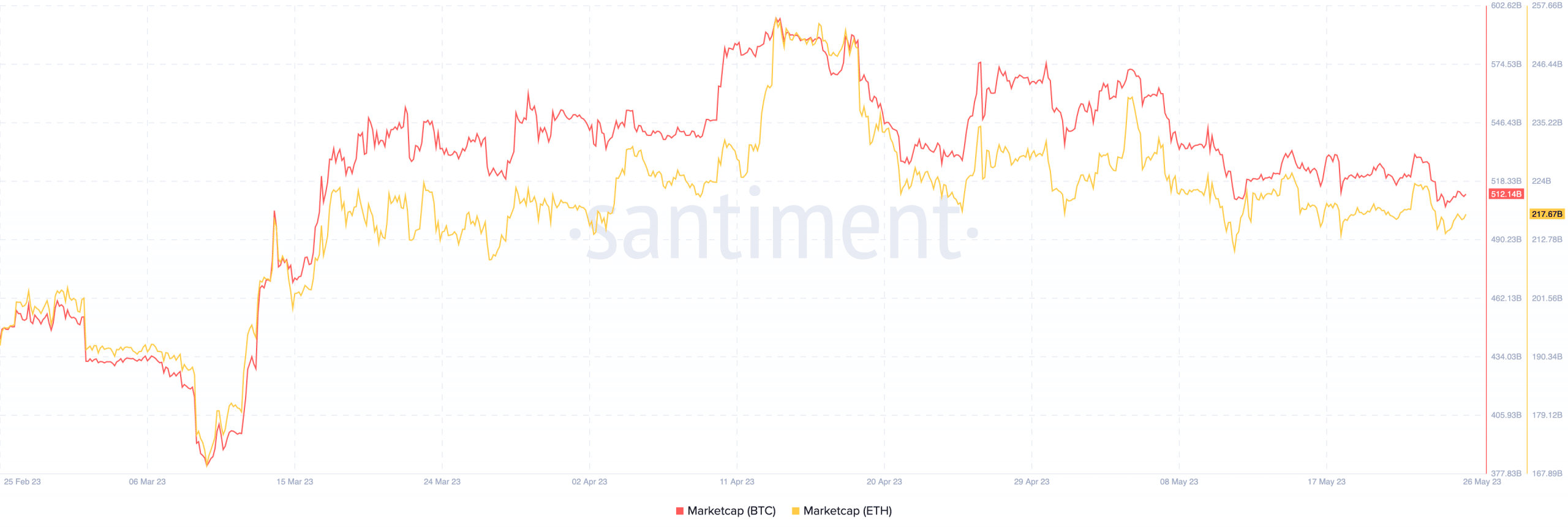

In addition to Tether’s expressed interest in Bitcoin, the potential utilization of Bitcoin and other established cryptocurrencies like Ethereum as a safeguard against potential banking failures may become a relevant factor. Over the last 3 months, the market caps of both BTC and ETH has risen significantly.

If the cynicism around banks continues to rise, interest in BTC and ETH might also appreciate.

Will exchanges bring about change?

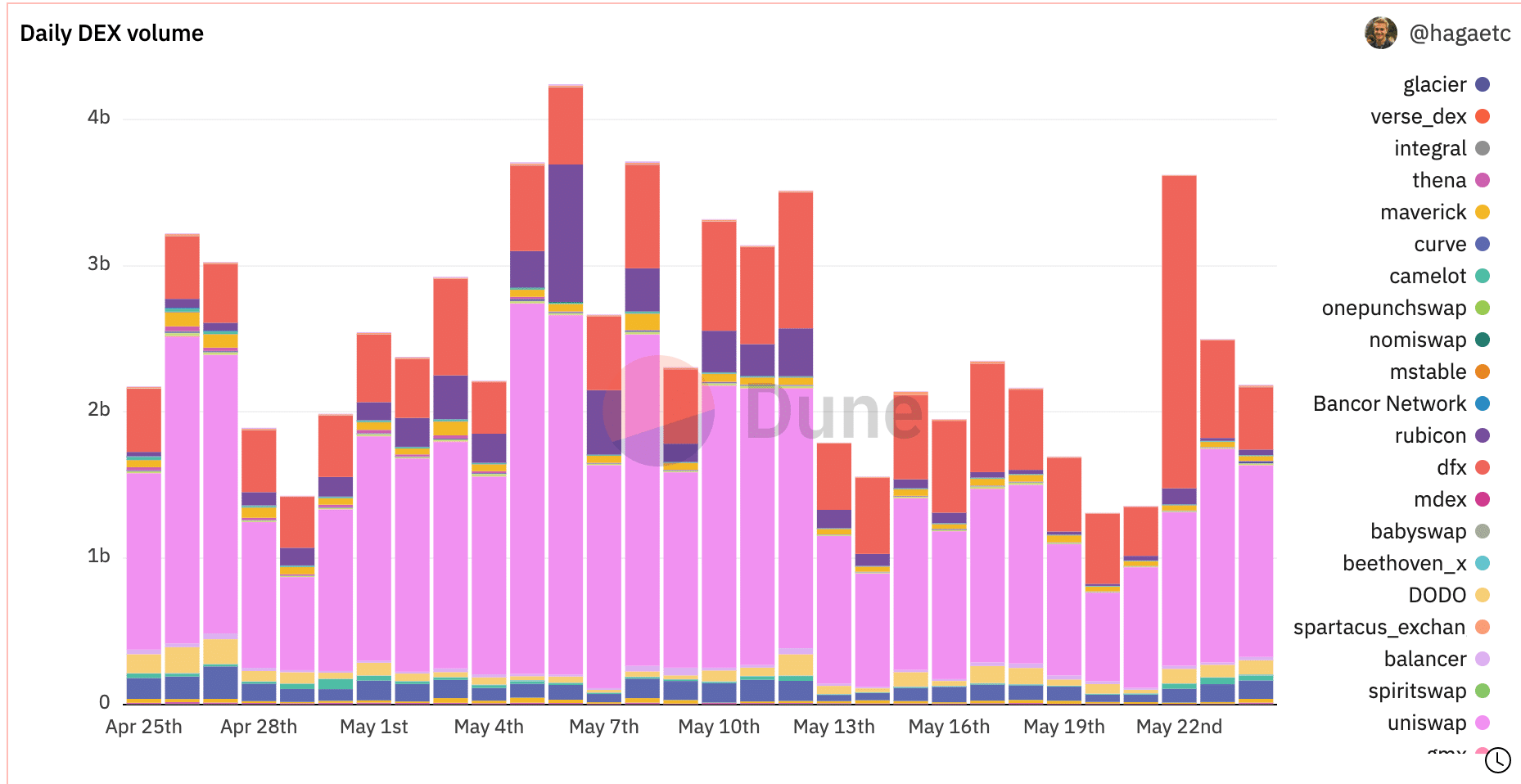

The impact of the banking crisis wouldn’t just be limited to stablecoins or blue chip cryptocurrencies. If people continue to lose their faith in banking systems, they may opt for other ways to safeguard their money. The use of centralized and decentralized exchanges could see a surge as an alternative as conventional financial institutions fail to meet requirements.

Realistic or not, here’s BNB’s market cap in BTC’s terms

Binance, Coinbase, and Kraken were the three most dominant centralized exchanges in the market at press time. All of these exchanges recorded growth in their trading volumes over the past week.

On the Decentralized exchanges (DEX) front, there was a healthy interest observed in the DEX space. Volumes fluctuated over the past few months, but activity remained consistent. Uniswap has been the most dominant player in this sector, accounting for a significant part of the volume in this space.