Bitcoin: These holders are selling at a loss and that means…

- Short-term holders were dumping their coins on exchanges at a loss.

- Long-term holders amassed a significant amount of BTC in the last 24 hours.

On-chain analytics firm Glassnode took to Twitter to draw attention to the exchange transfer patterns of Bitcoin’s [BTC] short-term holders (STH) and long-term holders (LTH).

Read Bitcoin’s [BTC] Price Prediction 2023-24

The analysis divulged that, on average, most coins were flowing into exchanges at a loss with a negative exchange inflow bias of 0.7.

When assessing the profit/loss ratio (bias) of #Bitcoin deposit volume to exchanges, we note a current negative bias of 0.7, suggesting coins are flowing into exchanges at a loss. pic.twitter.com/6dYAbsFdyg

— glassnode (@glassnode) May 25, 2023

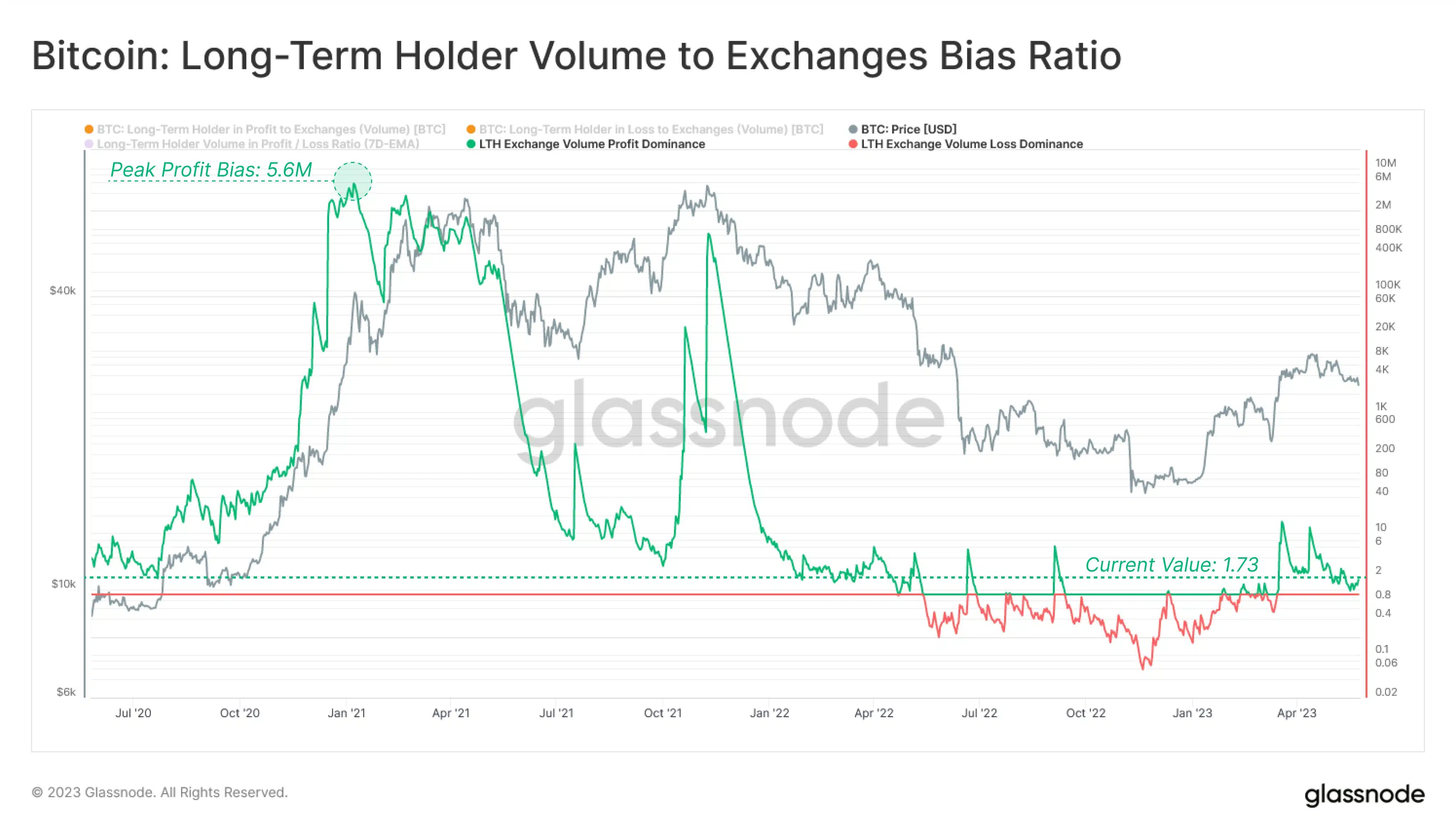

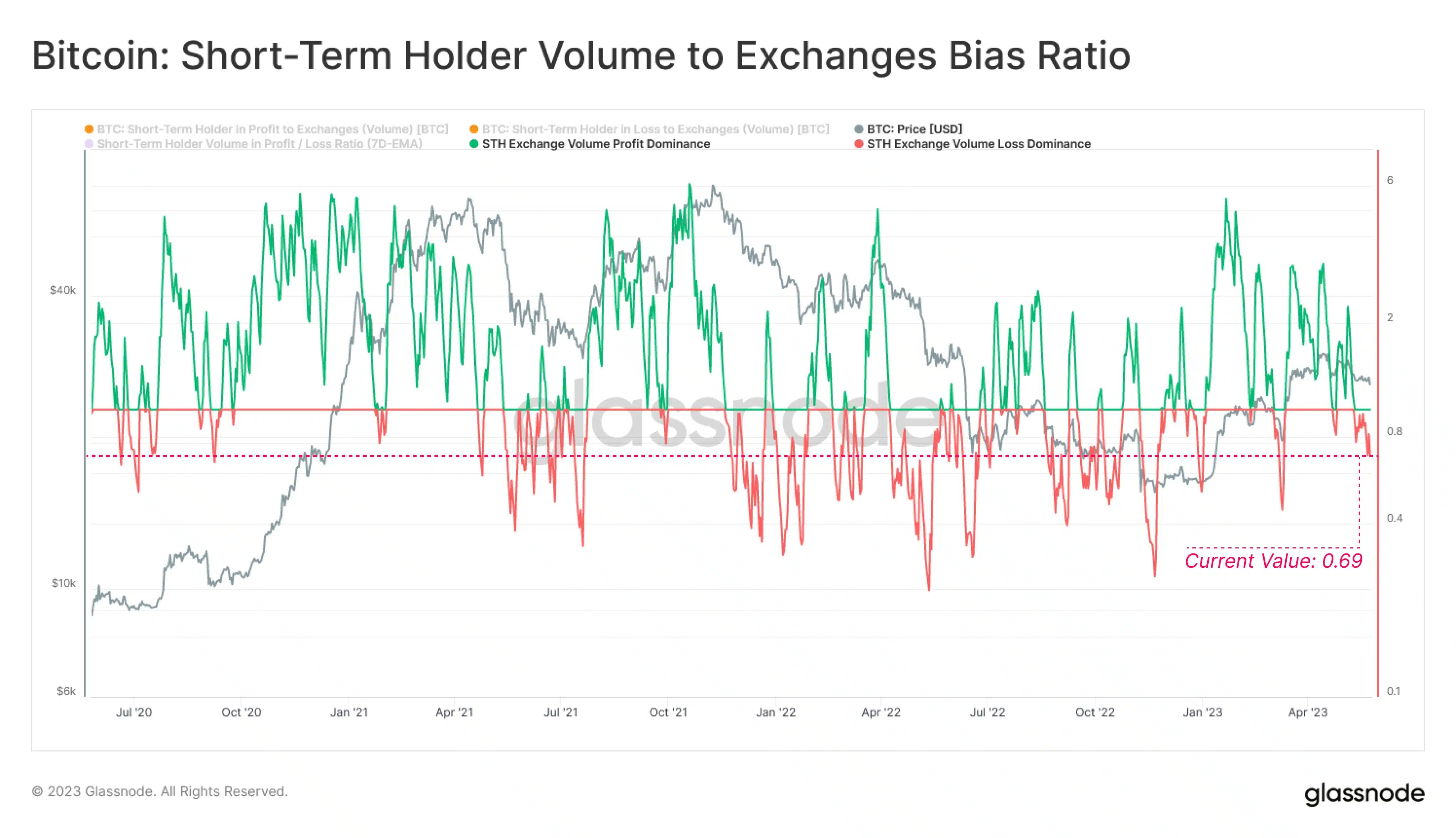

However, when the exchange inflow bias was scrutinized based on the duration of the holdings, a stark difference emerged between the STH and LTH.

Weak hands capitulating?

Long-term holders are the participants who keep possession of coins for more than 155 days. Popularly referred to as “diamond hands, ” this cohort of users is thought to have a high risk tolerance and will not sell despite protracted losses.

This group recorded a positive exchange inflow bias of 1.73, implying that most of their transfers to exchanges came at a profit.

On the other hand, short-term holders, who hold coins for less than 155 days, registered a negative bias of 0.69, indicating that these “weak hands” were dumping their coins on exchanges at a loss. STH are more likely to relinquish positions owing to market volatility.

It was also interesting to note that this cohort was the main contributor to overall exchange inflows.

Diamond hands were profitable

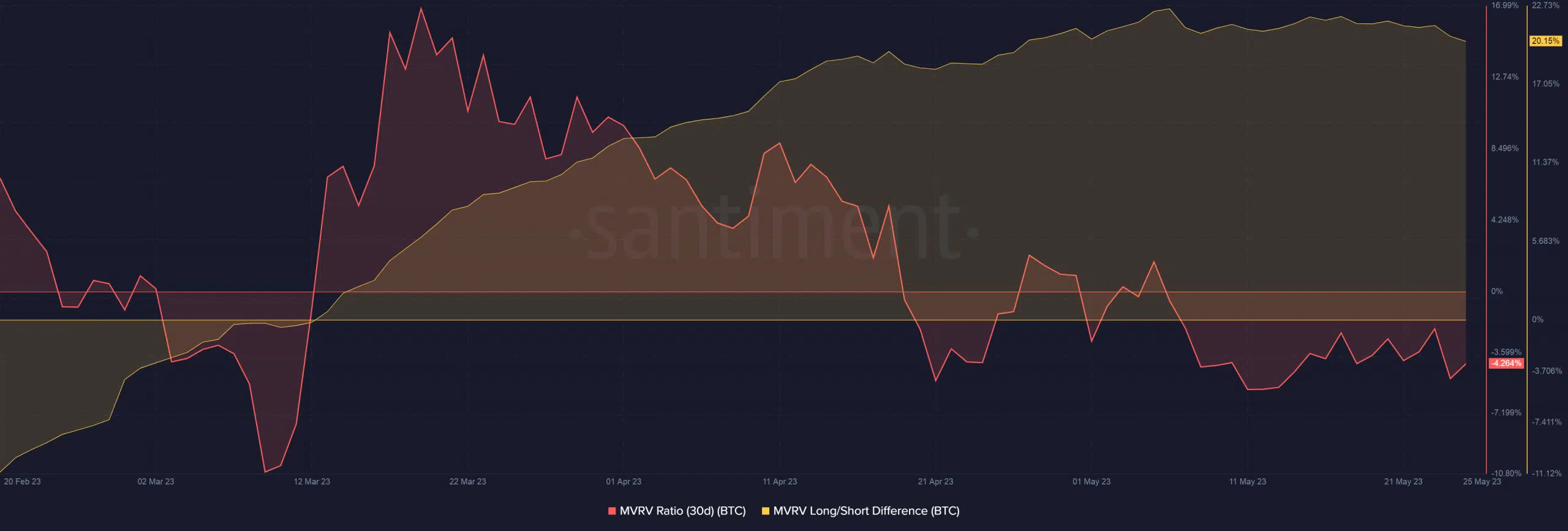

Examining the 30-Day MVRV Ratio made it clear that holders of BTC were under water and would incur losses of 4.53% on average. However, the MVRV Long/Short Difference was positive, meaning that LTH would realize higher profits as compared to STH.

This observation was in accordance with the aforementioned divergence in the profitability of the two cohorts.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Long-term holders start to accumulate

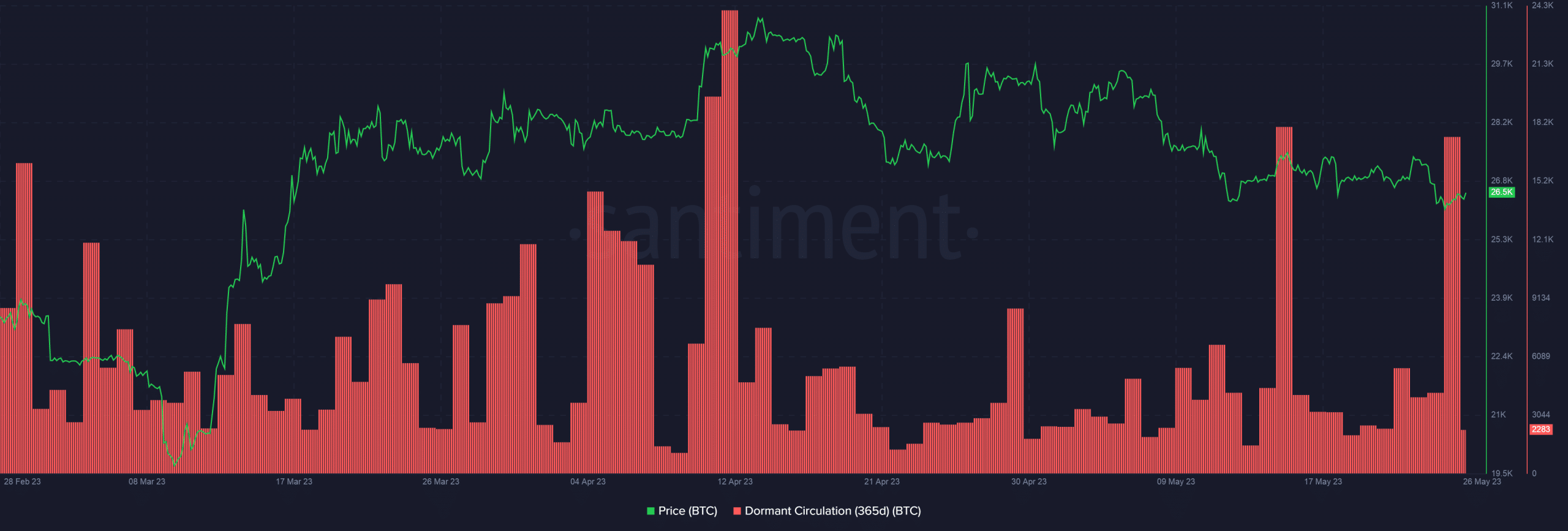

A big chunk of the LTH were probably amassing more BTC coins as evidenced by the sharp spike in the flow of tokens that didn’t move in the last one year. Because the transactions resulted in a price increase, it was possible to forecast that they were buyer-dominated.

At the time of publication, BTC exchanged hands at $26,496.51, as per CoinMarketCap. The king coin has entered a phase of consolidation, with trades over the past week hovering within the narrow range of $26,400- $27,500.