A health checkup of PancakeSwap [CAKE] as V3 launch draws near

![A health checkup of PancakeSwap [CAKE] as V3 launch draws near](https://ambcrypto.com/wp-content/uploads/2023/04/CAKE.png)

- CAKE’s revenue and fees were on a declining trend before v3’s launch.

- CAKE was ahead of UNI, but its price action was bearish.

PancakeSwap’s [CAKE] launched PancakeSwap V3 on 3 April. The V3 introduced new features that would make DeFi accessible to more people than before. Earlier, in March, CAKE had mentioned that early supporters would receive rewards in the form of NFTs.

?it’s #PancakeSwapv3 Day. Tell us how excited you are!??? https://t.co/6i3MK27OOU

— PancakeSwap?Ev3ryone's Favourite D3X (@PancakeSwap) April 3, 2023

How much are 1,10,100 CAKEs worth today?

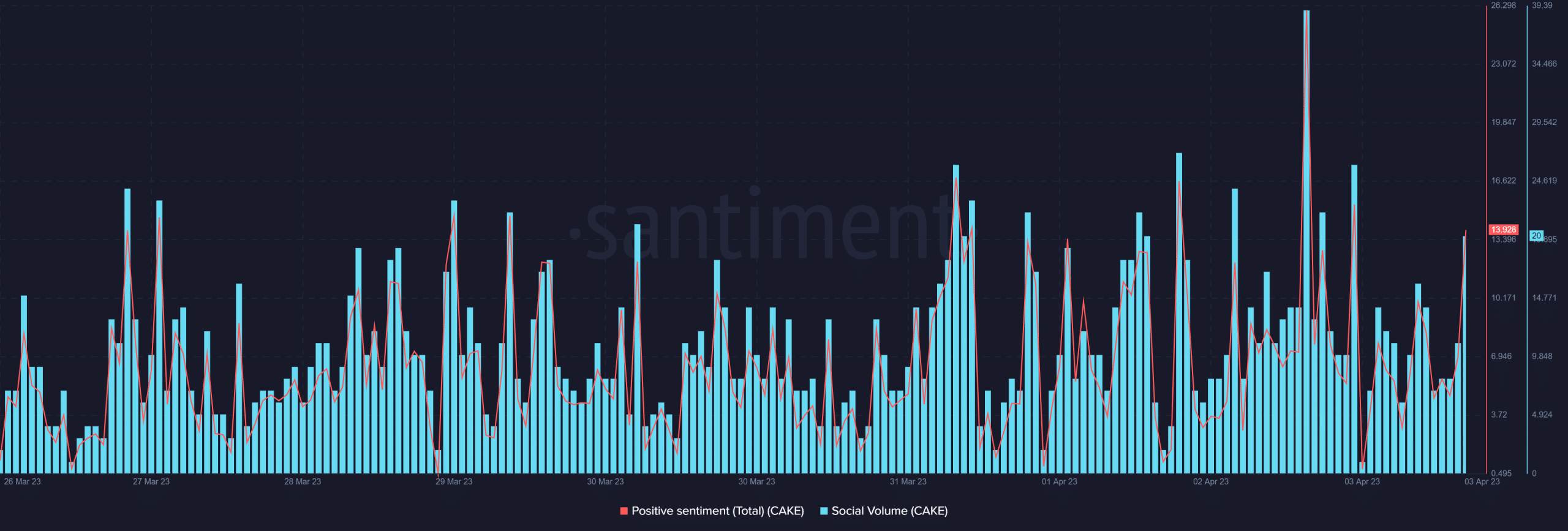

The hype around the V3 launch also helped increase discussions around CAKE, as its social volume went up. Additionally, positive sentiments around PancakeSwap rose considerably as well.

V3 can help boost the network’s revenue

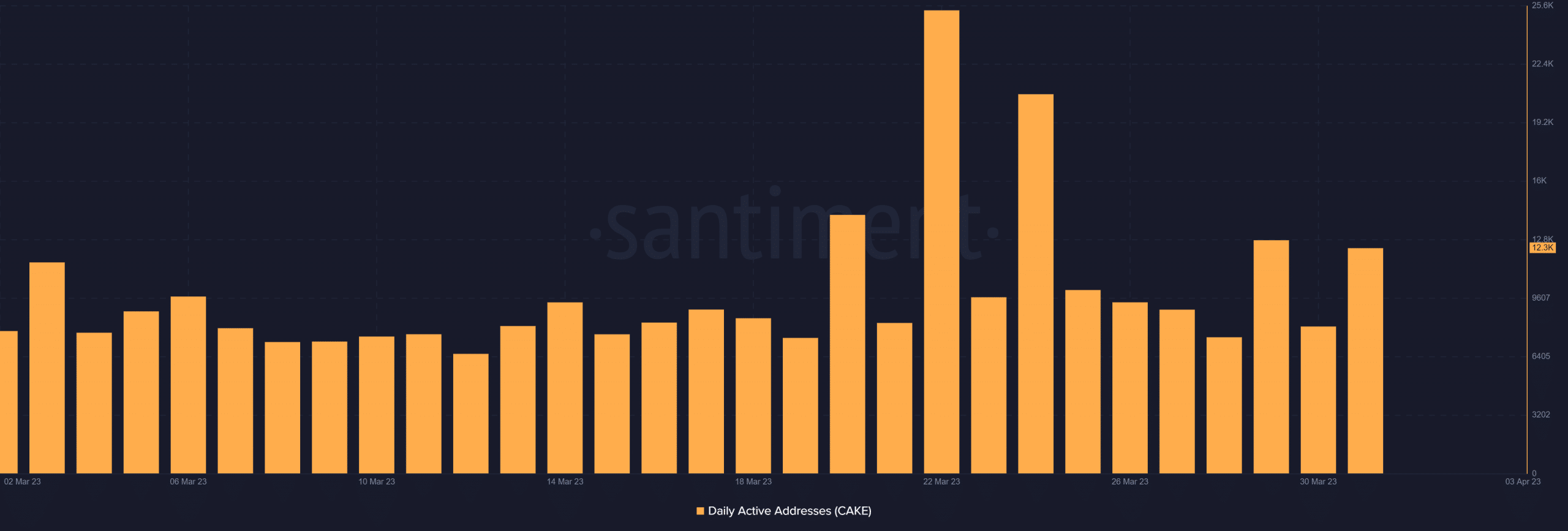

Token Terminal’s data revealed that PancakeSwap’s fees and revenue have been on a declining trend. However, V3’s launch could attract new users, in turn increasing its revenue over the coming months. In fact, network activity had already increased at press time, as evidenced by the increase in its daily active addresses.

Uniswap vs. PancakeSwap

While CAKE was gearing up for its V3 launch, an interesting episode happened on Uniswap [UNI] pools. Lookonchain’s latest tweet revealed that eight addresses stole assets worth over $25 million from eight Uniswap pools by sandwich attacking.

For starters, front-running attacks like the sandwich attack are quite common in DeFi on decentralized exchanges. When an attacker engages in both purchasing and selling on the same block, a sandwich attack occurs because the victim’s transaction happens in the middle.

8 addresses stole $25.2M assets from 8 #Uniswap pools by #Sandwich attacking.

Including:

– 7,461 $WETH ($13.4M)

– 5.3M $USDC

– 3M $USDT

– 65 $WBTC ($1.8M)

– 1.7M $DAIAnd these 8 addresses are funded by @kucoincom. pic.twitter.com/T769G8TgbI

— Lookonchain (@lookonchain) April 3, 2023

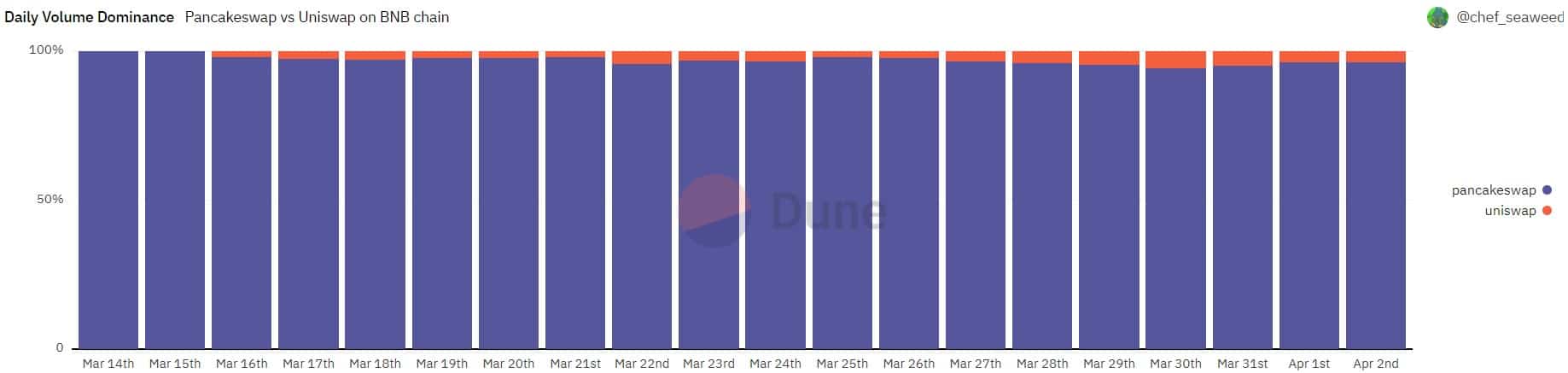

This attack could increase negative sentiments around Uniswap, which could in turn be beneficial for PancakeSwap. Interestingly, Dune’s data revealed that CAKE was already ahead of Uniswap in terms of daily volume dominance on the BNB Chain.

Realistic or not, here’s CAKE’s market cap in BTC‘s terms

Price action hasn’t been bullish

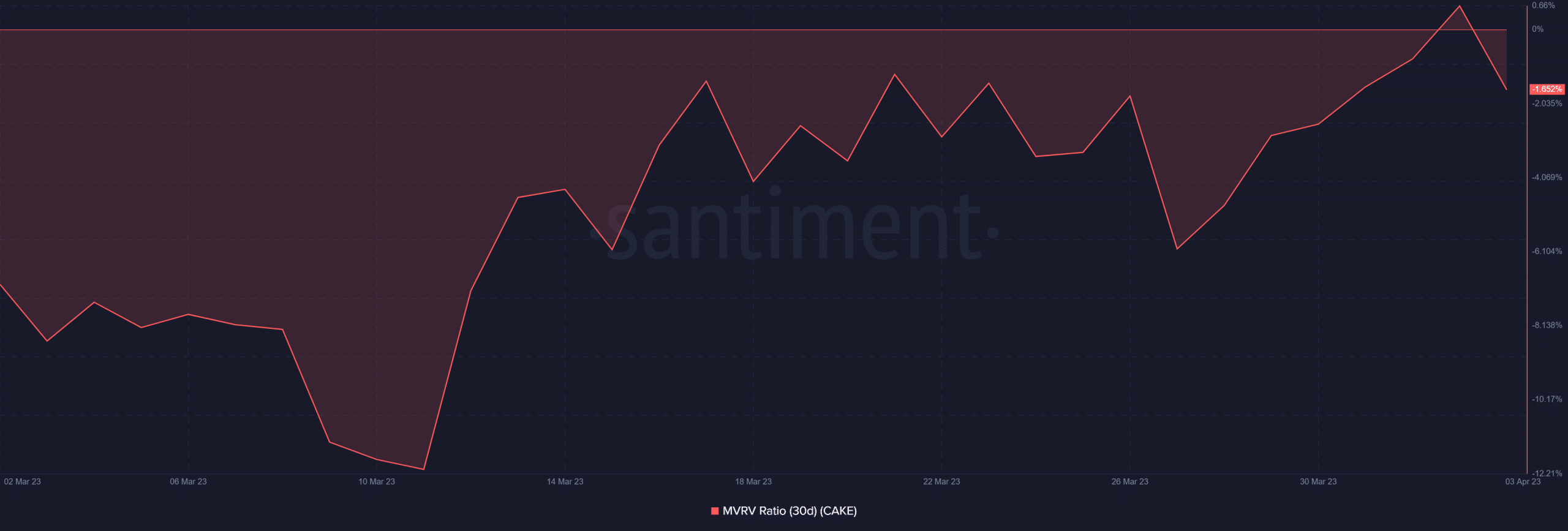

CAKE’s price action has not been favoring the investors, despite the big news of the V3 launch. As per CoinMarketCap, CAKE was trading 1.1% lower than yesterday, and at press time, it was valued at $3.74 with a market capitalization of more than $685 million. CAKE’s MVRV ratio also dipped after recovering over the last few days.

Nonetheless, CAKE’s burn rate looked pretty optimistic. On 3 April, PancakeSwap revealed that it burned 7,147,523 tokens, worth $27 million. Considering the token’s deflationary characteristics and the hype surrounding CAKE V3, the the token could rise and meet investors’ expectations soon.

? 7,147,523 $CAKE just burned – that’s $27M!

? Trading fees (Swap and Perpetual): 241k CAKE ($902k) +27%

? Prediction: 76k CAKE ($286k) -11%

?️ Lottery: 30k CAKE ($114k) +31%

? NFT Market, Profile & Factory: 496 CAKE ($2k) -9% pic.twitter.com/dDQoWQbKy1— PancakeSwap?Ev3ryone's Favourite D3X (@PancakeSwap) April 3, 2023

![Hedera [HBAR] defies market trend - All you need to know about altcoin's 27% hike!](https://ambcrypto.com/wp-content/uploads/2025/03/Hedera-1-400x240.webp)