A look at the state of stETH as it gains new followers

- stETH’s supply on exchanges declined while supply outside of exchanges went up.

- ETH’s 24-hour chart was red, but market indicators remained bullish.

After a bullish week, Ethereum’s [ETH] daily chart has turned red as its price went down. Another interesting development in the Ethereum ecosystem was how the popularity of liquidity staking increased over the last few months. Is Lido Staked Ethereum [stETH] becoming the next favorite token of investors?

Read Ethereum’s [ETH] Price Prediction 2023-24

stETH’s popularity is impressive

Glassnode’s recent tweet revealed that stETH’s popularity has been on an increasing trend since the Shanghai update. As per the tweet, Lido’s stETH maintains an impressive dominance, with DeFi capital flows suggesting it has become a preferred collateral asset. The total number of new addresses holding stETH has risen sharply over the last few months, which looked optimistic.

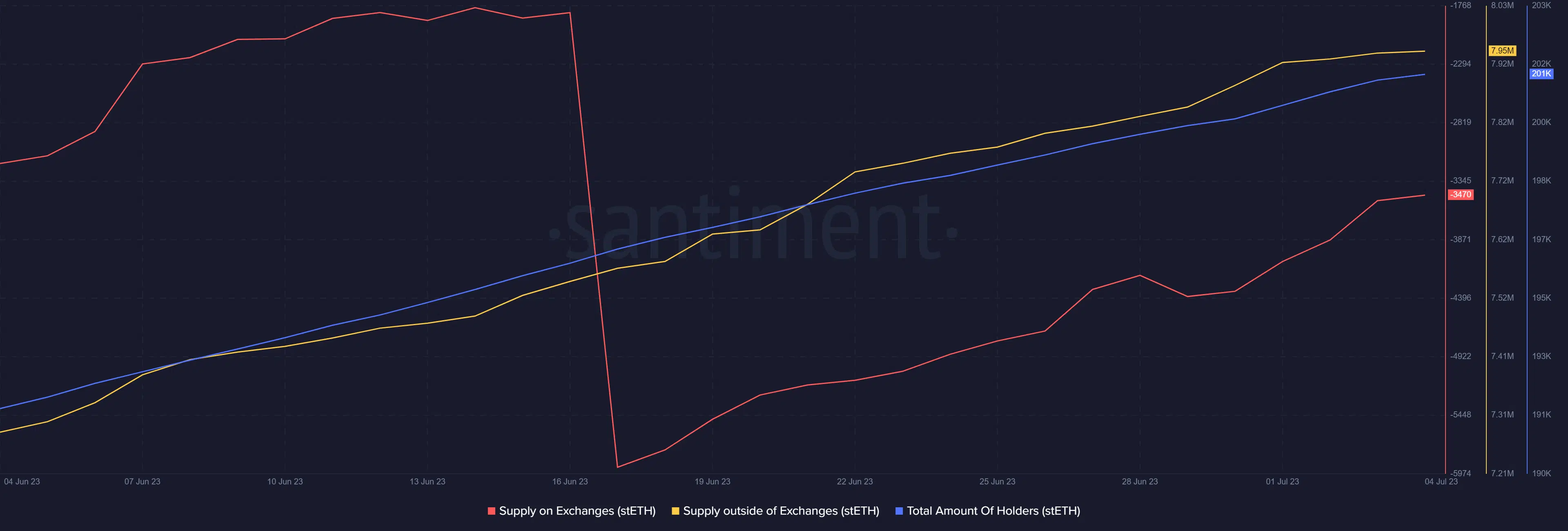

Santiment’s chart revealed that stETH’s supply on exchanges plummeted over the last month. While this happened, its supply outside of exchanges went up, which was an optimistic update. Additionally, its total number of holders also rose, further proving its increasing popularity among investors.

Ethereum’s daily chart is red

Amidst all this, Ethereum was enjoying a comfortable bull rally. However, the token’s uptrend ended as its price declined slightly in the last 24 hours. According to CoinMarketCap, at the time of writing, ETH was trading at $1,955.55 with a market capitalization of over $235 billion.

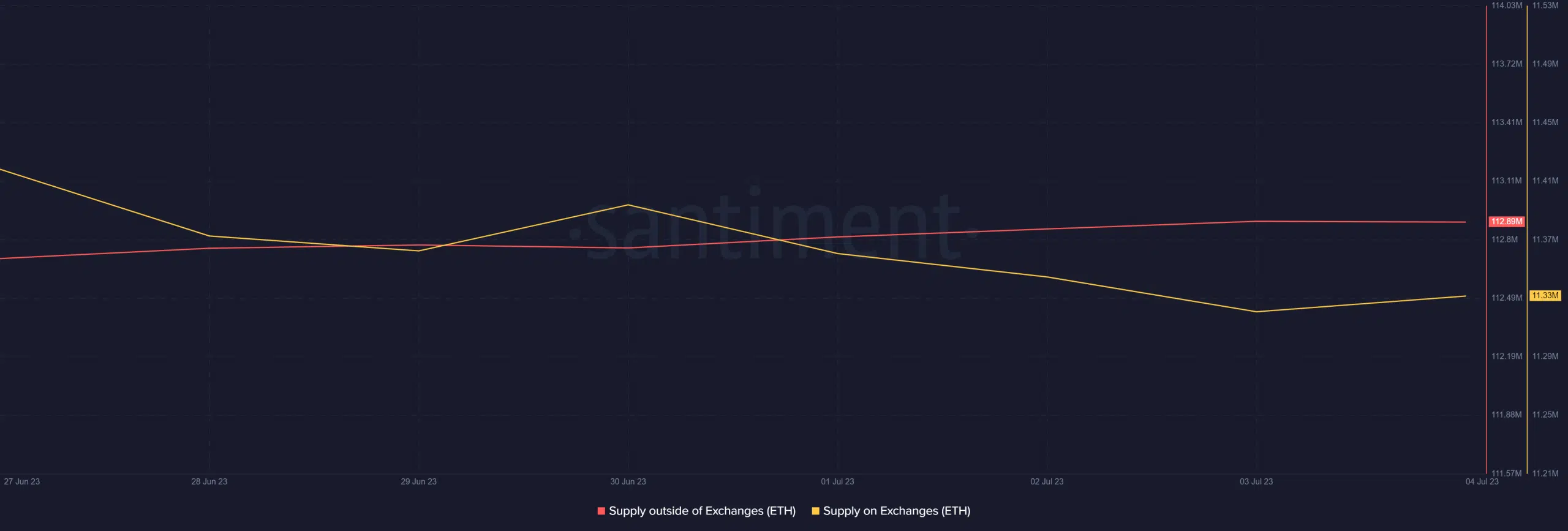

Interestingly, stETH was trading at a slightly lower price than ETH. On one hand, stETH’s supply outside of exchanges increased; on the other hand, Ethereum’s supply outside of exchanges remained flat. The same also remained true for ETH’s supply on exchanges, suggesting less movement of the asset in the last week.

CryptoQuant’s data revealed that the halt to the token’s growth might last longer as several on-chain metrics were bearish. ETH’s exchange reserve was increasing, suggesting that the token was under immense selling pressure. ETH’s number of active addresses also dropped compared to the last seven days, which looked bearish.

Is your portfolio green? Check the Ethereum Profit Calculator

This is what investors can expect

Though the metrics were bearish, a look at ETH’s daily chart revealed a different story. The Exponential Moving Average (EMA) Ribbon displayed a bullish crossover.

The token’s MACD also displayed a similar bullish advantage in the market. Its Relative Strength Index (RSI) also registered an uptick, increasing the chances of a price uptrend in the coming days.