A look at what prompted high activity on Ethereum scaling solutions

- The exponential growth in L2’s on-chain activity came during the bear market.

- Optimistic roll-ups maintained an average daily transaction share of 67% in September.

The Ethereum [ETH] layer-2 (L2) landscape has expanded by leaps and bounds in 2023. The blockspace demand for scaling solutions has hit the roof with users onboarding to capitalize on its relative advantages.

L2s see sharp rise in transaction fees

Erik Smith, Chief Investment Officer at 401 Financial, and a keen observer of the blockchain industry, took to social platform X to highlight the rapid strides taken by this emerging sector.

Citing data from on-chain analytics firm Token Terminal, Smith stated that network fees collected by L2 networks ballooned from 0 to $15 million in a span of just two years.

It was astonishing to observe that exponential growth came during the bear market. Notably, this was the phase where on-chain activity across major L1s stagnated.

Monthly fees paid to use L2 blockchains??

$0 to $15 million in 2 years. In a bear market.

Blockspace demand is up & to the right. ?

via @tokenterminal pic.twitter.com/L48oSjs7z2

— Erik Smith, CFP® (@eriksmithcfp) September 27, 2023

L2s unburden Ethereum

Over the years, Ethereum has been severely bogged down due to rapidly growing user traffic. This led critics to question its scalability in the long run.

L2 solutions, built atop the base layer Ethereum, were found to be the answer to the scalability question. It was planned that over time, these L2s would handle the majority of low-value transactions, with the base layer taking care of security and decentralization.

While it started on a slow note, the vision seemed to be coming to fruition. According to Lucas Outumoro of IntoTheBlock, optimistic roll-ups maintained an average daily transaction share of 67% in September, from just 16% a year ago.

Ethereum Layer 2 adoption has been increasing steadily in 2023

The share that optimistic roll-ups have out of the number of daily transactions has been averaging 67% in September, compared to just 16% a year ago pic.twitter.com/gTduPxMO4g

— Lucas (@LucasOutumuro) September 27, 2023

As is well-known, optimistic rollups included some of the top L2s like Optimism [OP] and Arbitrum [ARB] and the recently-launched Base. In fact, on the majority of days since its launch, Base has outperformed Ethereum in terms of daily transactions.

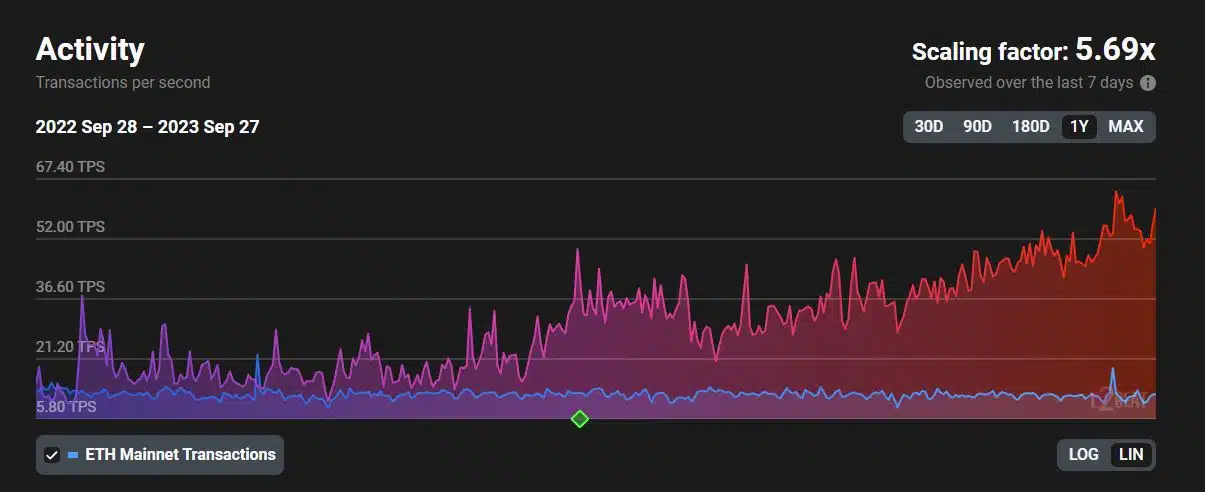

According to L2Beat, aggregated transaction throughput on L2s has grown metaphorically in 2023. On 27 September, the average transactions per second (TPS) was 60, nearly 5x higher than that of Ethereum.

Onwards and upwards for Ethereum scaling?

It appeared more likely that most on-chain activity will switch to L2s in the coming days. The upcoming Ethereum Cancun upgrade, or EIP-4844, could accelerate the rate. This upgrade was set to significantly reduce Ethereum’s gas fees and increase transaction throughput, allowing roll-ups to scale.