A possible Ethereum [ETH] price reversal will have to count on the following

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

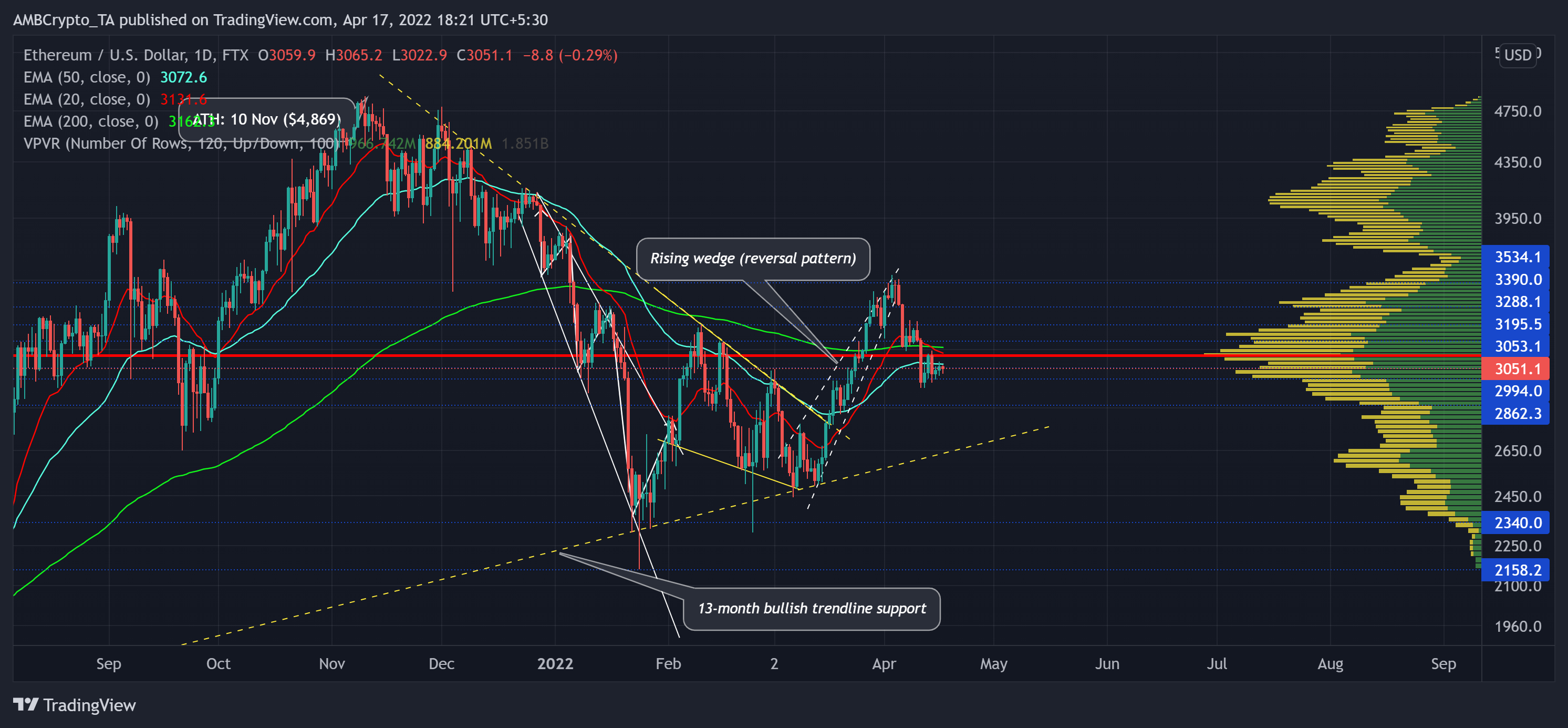

As anticipated by a previous article, Ethereum (ETH) glimpsed a setback near its Point of Control (POC) after breaking down from the rising wedge (white, dashed).

From here on, considering the market structure, the king alt would likely continue its low volatility phase near its POC. At press time, ETH was trading at $3051.1.

ETH Daily Chart

Since the altcoin brushed shoulders with its six-month low in late January, the buyers made their stance visibly clear by propelling higher peaks and troughs on ETH’s daily chart. After obliging to its past inclinations, the crypto picked itself up from the 13-month trendline support (yellow, dashed).

While this rally halted at the $3,500-level, ETH saw a notable correction after a nearly 45.5% monthly surge from its mid-March lows. Post the recent dip, the $2,996-level has been a vital area of value after its POC, offering high liquidity.

It is doubtful whether ETH would be able to sustain another bull run without an extended squeeze phase near the POC range. Furthermore, the southbound 20 EMA (red) fell below the 200 EMA (green) as the bears reignited bearish tendencies. Should the buyers prevent a bearish crossover of the 20/50 EMA, ETH buyers could aim to gather thrust to snap the $3,100-resistance.

Rationale

The RSI’s press time downtrend supported a bearish narrative. With a descending channel trajectory, the buyers could expect a reversal from its immediate trendline support. A possible recovery on this index could reinforce a near-term selling setback.

With the CMF paving its southward route, the money volumes into the crypto’s ecosystem took a significant plunge over the last two weeks. However, with the price action marking higher troughs, CMF undertook a hidden bullish divergence. This reading entailed the likely stall of the recent sell-off phase.

Also, as the Aroon down up (yellow) approached the zero-mark, the chances of bulls holding the $2,992-mark support were high.

Conclusion

Considering the hidden bullish divergence on its CMF and a likely revival of its Aroon up, the buyers would likely uphold the immediate support. But, with the 20 EMA looking south, the POC would continue to pose hurdles as the alt continues its tight phase.

Furthermore, investors/traders need to closely watch out for Bitcoin’s movement. Especially since ETH shares an 85% 30-day correlation with the king coin.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)