Aave: A look into how the lending protocol fared in last week

Members of the Aave [AAVE] community voted in support of a proposal to temporarily pause ETH borrowing on the platform. The vote that took place between 30 August and 2 September saw members in favor of the pause due to the Merge.

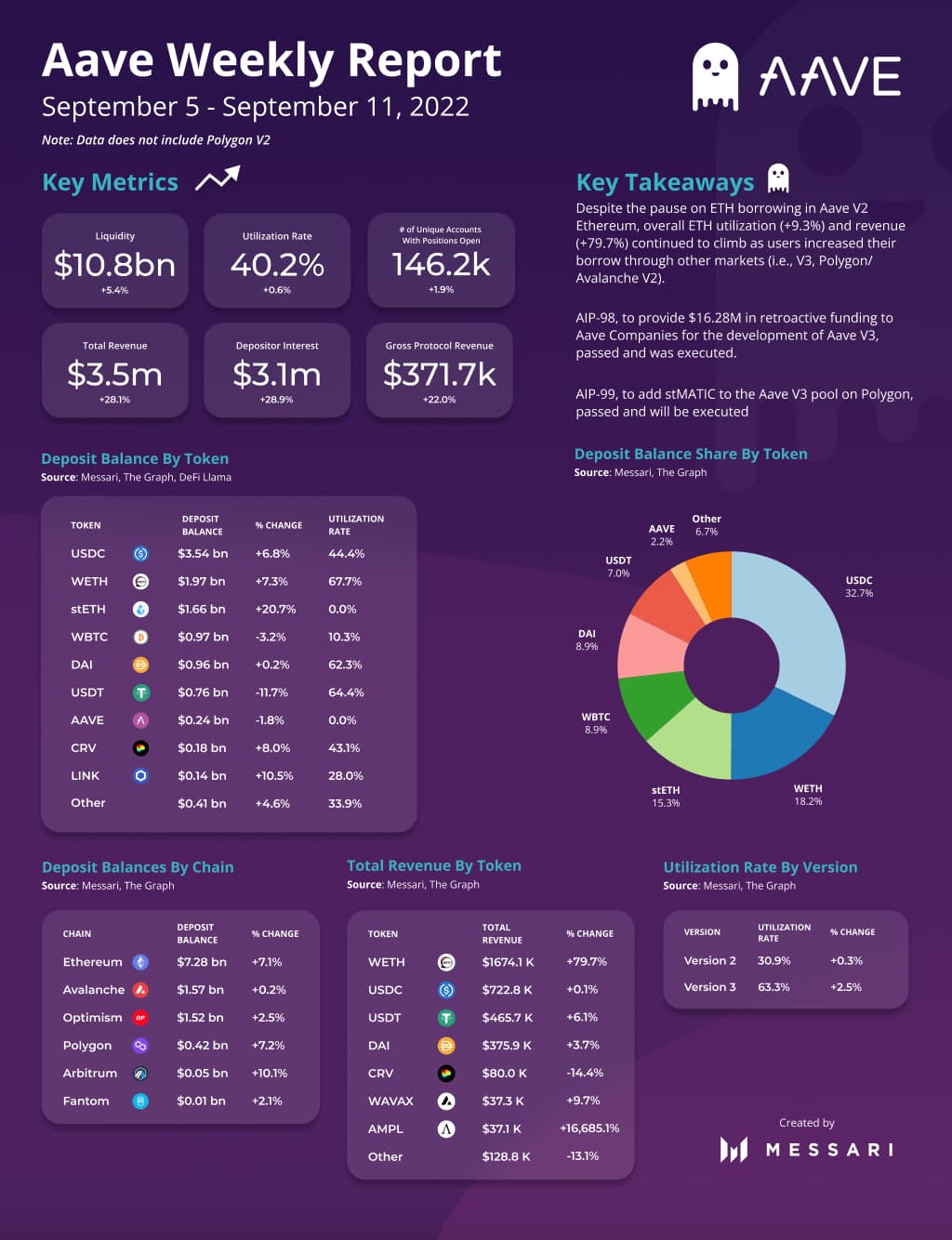

Blockchain analytics platform, Messari, found that despite the suspension, key ecosystem metrics registered growth on 5 and 11 September. These developments were highlighted in the recently published Aave Weekly Report.

The ‘Ghost’ protocol saw some growth

Furthermore, despite the pause in ETH borrowing, Messari found that overall ETH utilization grew by 9.3% between 5 and 11 September. This was because users of the protocol sourced for ETH loans through other means.

These included Aave 3 and Aave 2, deployed on Polygon and Avalanche chains. In addition, the protocol’s ETH revenue was up 80% within the same period.

For key ecosystem metrics, Aave saw a 5.4% growth in liquidity on the platform. Between 5 and 11 September, liquidity on the lending protocol grew to $10.8 billion from $10.3 billion registered between 29 August and 4 September.

Additionally, the total revenue made between 5 and 11 September stood at $3.5 million. This represents a 28.1% rally in total revenue from the $2.7 million recorded as total revenue between 29 August and 4 September.

In the period under review, wrapped Ethereum (WETH) was the most utilized class of asset on the lending protocol. It led other assets with a utilization rate of 67.7%. This was a 16% jump in utilization rate from the 58.4% registered during the same period.

Of all assets listed on Aave, WETH generated the most revenue in the period under review. This was followed by USDC, which logged a total revenue of $722,000 between 5 and 11 September. With a 32.7% share, USDC holds the highest deposit balance share by token on Aave.

What about AAVE?

According to data from CoinMarketCap, the protocol’s native token managed a 3% growth in price within the period under review. As of this writing, AAVE exchanged hands at $91.22. The price per AAVE declined by 1% in the last seven days.

In the last 24 hours, AAVE’s price was down by 2%. However, data from CoinMarketCap revealed a significant rally in trading volume within the same period.

It was up by 66% at press time. This kind of divergence between the price of an asset and its trading volume is usually suggestive of buyers’ exhaustion. Hence further price downside is imminent.