AAVE: ‘Behold the power of the death cross’

As most altcoins cashed in on Bitcoin’s positive momentum and made gains, some alts rose more than others on the charts. One such alt that quickly shed its bearish momentum and noted a northbound rally was AAVE. In fact, at the time of writing, the Defi token was up by almost 45% on the weekly timeframe.

Interestingly, over the last week, a subtle rise in the DeFi token’s unique addresses activity pointed towards a new demand wave for DeFi. What’s more, a recent report had highlighted how a “sustained rise in address activity may be an early signal of growing network confidence and a possible ‘return to form’ for DeFi’s blue chips.” The same also underlined how AAVE’s daily active addresses have risen by +24.1% since last Monday.

This growing popularity of some of the top DeFi assets in the market is indicative of another surgery as the market saw a bit of a recovery over the last few days. One could see parallels of this with the sheer rise of DeFi last year around the same time. And yet again, after some minor setbacks, the idea of DeFi seemed far from obsolete as rallies by assets like AAVE were welcomed with open arms by the industry.

AAVE is one of the few altcoins that has already retested its support, following which, its heading upwards again.

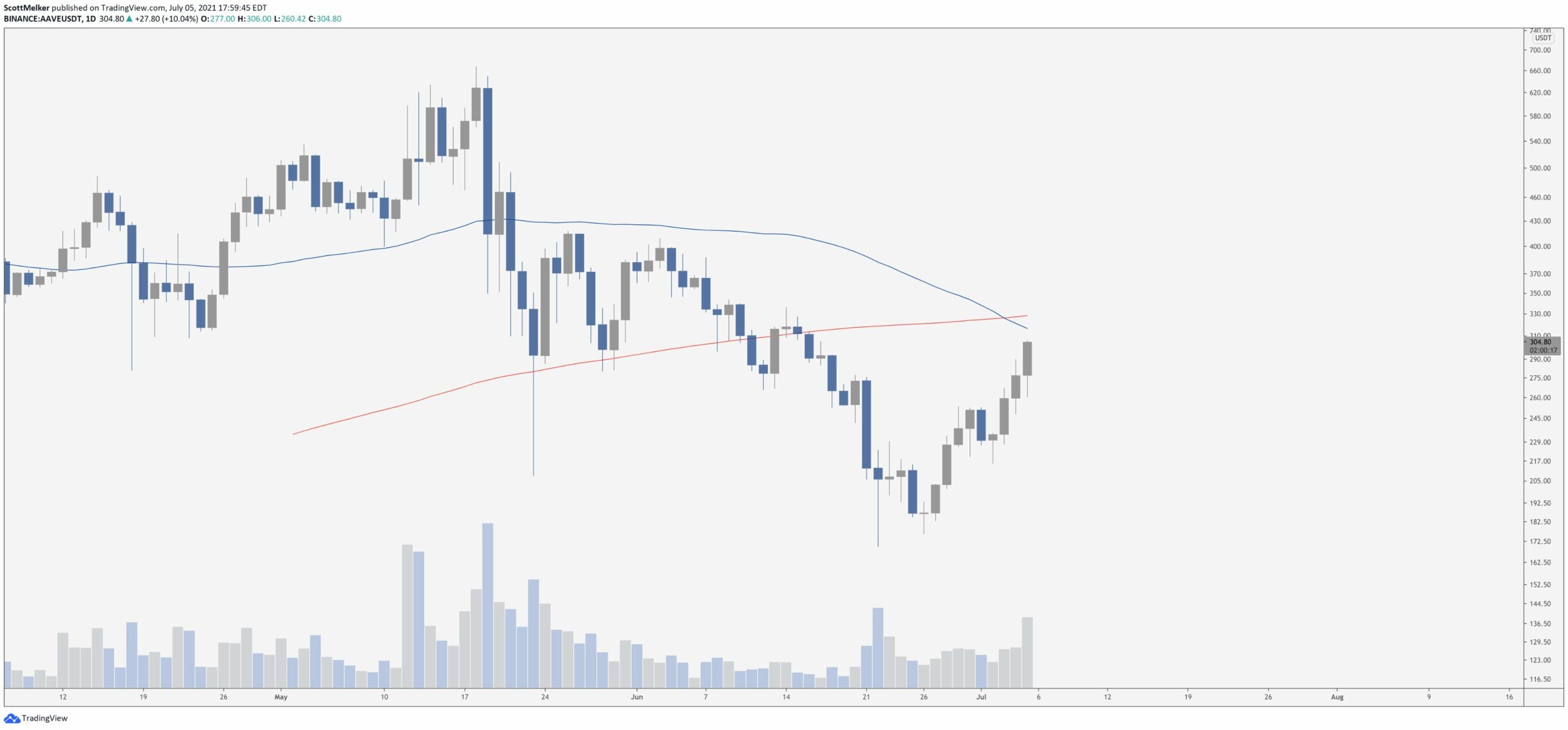

Analyst and trader Scott Melker is one of those who has been observing Aave since the beginning of this month. A recent tweet by Melker highlighted how Aave underwent a recent death cross on its USDT chart. However, the analyst was quick to discard the effect of the same against the alt’s constant rally.

He tweeted,

“Behold! The power of the death cross!

Wait, what? It (AAVE) went up? Death crosses are lagging indicators? Oh, ok, scratch that.”

Source: Scott Melker Twitter

Interestingly, the alt’s rally aligns with the platform’s plan to launch Aave Pro. This will operate segregated permissioned pools of “whitelisted” users that have passed KYC protocols.

Aave, the largest DeFi lending protocol with more than $16 billion in cryptocurrency assets locked, will remove a major roadblock to regulated institutions participating in decentralized finance (DeFi) after its launch of Aave pro.

Post its southbound price action until the 26th of June, Aave registered positive gains as its price went up by almost 83%. Melker also highlighted the crypto’s positive gains in a series of tweets where he pointed out that the alt is “Fully erect” against BTC. Aave’s recent price gains took the alt’s 7-day ROI up by 41.81%.

Fully erect. pic.twitter.com/WRyPjj6e7q

— The Wolf Of All Streets (@scottmelker) July 5, 2021