AAVE breaks 800-day range – What does it mean, and what’s next now?

- AAVE broke out as its daily price action held strong

- Fundamentals backed its price movement and suggested the altcoin might go further up

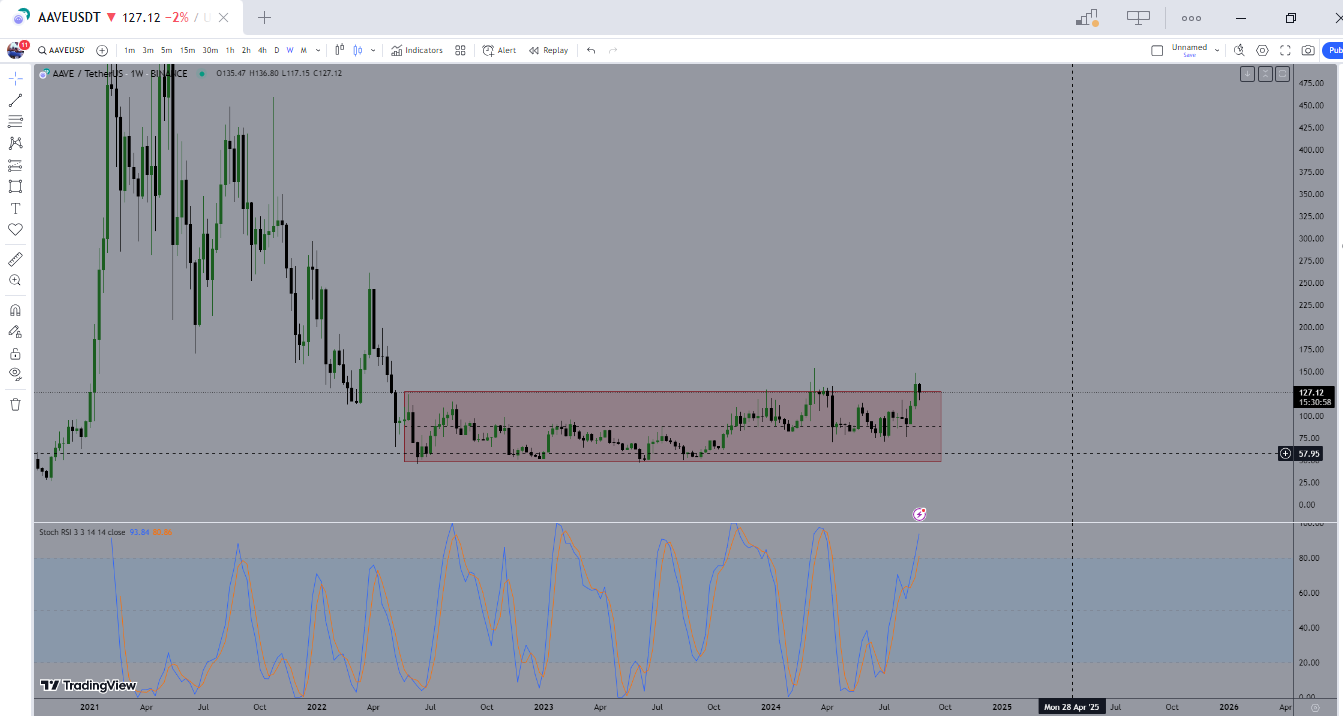

AAVE recently broke out of an 800-day accumulation range on the weekly chart, signaling a potential bullish trend. This breakout seemed to be supported by the stochastic RSI, which showed strong buyer interest.

Despite a potential bearish close for this week’s AAVE/USDT candle, the sentiment, at press time, remained positive on the charts. Even as other major cryptos with top market caps saw declines of their own.

In fact, last week’s candle closed above the critical levels within this range. And, for AAVE to continue its bullish momentum, this week’s candle must close above the same range. Regardless of whether it closes red or green.

The key factor to watch is whether AAVE can maintain its position above the range. If it does, this could mean strong upwards movement in the near future.

AAVE’s successful re-test holds strong

AAVE’s price action made a successful retest of the previous range high on the daily chart of AAVE/USDT. This lent further confidence to AAVE’s strength on the charts.

If AAVE’s price action continues to push higher without retesting the same range high, it would mean that a more significant upward move could be imminent.

This scenario would present a highly profitable, low-risk trading opportunity. Especially as AAVE has demonstrated resilience through the broader market’s challenges.

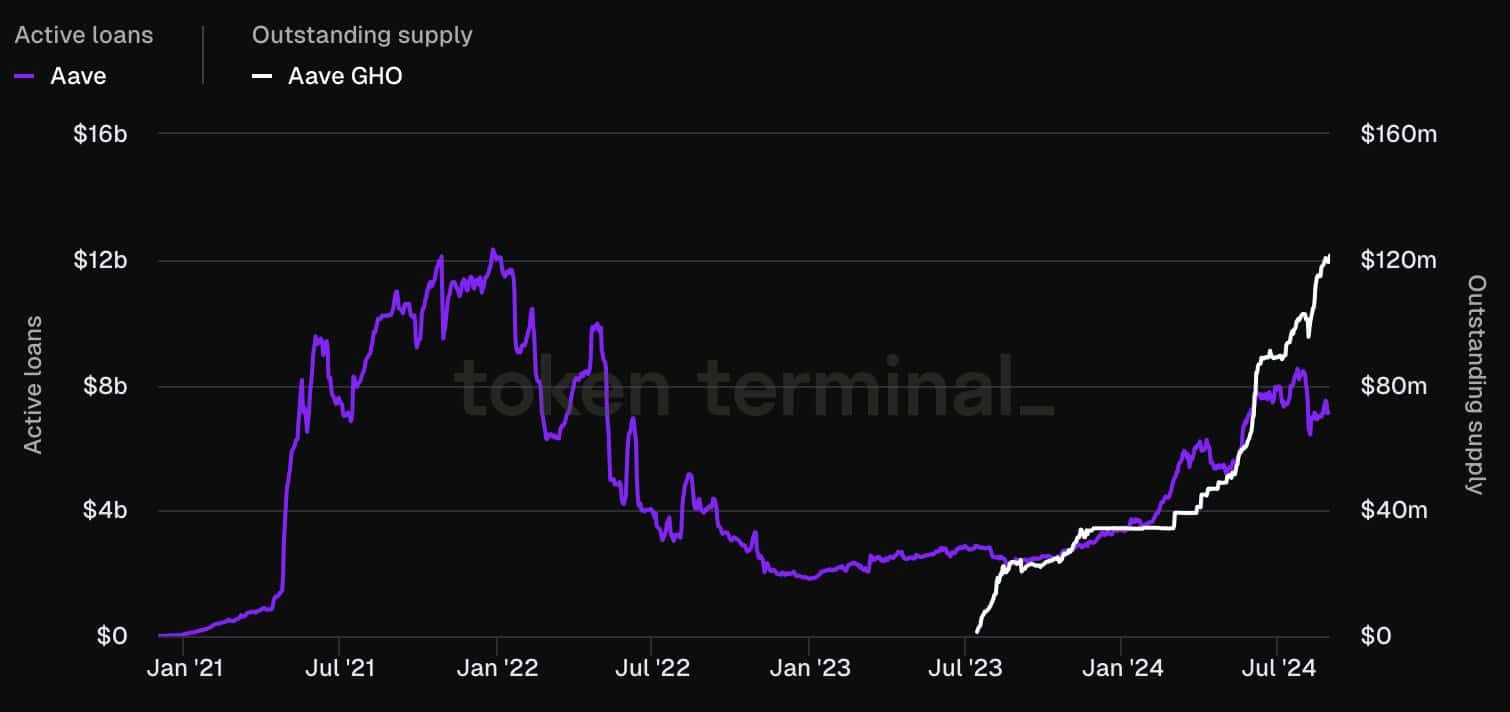

Aave products are booming…

Beyond technical indicators, Aave’s fundamentals also seemed to point to potential growth. The platform’s products, particularly its lending and stablecoin businesses, have seen significant growth over the past year.

This expansion supports the idea that AAVE might be poised for a price surge in the coming weeks or months.

Aave as utility for liquidity management

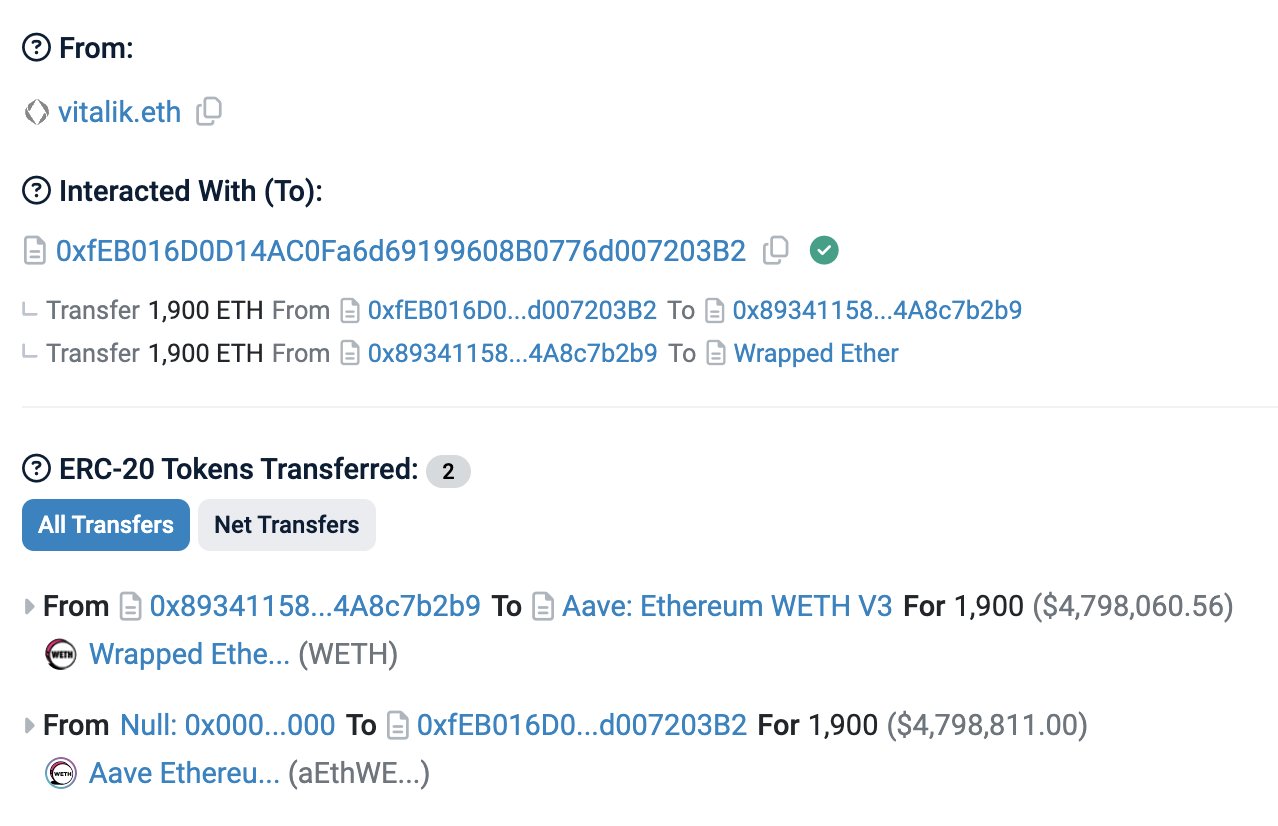

One of Aave’s key strengths lies in its ability to manage liquidity effectively. The platform allows users to deposit assets into liquidity pools, which others can borrow from. This ensures a balanced flow of assets within the ecosystem.

This utility for liquidity management has been recognized even by Ethereum co-founder Vitalik Buterin, who uses Aave. This could potentially be a critical tool for the Ethereum Foundation.

Aave’s vision is to be the backbone of all credit markets, offering liquidity against various forms of tokenized and native value. This growing utility and infrastructure might further bolster AAVE’s price in the near future.