AAVE faces turbulence: Are whales driving a market shift?

- Whale activity suggests a potential shift in sentiment as large AAVE holders offload assets.

- Technical indicators signal bearish momentum, though on-chain engagement metrics show steady interest.

Aave [AAVE], a top player in decentralized finance (DeFi), is currently facing heightened selling pressure as prominent investors—often referred to as “whales”—are offloading considerable holdings. Recent data highlights major transfers to exchanges, including Binance, MEXC, and OKX.

Notably, 25,790 AAVE worth $3.39 million and 7,822 AAVE worth $1.04 million were sent to MEXC and Binance, respectively. Additionally, Cumberland and Galaxy Digital, two significant institutional players, deposited 10,000 AAVE and 7,897 AAVE, respectively.

At press time, AAVE was trading at $129.58, up by a slight 0.14% over the past day. This wave of large transactions raises the question: Is AAVE experiencing a short-term dip, or is this the beginning of a larger sentiment shift?

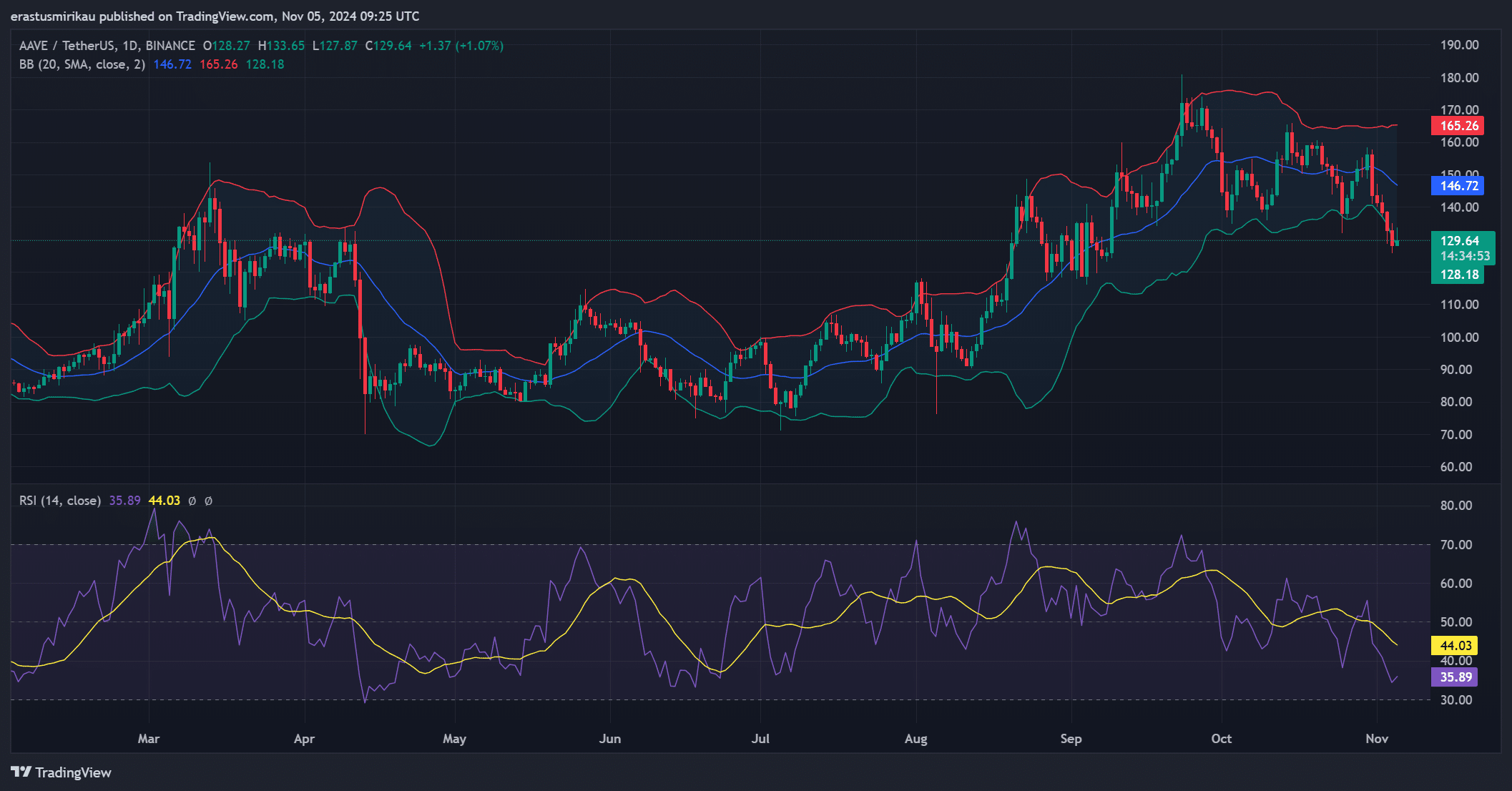

Technical analysis: Is a further decline on the horizon?

Technical indicators provide a mixed outlook for the price movements. The Bollinger Bands (BB) reveal increased volatility, with the price nearing the lower band, suggesting bearish momentum. This downward pressure could lead to further declines if selling persists.

Meanwhile, the Relative Strength Index (RSI) is at 35.89, bordering oversold territory, which often attracts buyers looking for value.

However, without stronger buying activity, the bearish trend could continue. Therefore, traders should exercise caution, especially if it remains close to the lower Bollinger Band.

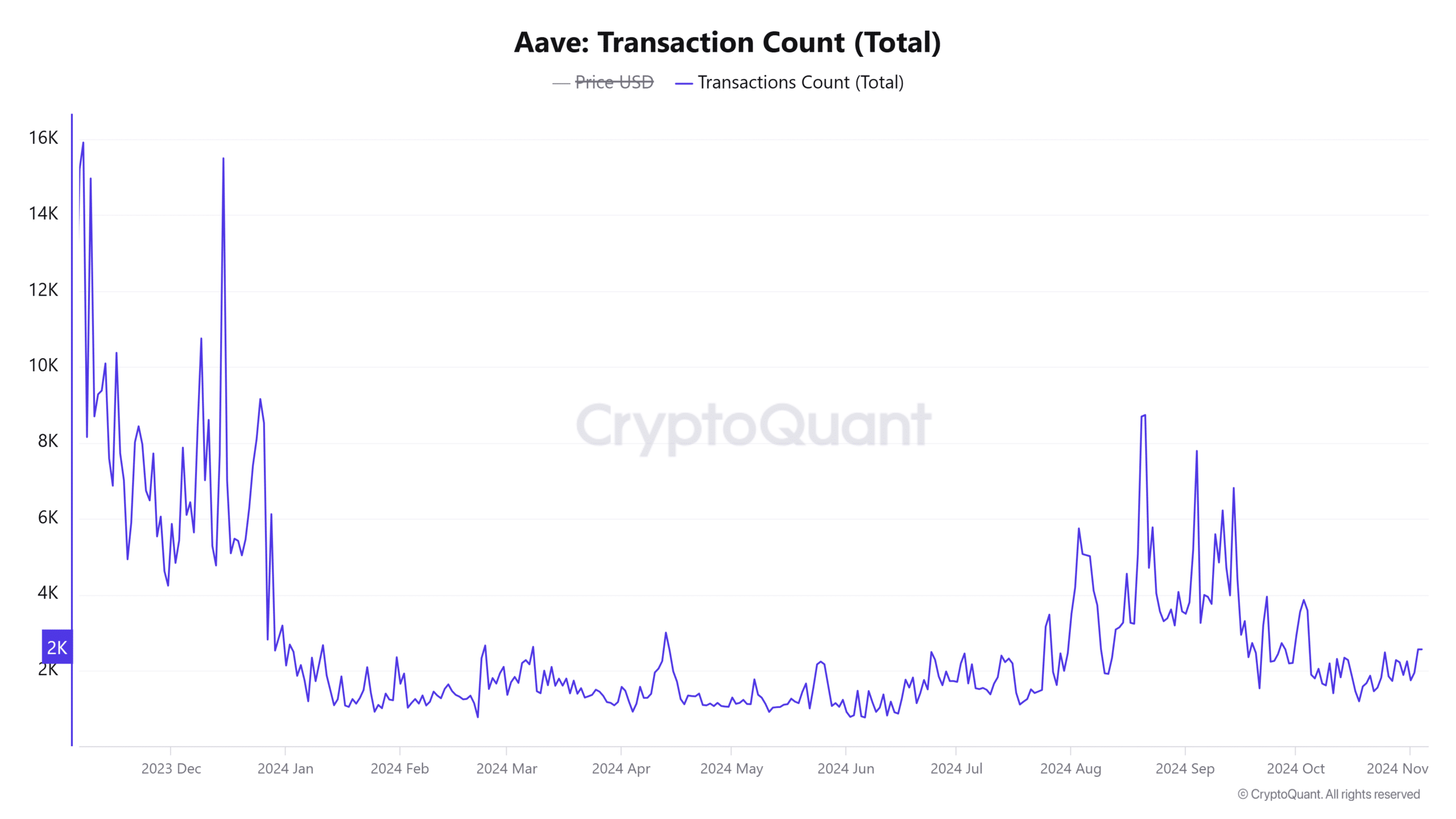

AAVE active addresses and transaction count

Despite the whale-driven selling pressure, on-chain metrics indicate steady engagement. The transaction count currently stands at 2.67K, a modest increase of 1.03% over the last 24 hours, while active addresses grew by 1.08% according to CryptoQuant.

This uptick in activity could signal that smaller investors are still interested, countering the selling pressure from larger players. However, the increase in active addresses may not be enough to offset the influence of whale movements unless retail buying intensifies.

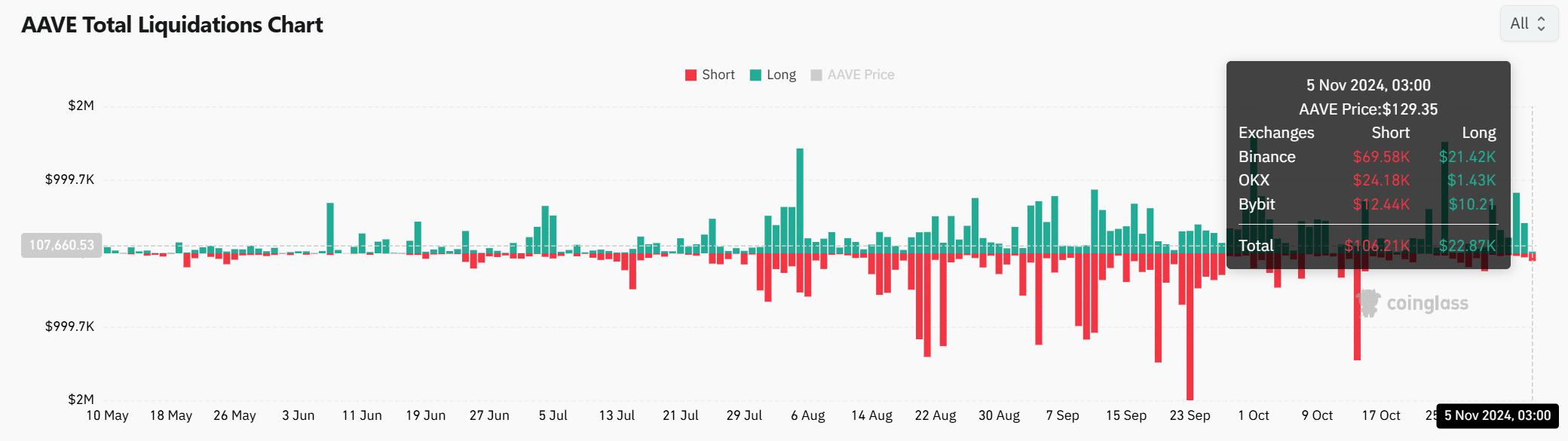

AAVE liquidations: Could this trigger further volatility?

Liquidation data adds a crucial dimension to AAVE’s outlook. As of the latest report, $106.21K worth of short positions and only $22.87K in longs were liquidated across platforms like Binance, OKX, and Bybit.

This imbalance points to a prevailing bearish sentiment, as traders continue to hedge against further downside. Therefore, should these liquidations persist, they may add to selling pressure, particularly if stop-loss orders are triggered on long positions.

Read Aave’s [AAVE] Price Prediction 2024–2025

Conclusively, AAVE is navigating a challenging period marked by significant whale activity, technical bearish signals, and a high volume of liquidations. The combination of whale sell-offs and technical indicators leans toward a cautious outlook.

However, the steady increase in active addresses and transactions shows that retail interest remains. Whether the current selling pressure results in a prolonged downtrend or a temporary dip will likely depend on retail buying strength and further whale movements.