Aave founder dumps $6.67M AAVE: Should you cash out too?

- Aave founder has dumped $6.67 million AAVE since February.

- The altcoin still enjoyed massive social interest and could present more buying opportunities.

Despite the market dip, Aave [AAVE] has been one of the top-performing altcoins. However, the price hike has attracted profit-taking, with Aave’s founder and CEO, Stani Kulechov, leading the line of sellers.

According to blockchain analytics firm LookOnChain, Kulechov has sold 55,596 AAVE, worth $6.67 million since February. The founder’s AAVE balance is now 243.9K coins, worth over $32 million.

Is AAVE’s price overvalued?

According to Kaito, the altcoin has captured vast mindshare across social media since its Q2 low of $75. The rising mindshare coincided with the AAVE recovery.

This indicated a strong market interest that could have partly boosted the recovery by nearly 80% since the Q2 lows.

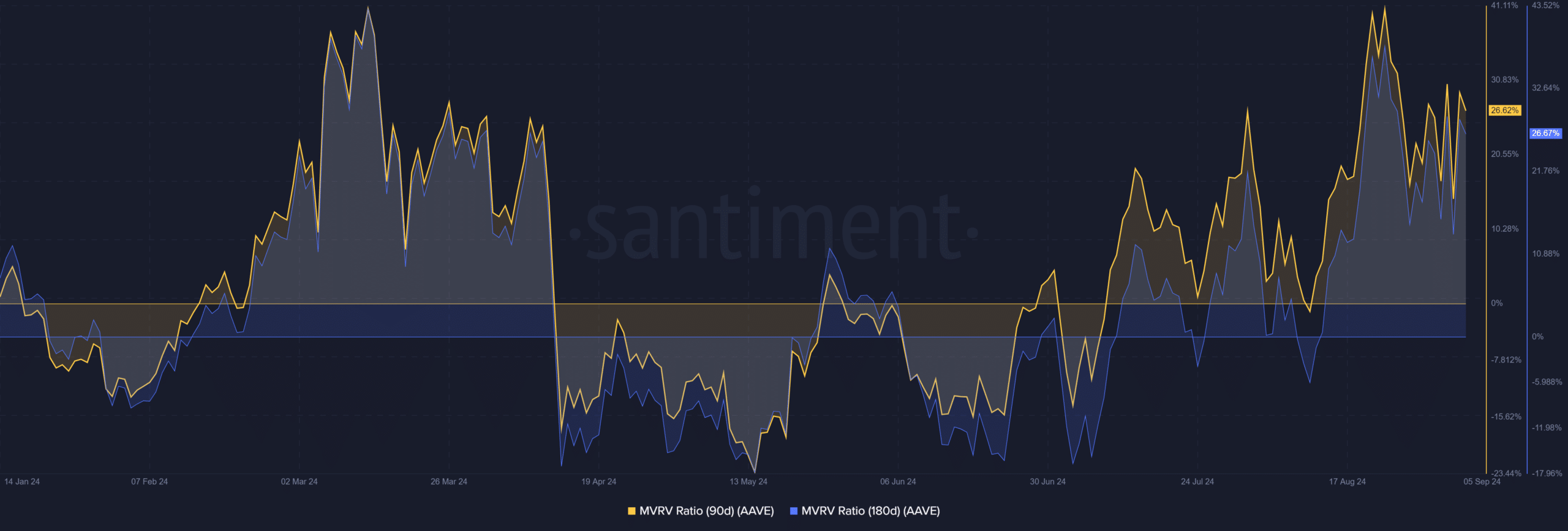

After the strong rebound, investor cohorts that held AAVE for the past three and six months had unrealized profits of 27% and 26%, respectively. This was based on the 90-day and 180-day MVRV (Market Value to Realized Value).

The metric also tracks whether a coin is overvalued. Short—and medium-term holders with high unrealized profits could be tempted to take small profits.

If so, AAVE was relatively overvalued at the current price and could expose late buyers to steep losses if profit-taking intensified.

Key levels to watch for AAVE

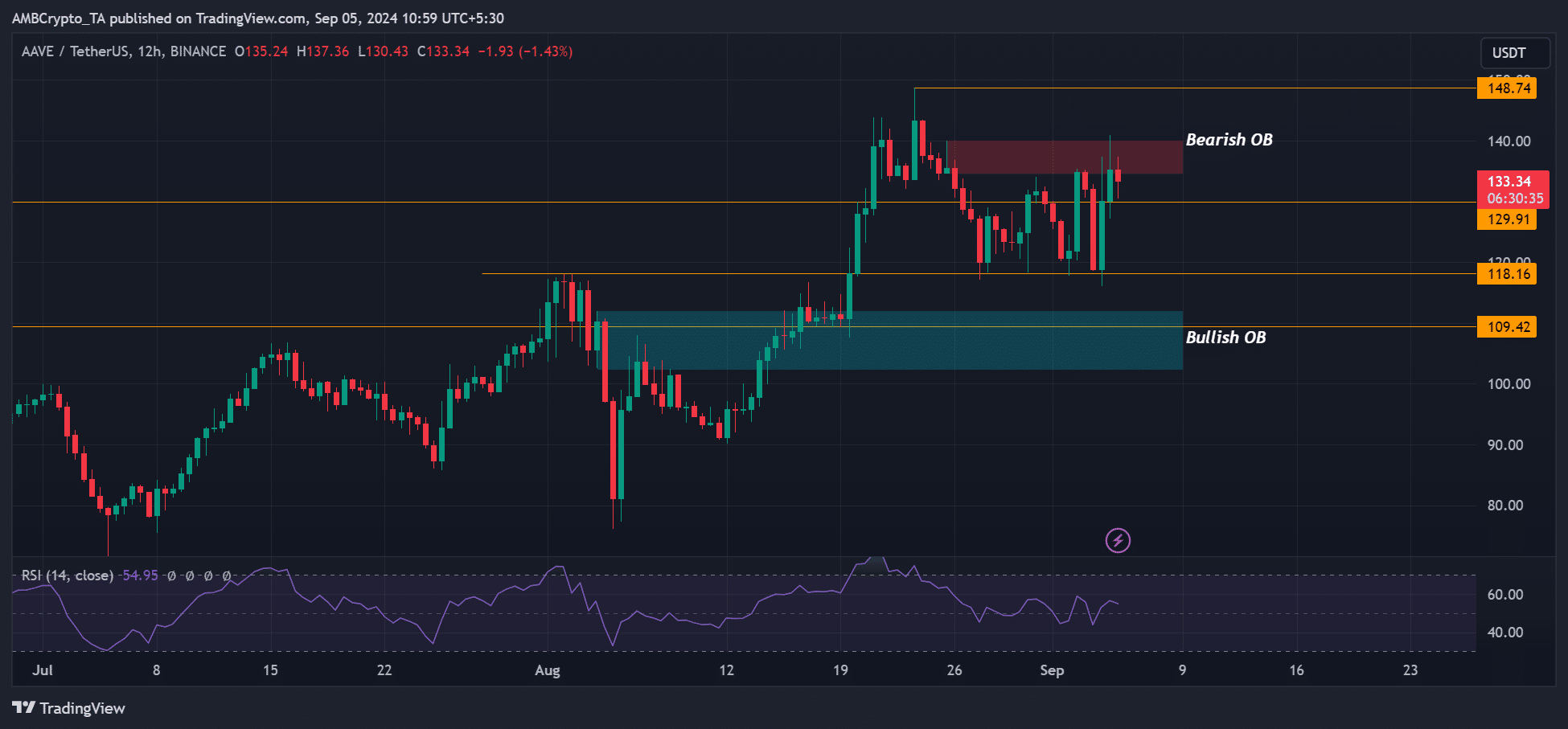

On the 12-hour price chart, AAVE’s recent upswing hit a short-term supply zone and bearish order block (OB) near $140.

The supply zone further confirmed the recent profit-taking from medium-term holders, including Kulechov’s sell-off.

Since late August, $118 has been a key support for bulls. However, despite the massive social interest, climbing above $140 has been challenging.

If the selling pressure at $140 persists, the short-term supports at $118 and $109 can be great buying opportunities.

Read Aave [AAVE] Price Prediction 2024 – 2025

That said, AAVE could still be a great opportunity, given the rising DeFi mindshare and the strong support from top crypto venture capitalists for the lending protocol.

According to Arthur Cheong, founder and CEO of DeFiance Capital, AAVE should be the most valuable DeFi protocol.

‘Unpopular opinion: Aave should be the most valuable DeFi protocol.’