Aave [AAVE] in a downtrend as another level of support is lost to the bears

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure and momentum of Aave were firmly bearish.

- A retest of the breached support level could offer a shorting opportunity.

Tether’s [USDT] dominance was slowly creeping upward since the beginning of May. This showed that investors’ capital flowed into stablecoins and out of the crypto market due to fears of further losses on the price charts.

Read Aave’s Price Prediction 2023-24

Aave has been in a downtrend since 20 April, when the previously bullish higher timeframe market structure was violently broken. The prices crashed 15% within a week back then, and the sellers have been dominant since.

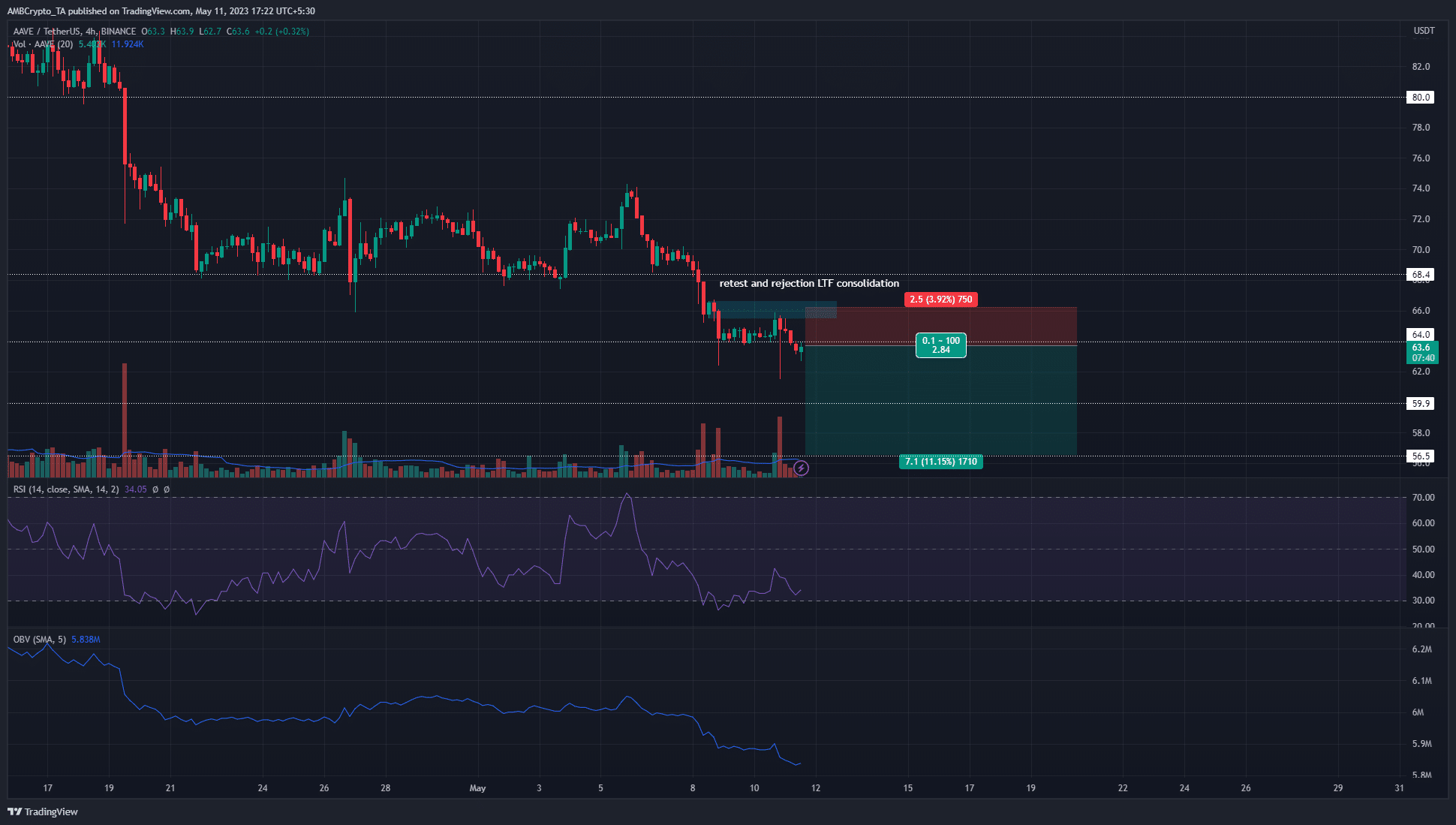

The incessant downtrend got extra impetus following a move below $64 support

Since 22 April, AAVE held on to the $68.4 level of support. The bulls were clinging on with every last ounce of strength, but eventually succumbed.

In doing so, the H4 market structure became bearish. On 8 May, a lower timeframe consolidation was seen at the $66 level, before AAVE saw a drop to the $64 support.

Over the past 12 hours of trading the $64 level was lost to the bears as well, following a retest of the lower timeframe bearish order block at $66. The fall below $64 offered a shorting opportunity.

The stop-loss can be set above $66 or the most recent lower high, depending on the trader’s risk appetite.

An H4 trading session above $66.6 will invalidate this idea. To the south, the $60 and $56.5 can be used to secure profits on an AAVE move southward.

The RSI and the price were forming a bullish divergence, but the strong decline on the OBV meant that sellers remained dominant.

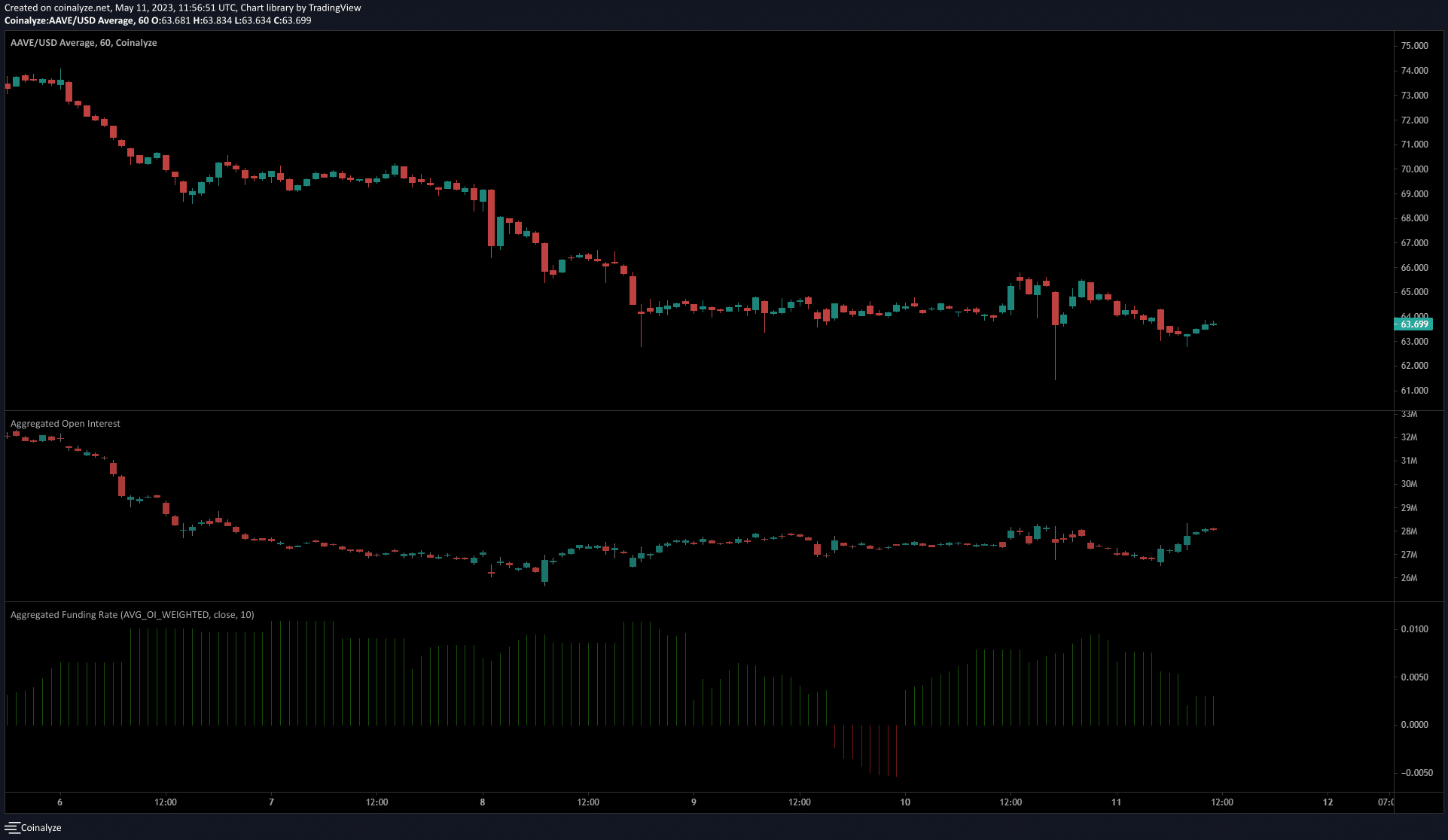

Funding rates slipped into negative before recovery

Source: Coinalyze

On 10 May the funding rates went negative for a few hours. This could be a sign of traders hedging short, or it could also mean that market sentiment leaned heavily in bearish favor then.

Is your portfolio green? Check the Aave Profit Calculator

Open Interest was flat over the past couple of days. There was a slight descent when AAVE saw a rejection from $66.

This was indicative of discouraged bulls and pointed to bearish sentiment overall. Combined with the price action, further losses seemed likely.