AAVE investors can savor the moment as the protocol has these plans for…

- Aave’s expansion plans may soon push into the BNB smart chain if this latest proposal is passed.

- AAVE bulls regain confidence following the proposal announcement.

Aave is looking to expand the accessibility of the third version of its lending and borrowing protocol. The network revealed this through a recently announced proposal that it had plans to expand into the BNB chain.

Is your portfolio green? Check out the Aave Profit Calculator

Aave V3 has already been deployed on multiple networks, especially Ethereum [ETH] layer 2s. The most recent announcement revealed that the BNB chain might be its next destination depending on the outcome of the proposal’s vote.

Aave revealed that it will initially deploy Aave V3 on BNB chain with a few handpicked digital assets as collateral.

The Aave community proposes to deploy Aave V3 on the BNB Chain and select assets as collateral, including BNB, WBTC, BETH, WETH, USDC, and USDT. The largest lending agreement of BNBChain is Venus Protocol, but there have been many security problems. https://t.co/u3D0dXDMdg

— Wu Blockchain (@WuBlockchain) April 4, 2023

The announcement reflected the collaboration trend that was observed so far this year in the blockchain and DeFi segment. Aave made it clear that both networks will benefit from this collaboration. So what are the benefits to expect? The first major benefit especially for Aave will be access to a larger and more diversified crowd of users.

The BNB chain already has an extensive user base, which may provide access to a lot more liquidity. As far as benefits are concerned, Aave stated that Aave V3 could boost BNB chain’s offerings courtesy of its flagship DeFi protocol status.

Will the development impact AAVE’s price action?

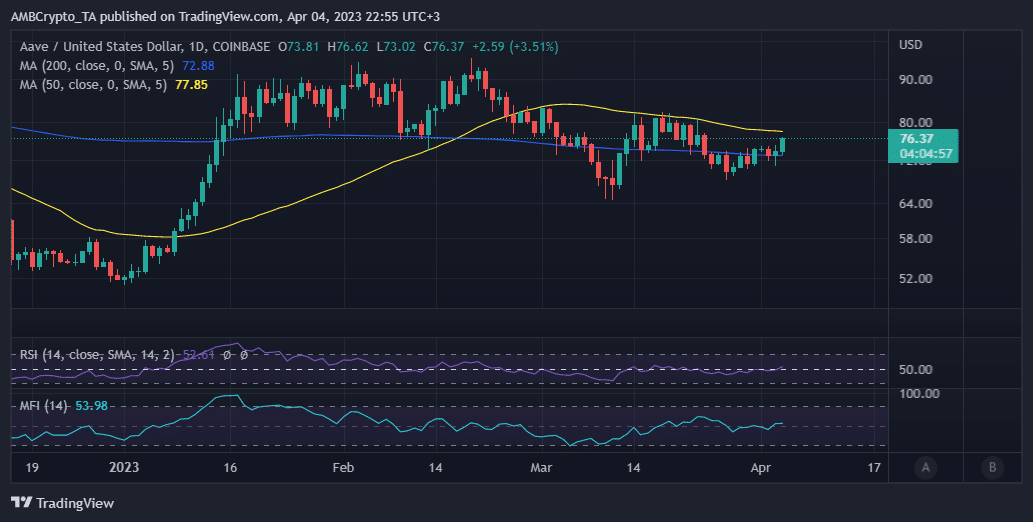

The AAVE token has been oscillating on its 200-day moving average for the last few weeks. Its latest pivot has so far yielded at 12% upside from a $68.18 low on 27 March to a press time price of $76.40.

More notably, the bulls pushed the price by over 4% in the last 24 hours, suggesting a confidence boost courtesy of the proposal announcement.

How many are 1,10,100 AAVEs worth today

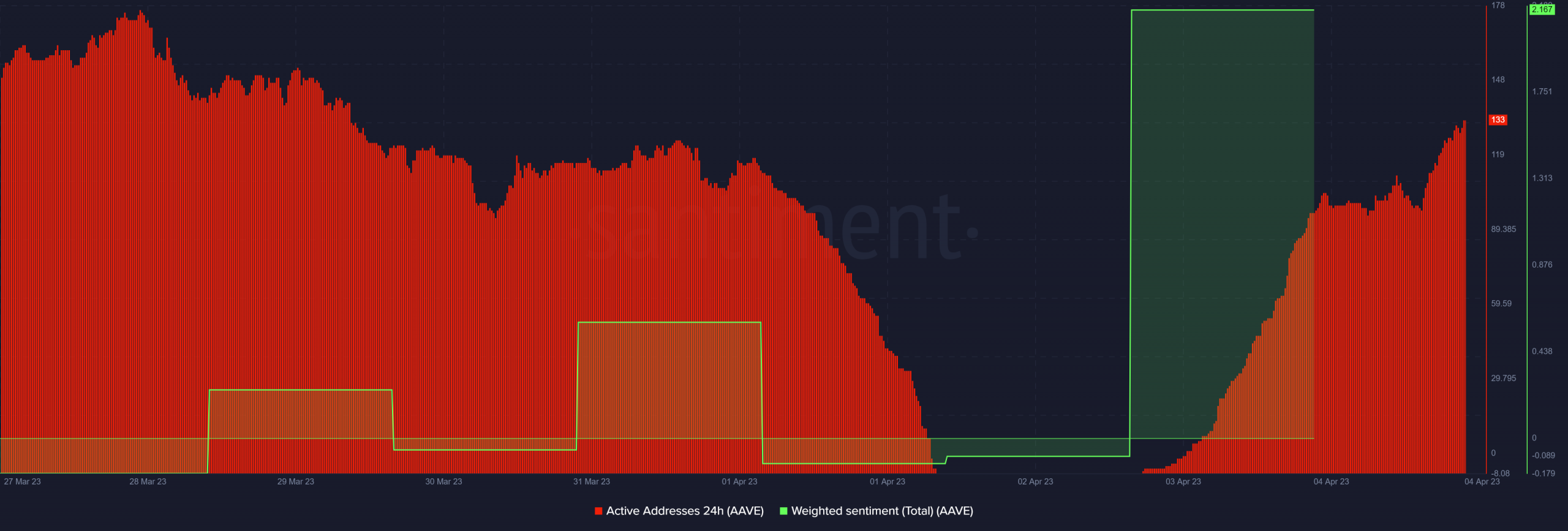

Furthermore, AAVE’s Relative Strength Index (RSI) indicated that the price recently crossed above the mid-level, suggesting an increase in relative strength. While this outcome may point to more confidence among investors, the weighted sentiment did offer more clarity with its latest uptick.

The surge on 3 April was accompanied by a resurgence of daily active addresses back above end of March levels.

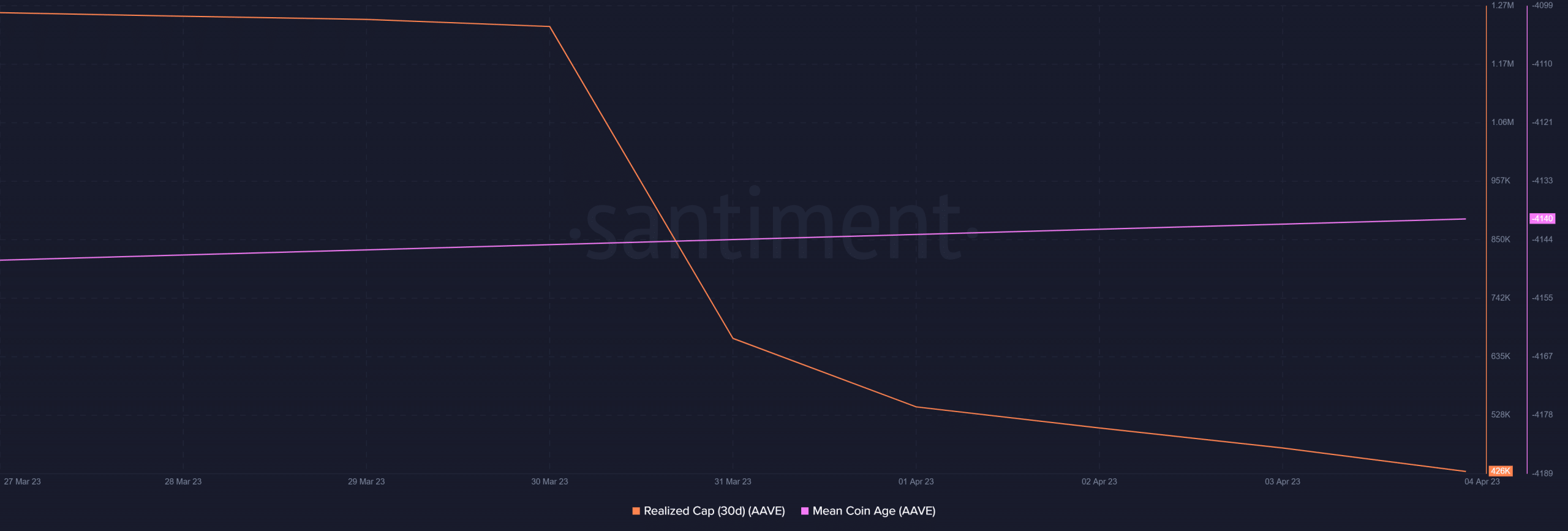

But what about the state of profitability and sell pressure? Well, AAVE’s mean coin age maintained a steady upward trend for the last seven days. This confirmed that most long-term holders were still holding on to their coins rather than focusing on short-term profits.

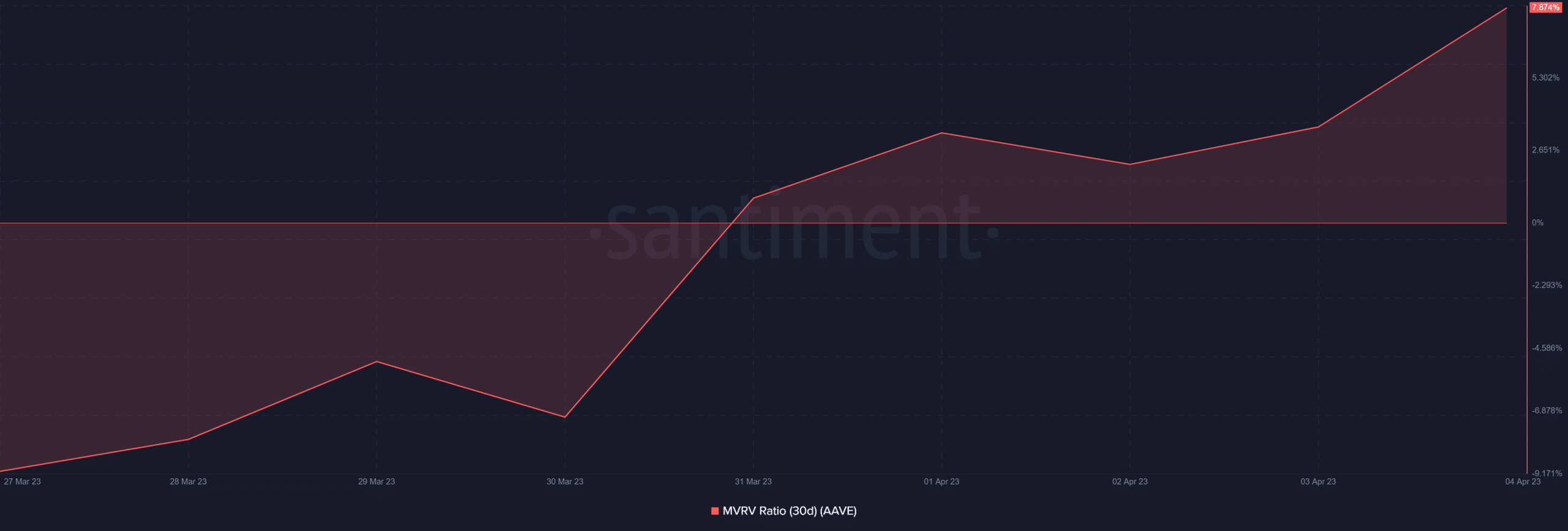

On the other hand, the realized cap dropped in the last week or so currently at a monthly low. The lower value indicated that more coins had been moved at more expensive prices, perhaps as a reflection in its ability to continue rallying. Meanwhile, the Market Value to Realized Value (MVRV) ratio adopted an overall upside in the last four months.

The higher MVRV ratio also confirmed that there was significant buying pressure towards the end of March. And most of those buyers enjoyed staying profitable at press time.