Can Uniswap, Curve and Aave reap the benefits of USDC’s fall

- Uniswap witnessed a high surge in activity due to SVB’s collapse.

- However, its UNI token didn’t see the same growth.

The fall of SVB has brought a shockwave to many investors in the crypto community. While major firms and large stablecoin issuers faced the heat, the DEX sector of the crypto space, managed to see growth.

Read UNI’s Price Prediction 2023-2024

For instance, Uniswap witnessed an all-time high in terms of volume and outperformed Nasdaq by 5%.

Other DeFi protocols such as Aave and Curve also observed a spike in activity during this period. Due to the high activity registered on these protocols, the fees generated by them increased.

Yesterday, #DeFi transactions were highly active because of the panic surrounding #USDC. #Uniswap fees saw a surge, reaching $8.7 million, the highest since May 12 of last year. Curve fees also increased, reaching $950,000, the highest since November 10 of https://t.co/TuhZEhbDtA… https://t.co/LGTNu4bUGi pic.twitter.com/vysQRnlfke

— BecauseBitcoin.com (@BecauseBitcoin) March 12, 2023

Interestingly, the spike in fees generated impacted the revenue collected by these protocols. According to Messari’s data, revenue generated by Uniswap increased by 0.74%, whereas the Curve protocol witnessed an uptick of 0.12%.

However, Aave observed the most growth in this regard as it saw a spike of 48.76% in terms of revenue collected over the last week.

The high spike in revenue for Aave was made possible because there was a surge of 89.93% in the number of unique users on the Aave protocol.

Not all roses and sunshine

The high activity on all these protocols, however, did not translate to a surge in the total value locked (TVL) on them.

According to DeFi Llama’s data, Uniswap’s TVL fell by 17.29% in the past few days. The Curve protocol’s TVL witnessed a similar decline and fell by 20% in the same period.

Meanwhile, it was found based on Messari’s data, bots were responsible for the majority of the activity on the Uniswap protocol.

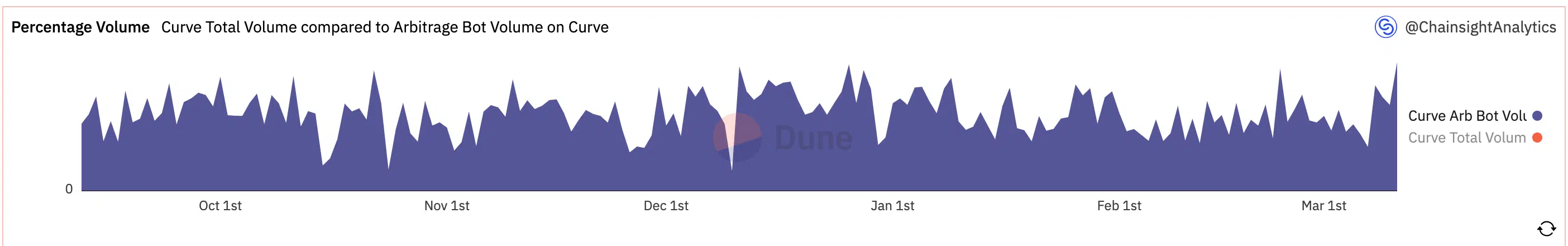

The same was observed for the Curve protocol. According to Dune Analytics’ data, the bot volume on the curve protocol increased from 13.5% to 41.3% in the last few days.

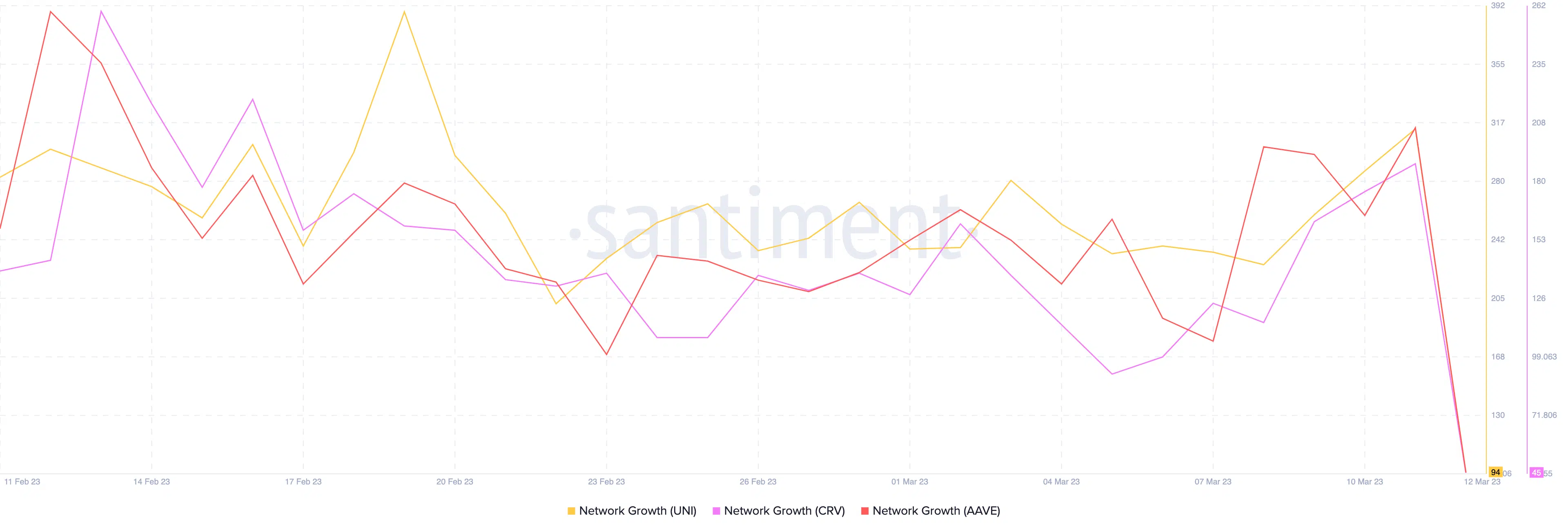

The tokens of these protocols did not observe any growth either. The prices of UNI, CRV, and AAVE, fell over the last month.

Parallelly, the network growth of the tokens declined at press time. Thus, suggesting that these tokens weren’t being used by any new addresses, at the time of writing.