Aave may be on a slippery slope, but here’s why there’s hope for recovery

Most DeFi tokens have been performing inconsistently of late. The China crackdown FUD did impact the broader DeFi market to some extent, but it failed to send these tokens into their ‘summer’ mode. However, their recovery over the past week has been notable.

The likes of Uniswap, Curve Finance, and SushiSwap have individually appreciated by 5%-7% in the aforementioned timeframe.

Why is AAVE missing the party?

Over the last 10 days, AAVE has spent more time under the $300-mark than above it. With the drop in value and market cap, the token has been slipping on its overall rankings too. And, quite a few fundamental factors are responsible for the same.

The cumulative value locked in DeFi witnessed a sharp hike from $86.2 billion to over $90.3 billion in just 10 hours. The surge was led by Curve Finance, Uniswap, and SushiSwap. In fact, their individual TVLs recorded surges in the 4%-6% bracket. Aave, however, recorded a 3% dip in the same timeframe.

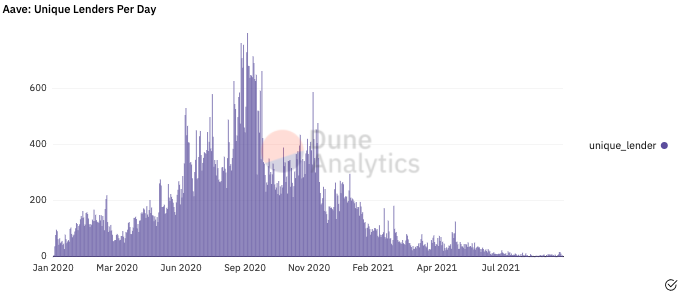

Aave’s liquidity crunch has primarily been caused by a drop in the number of unique lenders. In fact, the chart below clearly highlights the stark difference in the state of this metric over the past year. Quite inevitably, the pace of liquidity mining has slowed down on the platform.

As a protocol that allows people to lend and borrow crypto, the aforementioned data can be looked at to assess the ill-state of Aave.

Unique Lenders per day – AAVE || Source: Dune Analytics

The weakening fundamentals have had a ripple effect on the state of the token’s on-chain metrics. There has not been an influx of new people into the Aave market of late. According to ITB’s address stats, the number of active addresses has shrunk from over 1.5% to 0.9% in just one month.

The exchange outflow numbers were additionally more inclined towards the lower side, pointing to the lack of buying momentum. In fact, the diminishing returns provide no incentive to new participants to buy new tokens or step into the Aave market.

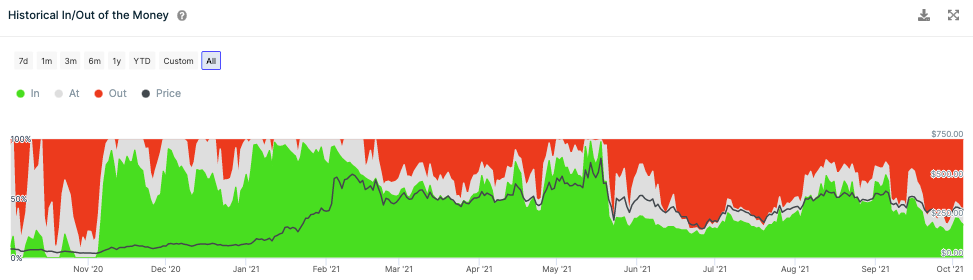

At the time of writing, more than half the addresses were suffering notional losses.

In/Out of the Money stats – AAVE || Source: IntoTheBlock

All hope is not lost

Amidst the gloomy state of most of the metrics, the pace of the protocol’s development activity does provide some respite. As can be seen from the chart attached herein, the same has been going on swiftly over the last couple of weeks. What’s more, this would most likely brush off positively on the fundamentals in the foreseeable future.

Additionally, Aave’s counterparts have been faring better on most of the fronts lately. The DeFi market, more often than not, tends to swing up and down together. Thus, if Uniswap, SushiSwap, Curve Finance, and others continue to perform well, the favorable environment will aid Aave’s recovery.

Development activity – AAVE || Source: Santiment