AAVE price jumps 10% after major sell-off: What happens now?

- AAVE’s Open Interest has skyrocketed by 15% in the last four hours and 5.5% in the past hours.

- If AAVE rises to $131.5 level, approximately $1.19 million worth of short positions will be liquidated.

Aave [AAVE] surged nearly 10%, rebounding to the level at which a whale had recently dumped a significant amount of tokens.

On the 4th of September, the overall cryptocurrency market experienced a notable price decline as Bitcoin [BTC] fell below the $57,000 level.

Aave whale’s recent activity

An early AAVE holder dumped their entire 17,447 tokens worth $2.16 million at a loss of $2.14 million, as reported by the on-chain analytic firm Lookonchain.

This whale had purchased the AAVE tokens worth $4.3 million from Binance on the 28th of March, 2021, at an average price of $246.

This multimillion-dollar AAVE dump occurred at a crucial support level of $118 and had the potential to create selling pressure, but it didn’t happen as expected.

Rising AAVE price and open interest

At press time, AAVE was trading near $130 and has experienced a price drop of over 1.25% in the last 24 hours. Its trading volume has increased by 85% during the same period, indicating higher participation from traders.

However, AAVE’s Open Interest skyrocketed by 15% in the last four hours and 5.5% in the past hours, according to Coinglass.

This rising Open Interest indicated growing investor and trader interest amid the recent price drop.

Technical analysis and key levels

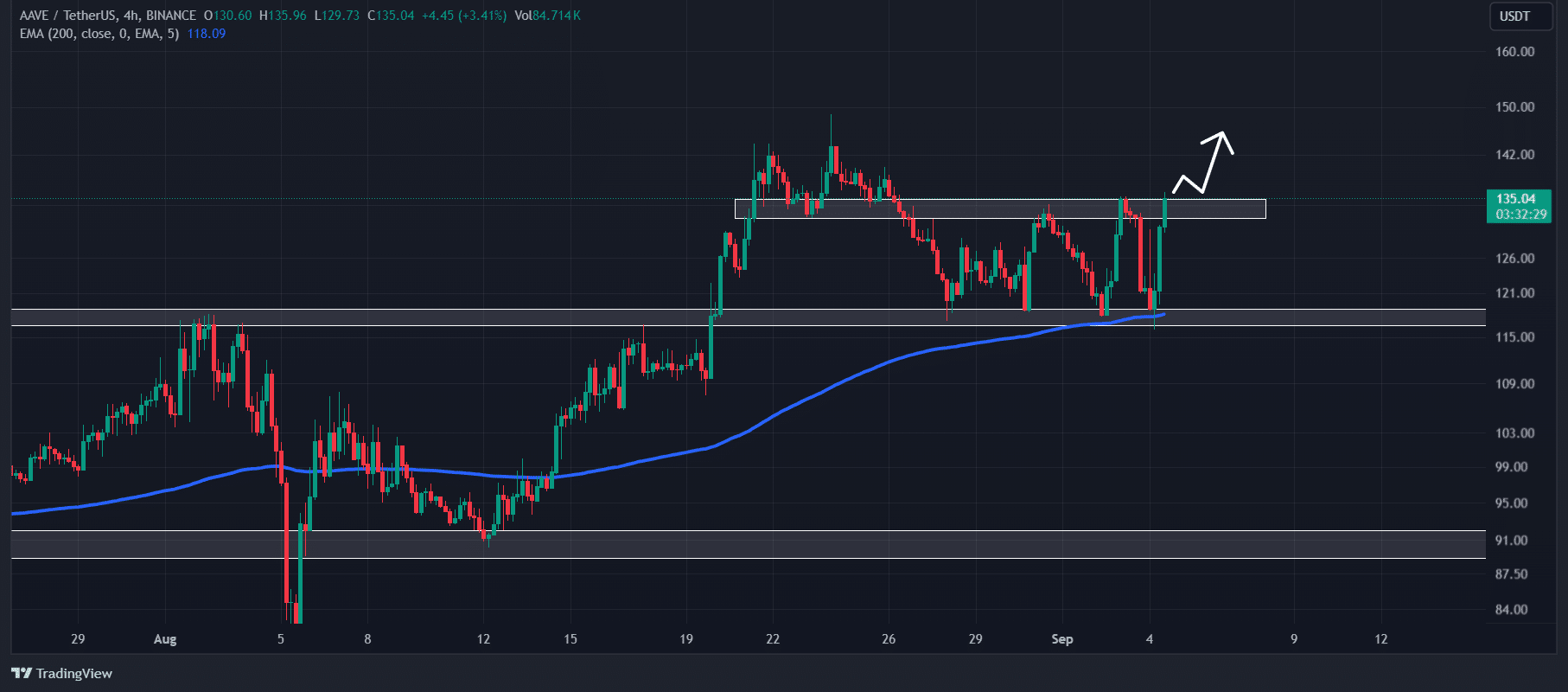

According to expert technical analysis, AAVE was in an uptrend as it trades above the 200 Exponential Moving Average (EMA) on a daily time frame.

Additionally, it has been currently consolidating in a tight range between $118 and $134 over the last few days.

On the four-hour time frame, there is a strong resistance level near $135. If the AAVE price breaches this resistance and closes a candle above that level, there is a high possibility it could soar to the $146 level.

However, there is also a possibility of a price reversal from the resistance level.

Major liquidation levels

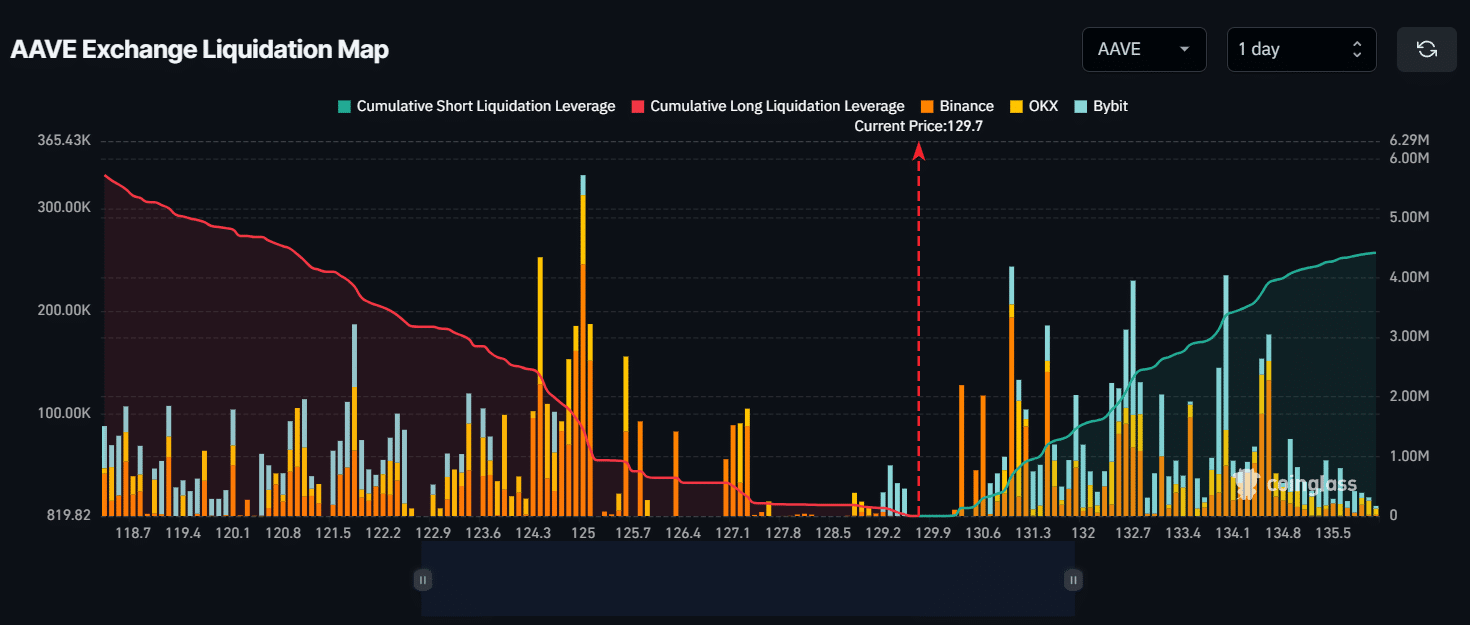

As of now, the major liquidation levels are near $125 on the lower slide and $131.5 on the upper side, as intraday traders are over-leveraged at these levels, according to the on-chain analytic firm Coinglass.

If AAVE’s sentiment changes and the price falls to the $125 level, nearly $1.46 million worth of long position will be liquidated.

Conversely, if the overall sentiment shifts and the price rises to $131.5 level, approximately $1.19 million worth of short position will be liquidated.

Read Aave’s [AAVE] Price Prediction 2024–2025

The press time data suggested that bulls were currently dominating the assets and have the potential to liquidate higher short positions.

The overall cryptocurrency market is down by 1.2% and major cryptocurrencies including Bitcoin, Ethereum [ETH], and Solana [SOL] have experienced a price drop of 4%, 4.9%, and 3% respectively in the last 24 hours.