Altcoin

Aave stays strong as Bitcoin falters: Next target $142?

The mean coin age metric has slowly trended higher since early July, a sign of accumulation, but velocity augured volatility.

- Aave posted gains at a time when Bitcoin and the rest of the large-cap coins struggled to stay afloat.

- The on-chain metrics were bullish but price dips and volatility could heighten next week.

Aave [AAVE] has performed exceedingly well over the past week. While Bitcoin [BTC] crashed by 11.25% since the high of Monday, the 29th of July, AAVE prices have surged by 11% from Monday’s high.

This show of resilience and exceptional relative strength against Bitcoin in a week dominated by bearish news is great for AAVE holders. Here’s what traders and investors can watch out for.

Aave saw a firmly bullish performance in July, starts August on the right note

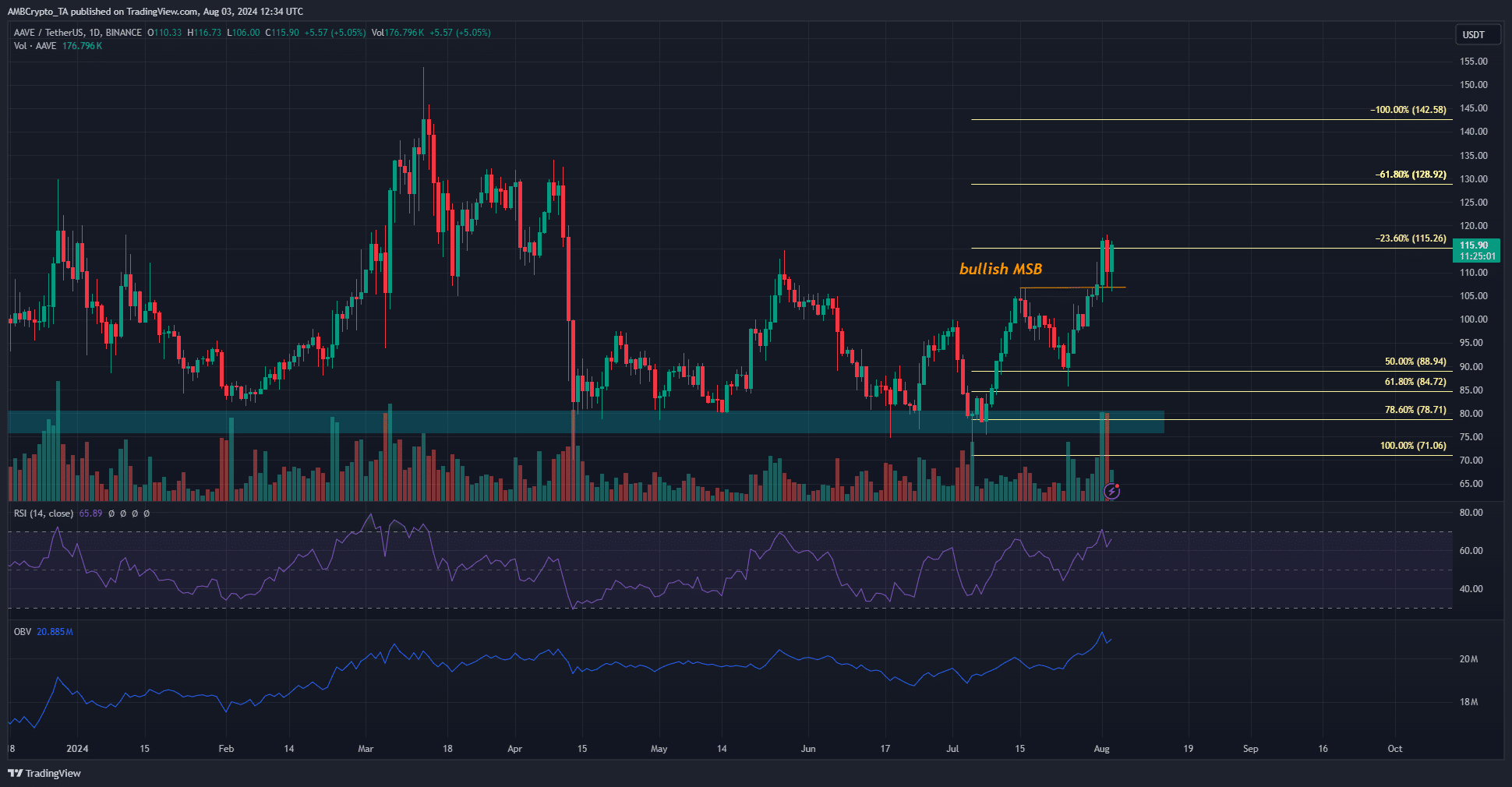

A set of Fibonacci retracement and extension levels were plotted based on the July rally from $71 to $106.7. The 50% retracement level at $88.94 was tested as support on the 24th of July before the bulls reversed the losses.

Over the past nine days, AAVE surged higher and made a bullish market structure break in the 1-day timeframe. The daily RSI was at 65, signaling hefty upward momentum but no overbought conditions yet.

There could be more room to expand, with the OBV also trending higher to underline steady buying. The Fibonacci extension levels at $129 and $142 line up well with the local highs formed in the past three days, making them the next take-profit targets.

On-chain metrics show volatility is likely

Source: Santiment

The mean coin age metric has slowly trended higher since early July, a sign of accumulation. However, the 30-day MVRV was at highs not seen since March.

This could foreshadow a strong wave of selling from short-term holders enjoying healthy profit margins.

Read Aave’s [AAVE] Price Prediction 2024-25

The circulation metric saw an uptick over the past few days, and its velocity also trended upward. Together, it showed bullishness but also warned of increased short-term price volatility.

Hence, traders can anticipate a move toward $142 with a few price dips thrown in along the way.