AAVE & Sushiswap: How will these alts affect your portfolio?

Among other DeFi projects, AAVE, Sushiswap and Quickswap have emerged as the projects with the highest on-chain activity. In DeFi it is critical to have social volume, demand, and volatility for investment inflow to increase, and the project to rally. These altcoins have a steady investment inflow and have offered high ROI to traders in the short term based on the price action over the past 90 days.

Notably, these projects AAVE, Sushiswap and Quickswap have a relatively high correlation with Bitcoin and that has supported their bullish narrative.

AAVE’s price was up 10% in the past 24 hours, based on data from coinmarketcap.com and the market capitalization was up nearly 10%. The trade volume was up over 40% in the past 24 hours, however, price continued to remain 52% away from its ATH. Over 25% HODLers were profitable at the current price level and the concentration by large HODLers was 88%.

As profitability increases, this is likely to increase. This concentration is also one of the driving factors of AAVE’s price in the current cycle.

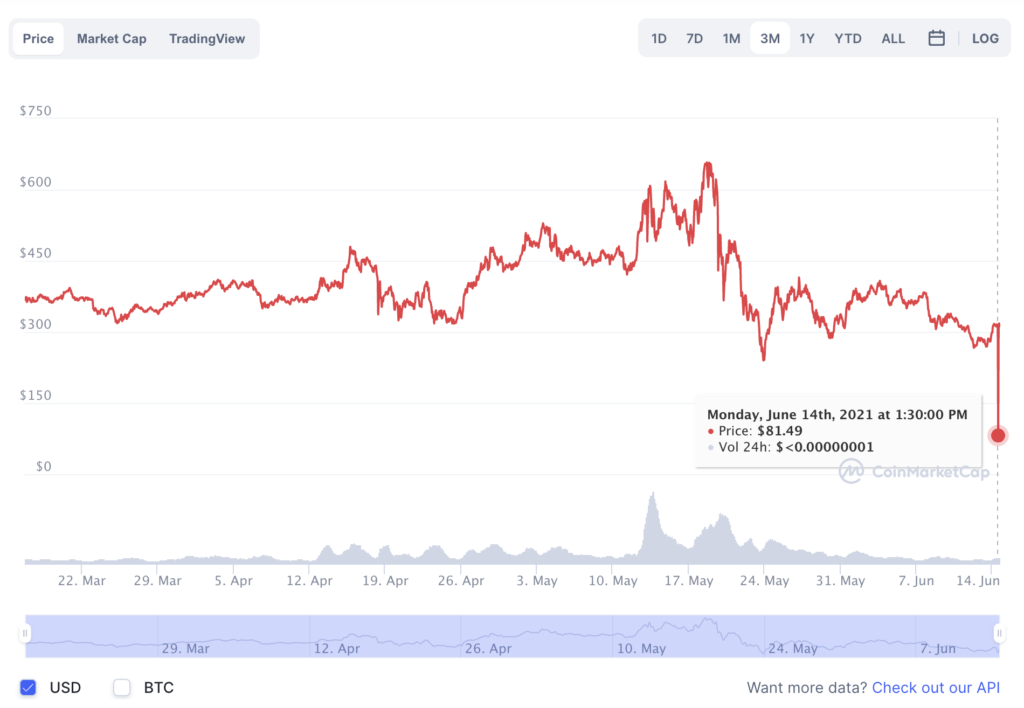

AAVE Price Chart | Source: Coinmarketcap.com

Based on the above price chart, the price has dropped below the level it was 90 days ago. AAVE was in the buy zone, before the price rallies to ATH again. Current on-chain sentiment was bearish and this is likely to change, once the social volume drops and engagement increases.

In the case of Sushiswap, the price is up nearly 10% and it is currently trading at the $8.62 level. The trade volume is up over 25%; with increasing liquidity, it is likely that the selling pressure will increase and the altcoin will consolidate before rallying higher, this may be the ideal time to accumulate.

With an ROI of 150%, SUSHI makes an ideal addition to the DeFi/ altcoin portfolio, with high short-term returns and rangebound price action through flash crashes.

Similar to Sushiswap, Quickswap’s price and trade volume have increased. The price was nearly 70% below its ATH a month ago, and the DeFi project continues to remain undervalued. Adding SUSHI and QUICK to your DeFi portfolio is likely to offer over 30% in ROI within 60-90 days if accumulated during the dip.