Altcoin

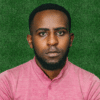

AAVE traders position for gains as exchange outflows grow

AAVE set for a short-term correction before a bullish run despite gradually rising outflows.

- AAVE exchange outflows were gradually rising after U.S. election results.

- A shift towards long positions hints at growing market optimism, with 64% of active addresses currently in profit.

Following the U.S. election results, Aave’s [AAVE] exchange outflows witnessed a notable decline. This dip again indicates the cautious stance by investors over the implication of possible regulatory changes.

However, over the last three days, AAVE exchange outflows have begun to rise steadily. This upward trend could indicate some sense of activity and perhaps a buildup of confidence among the market participants.

Also, the uptick in exchange outflows may signal that traders are cashing out profits in the short run and once again taking positions for strategic opportunities.

Source: Cryptoquant

Bulls gradually taking control

AMBCrypto’s analysis of the Coinglass long/short ratio data reveals several fluctuations in AAVE’s market. While some heavy indecision between longs and shorts existed among traders earlier, there has been a notable bias toward long positions recently.

This change marks the beginning of a wave of optimism in the market, as traders start to expect a price increase, probably after the recent market corrections.

The gradual movement toward longs showcases a collective sentiment of anticipation that the price may trend upward.

Source: Coinglass

Holders prepare for strategic positions

The profitability of active addresses adds another layer to this evolving market picture. According to data from IntoTheBlock, a total of 64% of AAVE active addresses are in profit at the current price.

This is a strong indication of the health of the market, as most participants are benefiting from their positions despite recent market volatility and fear.

Source: IntoTheBlock

Piecing it all together

The interaction between rising exchange outflows, a shift to long positions, and strong profitability among active addresses correlate AAVE’s price action. Initially declining after the election, Aave’s market is now showing signs of life.

Read Aave’s [AAVE] Price Prediction 2024–2025

This combination of indicators suggests cautious optimism, with traders gradually starting to take measured risks. AAVE community resilience and positioning for strategy may suggest that exciting times could be just around the corner.

AAVE price may just take a short-term correction to the $177 key support level before an anticipated rally to test higher resistance levels.

Source: Tradingview