AAVE, UNI, CRV surge amid market complexities

- Sticking to PoW helped UNI, AAVE, and CRV enjoy a period of institutional adoption.

- Prices of the tokens went high; the same as the TVL.

The prices of Uniswap [UNI], Aave [AAVE], and Curve Finance [CRV] increased significantly in the last 24 hours. According to CoinGecko, AAVE’s value increased by cryptocurrency 27.2%. UNI rose by 10.9% while CRV surged by 8.7%.

How much are 1,10,100 AAVEs worth today?

The spike in price could be linked to the complex interplay of factors in the market. Some of these include institutional appearance and regulatory actions. Recently, the U.S. SEC named several tokens as unregistered securities.

Escape drives gain

Most of these labeled assets fall under the Proof-of-Stake (PoS) consensus mechanism. Also, the regulator considered them relatively centralized. As a result, institutional adoption, which has been rising since Bitcoin [BTC] ETFs approval, also looked to the DeFi sector.

So, since these tokens had not yet migrated to PoS despite being linked to Ethereum [ETH], institutional funds trooped in.

For AAVE, Lookonchain reported that a certain whale speculated to be an institution, accumulated $13.2 million on 25 June. This action was instrumental in sending the price up the charts.

This shift in investor sentiment highlights the growing appetite for Decentralized Finance (DeFi) projects amid unclear regulation from the SEC.

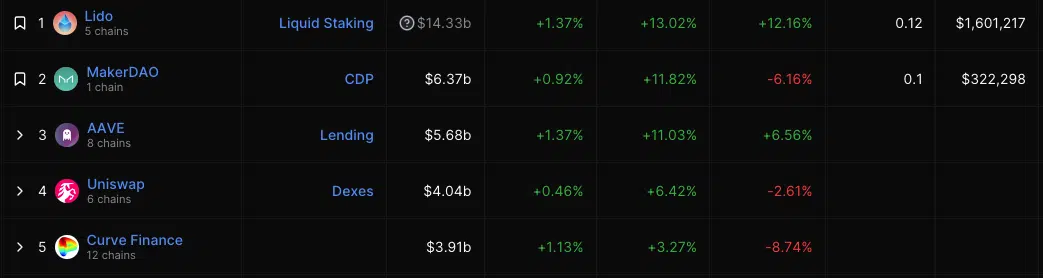

Regarding their respective Total Value Locked (TVL), DefiLlama showed that Aave, Uniswap, and Curve aligned in descending order.

At press time, AAVE’s TVL was $5.68 billion — an 11.03% in the last seven days. Curve’s TVL was $3.91 billion while Uniswap’s was $4.04 billion.

The hike in the TVL suggests that investors’ trust in the project had improved. And practically, deposits into smart contracts operating under each protocol increased.

Rising volumes for all

AAVE’s volume, which has been in an unimpressive state for a while, surged to 431.61 million. UNI also increased to 135.49 million, and CRV’s volume rose mildly to 57.73 million.

The rising volume indicated that transactions with the token increased. Also, it indicates increased enthusiasm among buyers.

If this continues without glaring sell pressure, then the prices of the token might get more strength behind them. Consequently, this could lead to another price increase.

Realistic or not, here’s CRV’s market cap in UNI’s terms

As prominent DeFi tokens, AAVE, UNI, and CRV, it’s unusual to be typically associated with traditional financial systems.

Additionally, their respective ability to provide decentralized lending, borrowing, and yield farming has made them gain attention. These activities, which happen without relying on traditional intermediaries, could have also played a role in increasing investment interest.