Aave’s DeFi success cushions AAVE prices amid market crash – More gains likely?

- The crypto market is seeing mild recovery after prices across the board jumped higher on Tuesday.

- Aave has been an outlier this week, largely trading against the general market downtrend.

Crypto assets are reeling from the sector-wide bloodbath on 5th August, with Bitcoin [BTC] price rising above $56K during Tuesday’s trading session.

Meanwhile, Aave [AAVE] was trading at $101 at press time, slightly below an intra-day high of $106.92 per CoinMarketCap data.

Crypto-related equities and global stock markets are also seeing stability after plunging this week.

The restored sentiment has been partly attributed to the renewed hopes for a Fed rate cuts after Monday’s global market slide which rekindled concerns about the US economy facing recession pressure.

Aave protocol’s DeFi operational success

In a 5th August post on the X platform, Aave Labs cofounder Stani Kulechov noted that the protocol held out against stress across active markets on various Layer 1 and Layer 2 blockchains.

The lending protocol handled decentralized liquidations effectively, earning the Aave Treasury $6 million in revenue overnight.

Circle cofounder Jeremy Allaire affirmed Stani’s take in a repost,

“DeFi always on, never sleeps, open networks, open-source protocols, auditable in real time.”

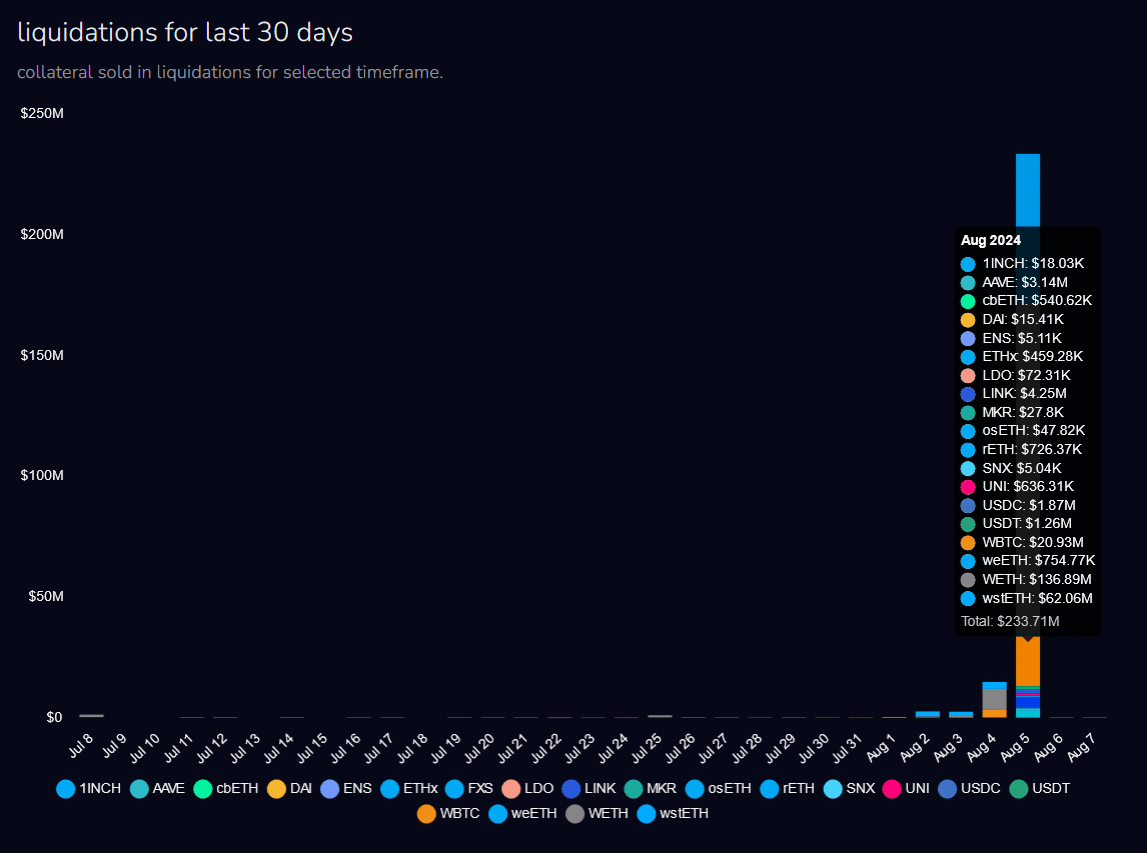

The three-day sell-off between 3rd August and 5th August saw $350 million worth of DeFi positions liquidated, according to data from Parsec Finance.

DeFi risk intelligence platform Block Analitica shows liquidations on Aave peaked at $234 million on 5th August.

Source: Block Analitica

The Aave protocol is currently deployed across a dozen chains including Ethereum mainnet, Optimism, Arbitrum, Polygon, Base, Gnosis Chain and BNB Chain.

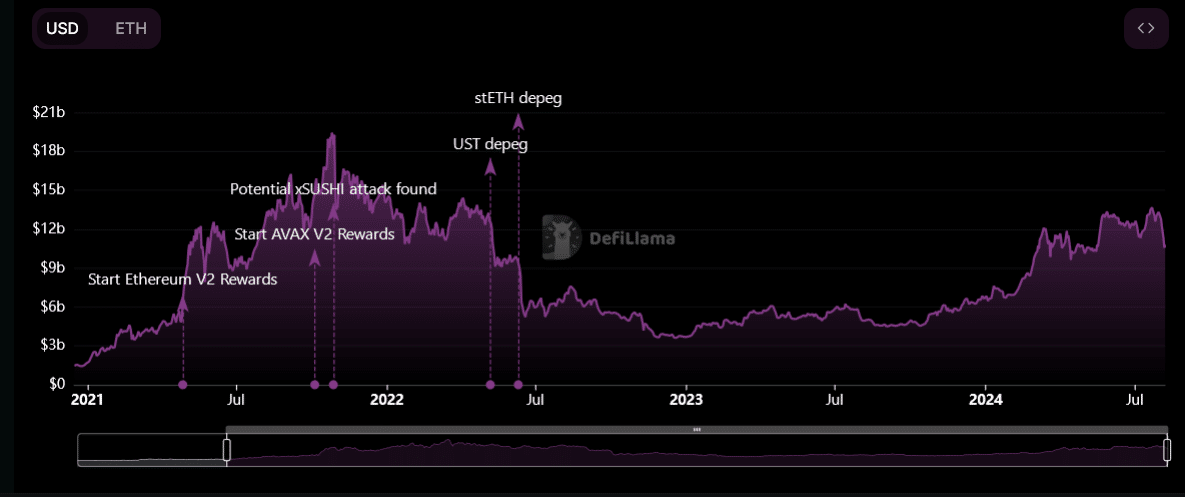

DeFiLlama data shows Aave had $10.8 billion in total value locked (TVL) at press time.

These fundamentals helped AAVE, the governance token, recover swiftly and fare better than many other tokens on Tuesday.

Milestones in July

On 25th July, Aave-chan Initiative founder Marc Zeller proposed introduction of a ‘fee switch’ within the protocol as a strategy to distribute fees to AAVE holders by buying back tokens from the secondary market.

The new Lido V3 market, which marked the first custom deployment on Aave V3, had a market size of $250 million at time of publishing.

In a separate milestone, Aave Labs announced Aave V3.1 release going live on 31st July.

The Aave v3.1 upgrade was floated in April by BGD Labs which presented the proposal for activation of the upgrade on the community forum.

AAVE price outlook

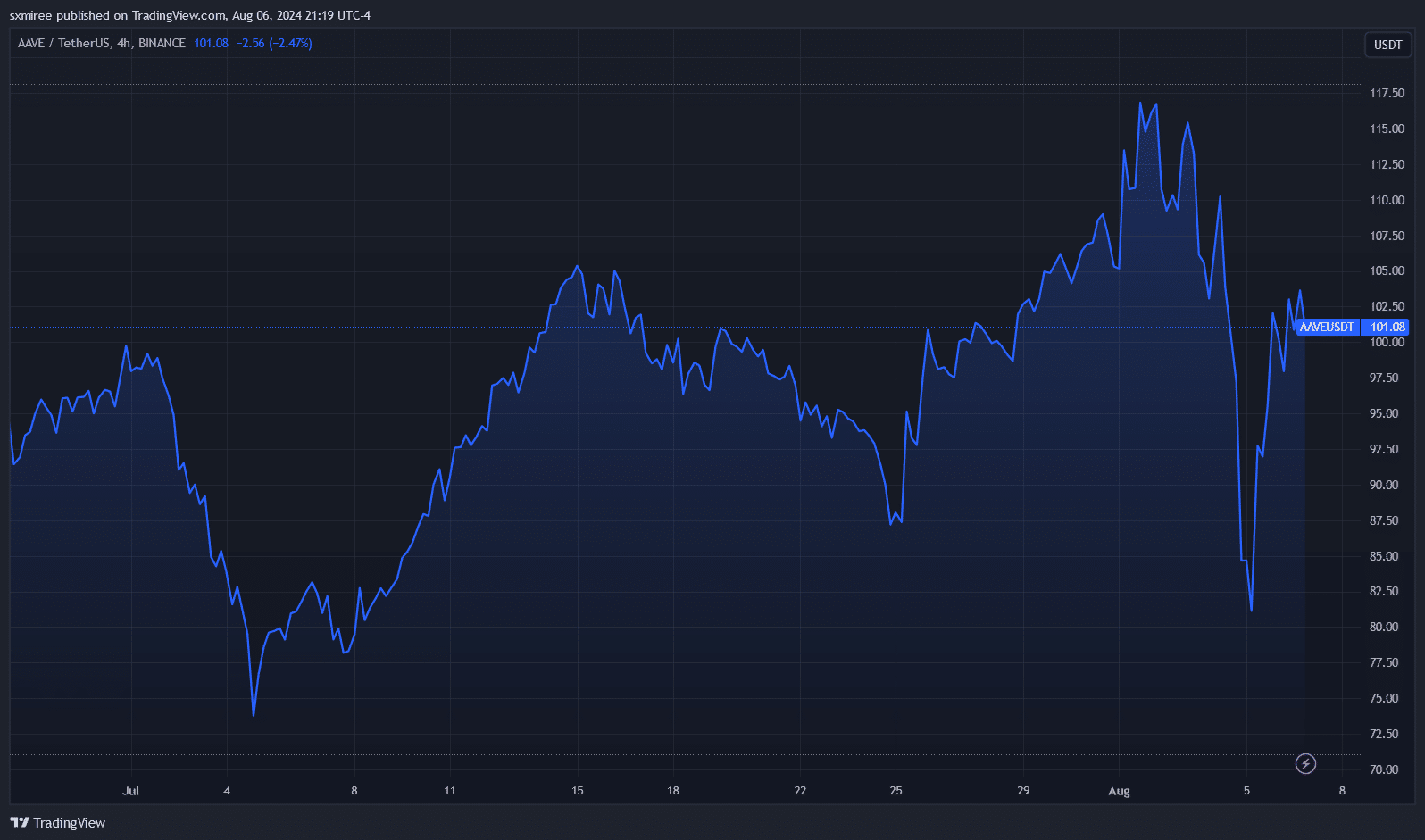

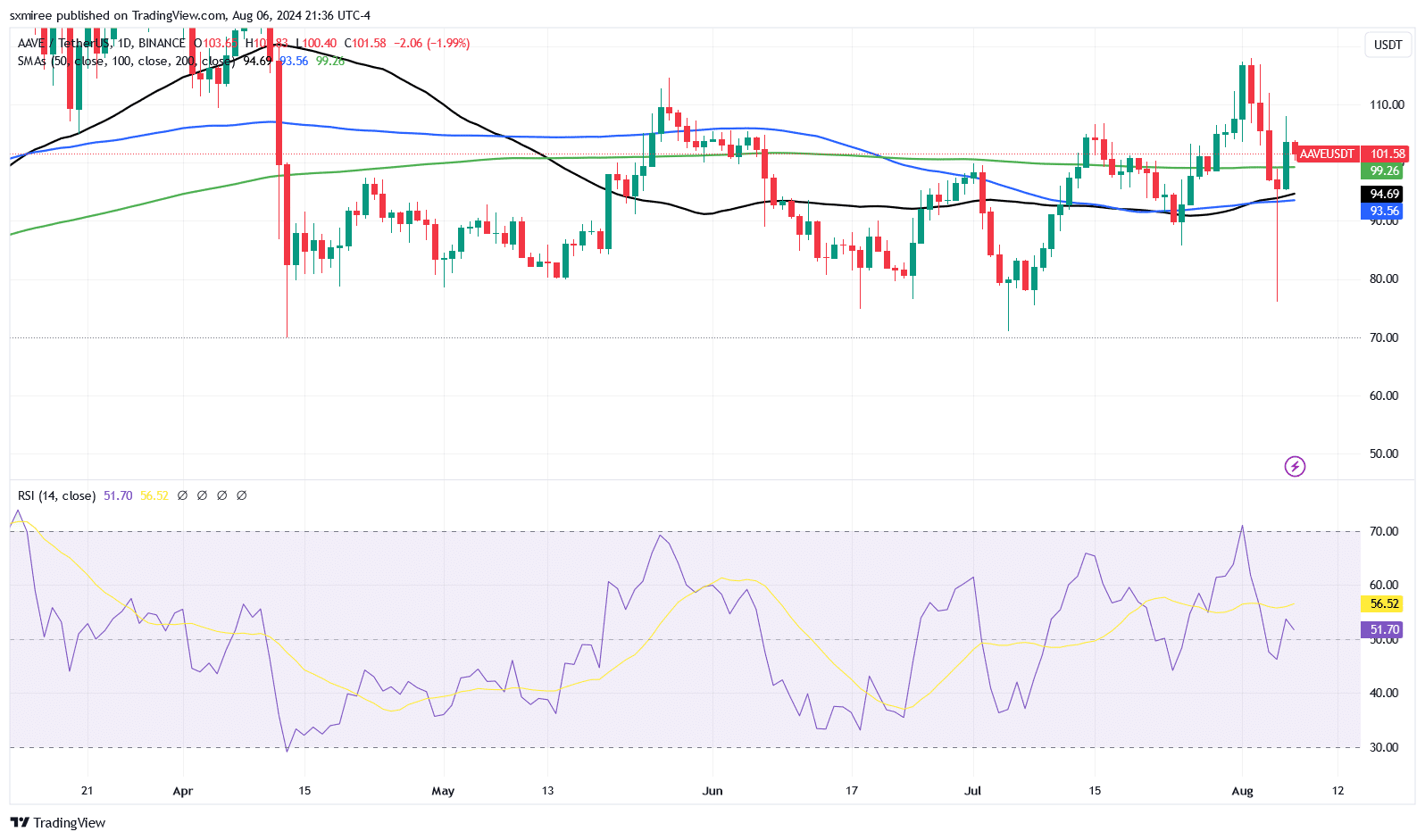

AAVE slid below $80 on 3rd August before reclaiming $100 on Monday where it has mostly held above. Tuesday’s rebound pushed the price above the 50-,100- and 200- simple moving averages on the 4-hour chart but failed to hang to the higher ranges.

On the daily chart, however, AAVE/USDT is ranging below all three averages.

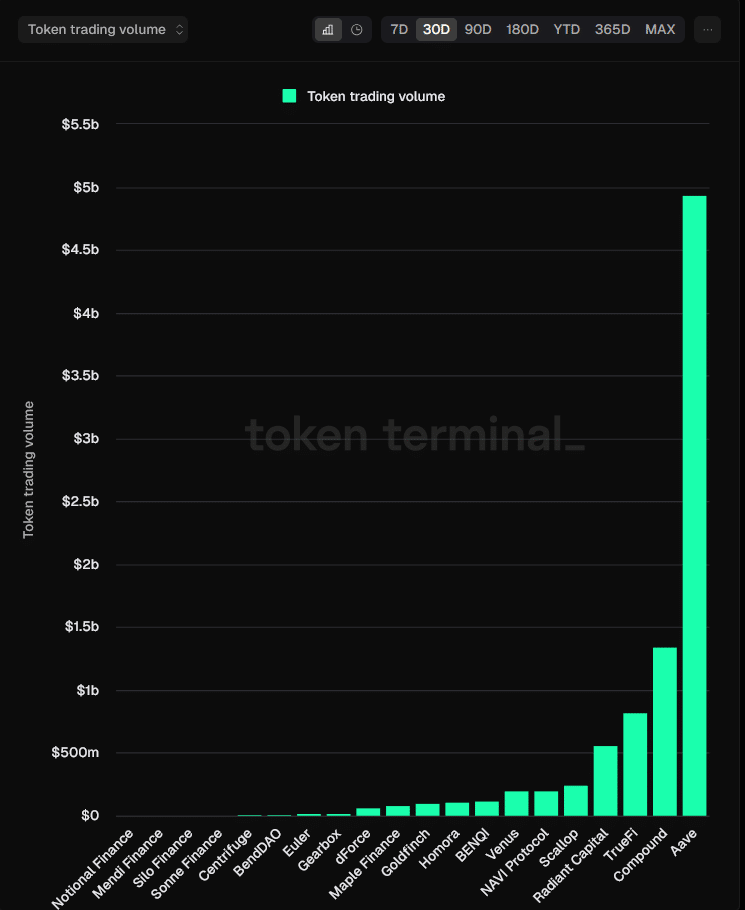

Token Terminal data shows AAVE has attracted the most interest from market participants over the last 30 days with a monthly trading volume of over $4.9 billion during this period.

Meanwhile, the Relative Strength Index (RSI) indicator is back around the 50 neutral level. This suggests a balance between buying and selling pressures.

Still, it is important to keep in mind crypto markets are vulnerable as speculators take cautionary approaches. As such, any rebound is likely to be limited by the prevailing pessimism in the markets.