ADA, MATIC, SOL face the music as Robinhood delists tokens

- The decision to end support for the tokens caused a $387 million wipeout from the crypto market.

- Several indicators revealed that ADA, SOL, and MATIC’s momentum were bearish.

The prices of Cardano [ADA], Polygon [MATIC], and Solana [SOL] tumbled in double-digit figures after Robinhood confirmed that it was delisting the tokens from its platform.

Is your portfolio green? Check the Solana Profit Calculator

While the U.S. trading platform did not give cogent reasons for its decision, speculation went around that it was linked to the recent SEC “unregistered securities” tag.

Unlike recently targeted exchanges like Binance [BNB] and Coinbase, Robinhood is duly regulated by the SEC. Hence, it could have been necessary to take such action.

Regulatory fear leads traders to liquidation

In its statement, Robinhood noted that no other coins were affected. But holders of the ADA, SOL, and MATIC had until 27 June to stop transacting the tokens.

The exchange explained:

“We regularly review the crypto we offer on Robinhood. Based on our latest review, we’ve decided to end support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27th, 2023 at 6:59 PM ET.”

As the sudden move sent shockwaves through the crypto market, the implication of the decision revealed itself.

According to CoinMarketCap, SOL’s value decreased by 22.47% in the last 24 hours. ADA could not escape the heat, registering a 23.06% decrease. As for MATIC, it was down by 26.12% within the same period.

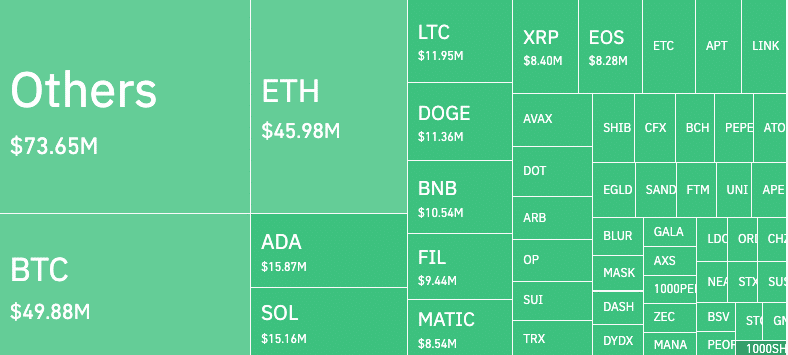

Because of the significant decline in the prices of these tokens, liquidations in the past 24 hours surged to $387 million, with longs suffering the most.

Based on the liquidation heatmap from Coinglass above, SOL accounted for $15.15 million out of the total wipeout. MATIC’S liquidation went up to $8.54 million, while ADA was $15.87 million.

Red season for the cohort

Meanwhile, an evaluation of the ADA/USD daily chart showed that the token’s momentum had breached the oversold region, as indicated by the Relative Strength Index (RSI).

At 17.21, the RSI showed that selling pressure was tremendous. Thus, the momentum was bearish, and slight buying power might do almost nothing to save the price action from the press time state.

With a sharp red bar, SOL’s Moving Average Convergence Divergence (MACD) placed sellers in absolute control of the market.Realistic or not, here’s ADA’s market cap in MATIC terms

Here, the orange dynamic line was above the bullish, indicating how bullish strides have been completely neutralized. Moreso, both lines were below the zero-midpoint histogram. So, the chances of a quick recovery were close to non-existent.

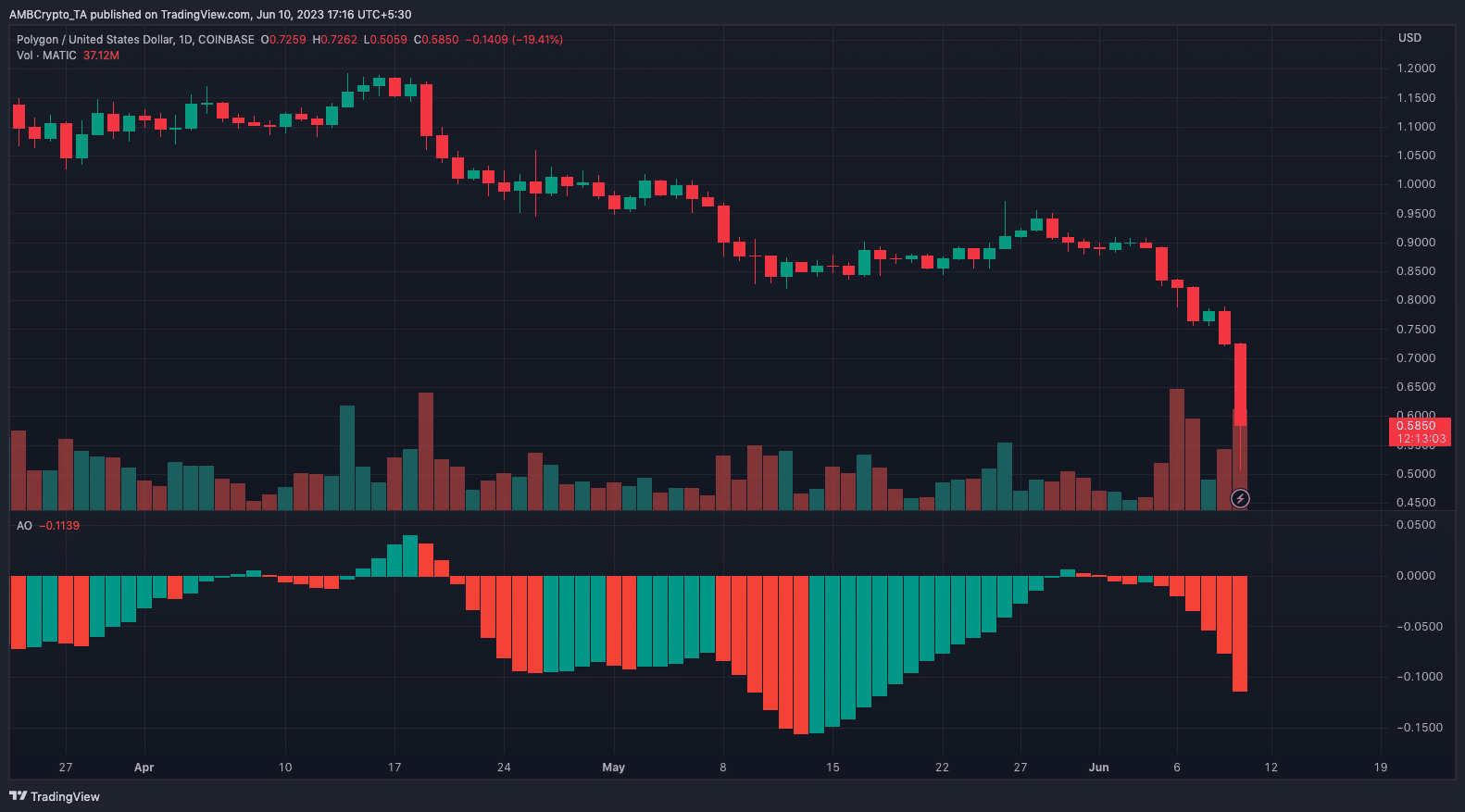

The daily timeframe of MATIC was not any better. This was because the Awesome Oscillator (AO) was down to -0.1139. Thus, AO crossing into the negative territory indicated a bearish signal.

![Cardano [ADA] price action](https://ambcrypto.com/wp-content/uploads/2023/06/ADAUSD_2023-06-10_12-38-40.png)

![Solana [SOL] price action](https://ambcrypto.com/wp-content/uploads/2023/06/SOLUSD_2023-06-10_12-42-26.png)

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)