ADA may repeat this price pattern from 2019 and the odds are in favor of…

- Market indicators suggested that ADA’s price might continue to decline in the coming days

- Cardano’s current on-chain performance looked similar to that of late 2019

Bitcoin [BTC] halvings are one of the major events in the crypto space that somewhat shape the market. As the date of the next halving draws closer, historical data reveals how altcoins like Cardano [ADA] behaved in the past.

During the last halving, ADA’s price bottomed just two months ahead of the halving. If history is to repeat itself, the possibility of ADA witnessing a further drop in price before a bull run seems likely to happen.

Read Cardano’s [ADA] Price Prediction 2023-24

Cardano during the 2020 halving

During the last halving that took place in 2020, ADA’s price bottomed about two months before the event. Therefore, if past figures are to be considered, we can expect ADA’s price to go down further over the coming weeks as the next halving is scheduled to happen in April 2024.

We’re currently in the phase between the bear market rally and the BTC halving. This is typically where many cryptocurrencies, including #Cardano, find their bottom.

In fact, $ADA found its bottom 2 months before the last halving. The next halving is scheduled for April 2024. pic.twitter.com/nosqzsFkTz

— Eilert (@Eilert) September 9, 2023

Interestingly, Cardano’s price surged right after the last halving, which could offer some hope for the next bull rally to happen in the first half of 2024. At the time of writing, ADA was been down by more than 4% over the last seven days.

At the time of writing, it was trading at $0.2419 with a market capitalization of over $8.4 billion. A look at ADA’s daily chart shed light on whether ADA’s price could decline further, like what happened in 2019–2020. ADA’s Money Flow Index (MFI) and Chaikin Money Flow (CMF) both registered downticks as they were heading southwards.

Additionally, the Bollinger Bands (BB) revealed that ADA’s price was entering a slightly higher volatile zone, increasing the chances of a further price plummet. Furthermore, Cardano’s Moving Average Convergence Divergence (MACD) told a different story, though, as it displayed the possibility of a bullish crossover.

Speculating the past

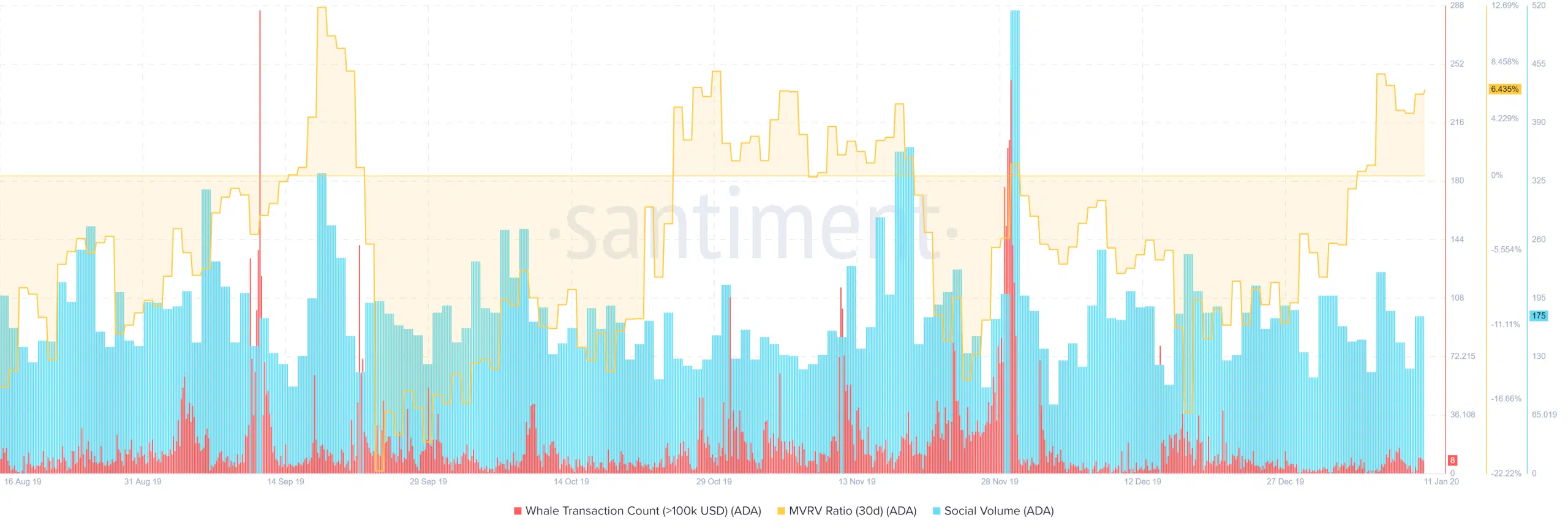

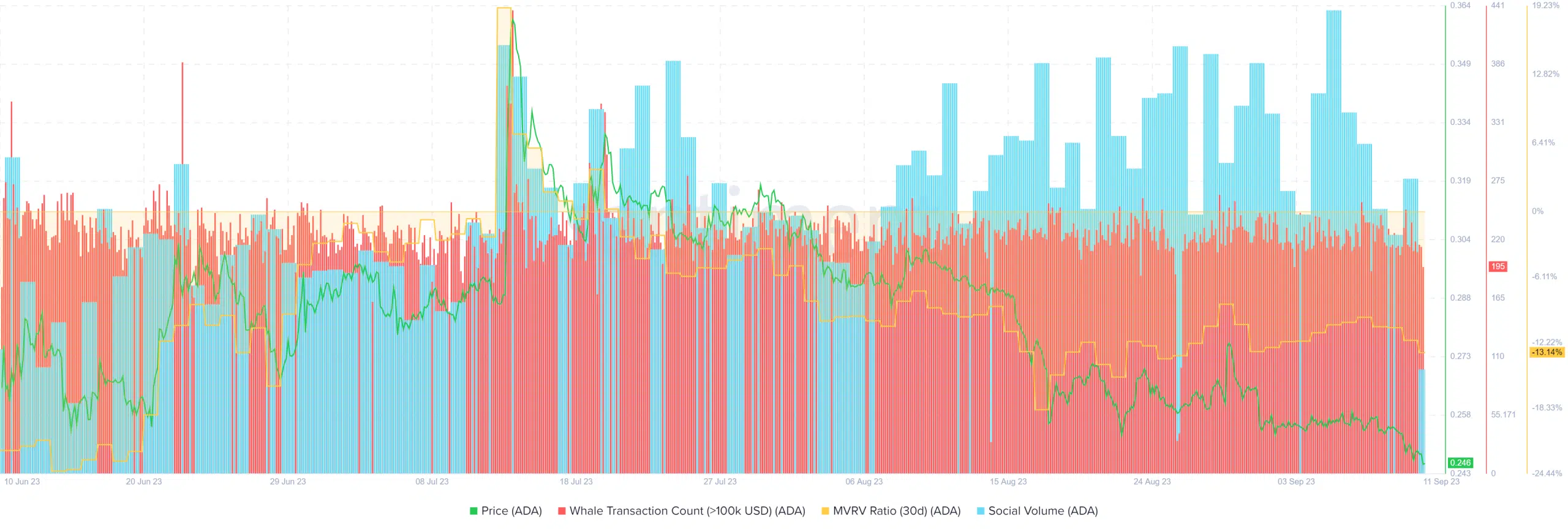

While taking Cardano’s past into consideration, it’s important to also contemplate ADA’s on-chain performance a few months before the last halving. Data from the on-chain intelligence platform Santiment revealed that whale activity around the token was quite high during that period, as was its social volume.

Cardano’s 30-day Market Value to Realized Value (MVRV) Ratio remained somewhere in the -16–5 range. Surprisingly, the token’s current performance looked pretty similar to that of late 2019.

For instance, ADA’s MVRV Ratio was hovering near the same band. Whale transaction count and social volume were also behaving similarly. This increases the chances of Cardano following its past trend in 2024.

Is your portfolio green? Check the Cardano Profit Calculator

It was interesting to note that while past trends and market indicators suggested a continued price decline, ADA’s derivatives market metrics suggested otherwise.

As per Coinglass, ADA’s open interest declined when its price plummeted. The market experiences liquidation when open interest declines. This suggested that the current price trend was about to end. Therefore, the possibility of a price uptick can’t be ruled out yet.