ADA swings below April high of $0.4620, what should traders expect next

- ADA has experienced a 15.5% dip from its year high.

- The coin’s RSI remained under neutral 50 which might signal an increase in selling pressure.

Cardano [ADA] began the year on a bullish note, reaching a yearly high of $0.4620 in April. This translated to an 89.1% gain for the coin.

ADA’s bullish run has been strongly correlated with BTC’s gains, as its yearly high was recorded when BTC briefly reclaimed the $30k mark.

With BTC experiencing a correction and dipping to the $28k price area, ADA has also seen some part of its gains wiped off. The coin experienced a 15.5% dip from its year high and was trading at $0.3904, as of press time.

Read Cardano’s [ADA] Price Prediction 2023-24

A brief decline or the start of a bearish swing?

ADA, at press time, was trading at a key price area. A look at the Visible Range Volume Profile tool on the four-hour timeframe showed that the Value Area High and Value Area Low was at $0.4200 and $0.3400, respectively.

The price is slightly above a bullish order block with the POC supporting it.

The RSI remained under the neutral 50 which might signal an increase in selling pressure. The OBV and volume showed buying power might be waning, as they both posted slight dips over the last 72 hours.

A concern for bears on the downward trend is the bullish order block between $0.3900 – $0.3740. Price has reacted positively at that bullish block previously.

A daily candle close below the bullish order block will see increased bearish momentum with bears targeting the next support zones at $0.3542 and $0.3140.

On the flip side, the bullish order block might provide a rallying point for bulls to re-enter the market and push for $0.4200 again.

Bears remain in control

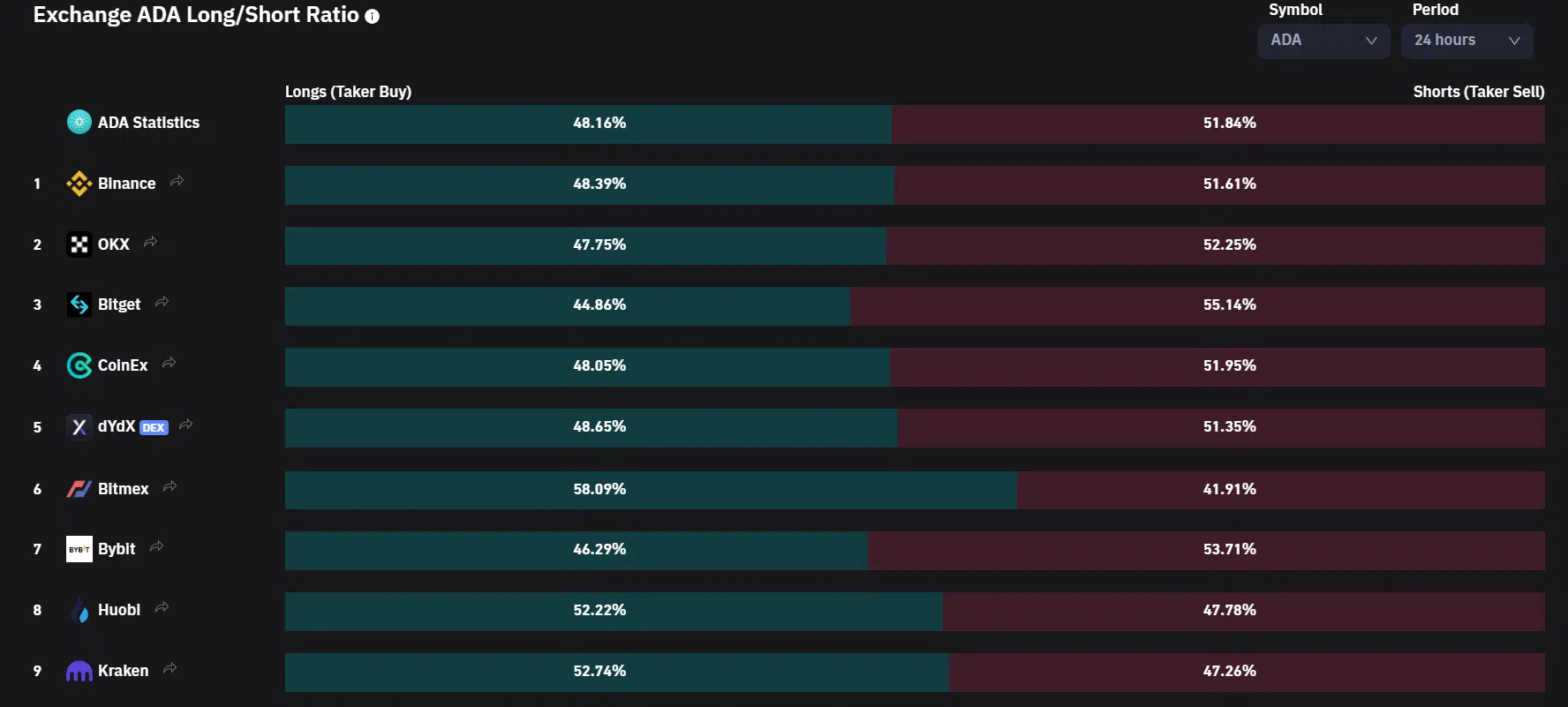

According to Coinglass, the ADA long/short ratio showed sell positions had a slight advantage on the daily timeframe with 51.84%. This suggested that ADA’s long-term outlook still remained bearish.

How much are 1,10,100 ADAs worth today?

ADA longs also suffered losses over the past four days. A total of $1.86 million worth of longs were liquidated against just $370.82k shorts.

ADA’s next move will closely align with BTC’s. A recovery of the $30k mark by the king coin could see ADA record more gains. A dip to $27k-$25k by BTC could lead to more bearish price action for ADA.