AERO breaks TVL records: Is a $1.5 price target realistic for Q4?

- Aerodrome hit a new all-time high in TVL while its revenue soars.

- AERO price action breaks out of a symmetrical triangle.

Aerodrome Finance [AERO] is making waves in the crypto space, competing with major players like Ethereum [ETH] and Uniswap [UNI].

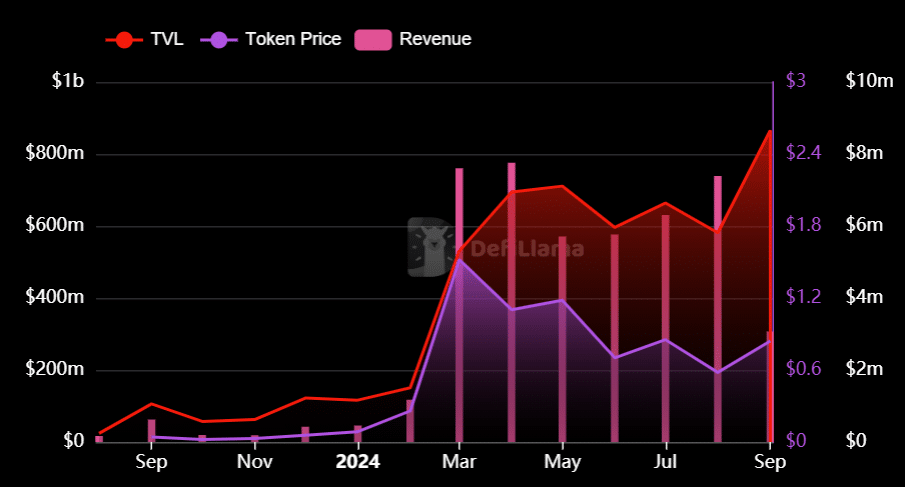

Despite being in a correction phase after hitting a high of $2.36, AERO’s fundamentals suggest its price could go higher. The token’s total value locked (TVL) has hit a new all-time high of $869.73 million, and its market cap is $524.3 million.

The 24-hour trading volume stands at $30.22 million, with a fully diluted valuation of $1.069 billion. As TVL grows, this could lead to greater adoption and a higher price for AERO.

AERO revenue distribution

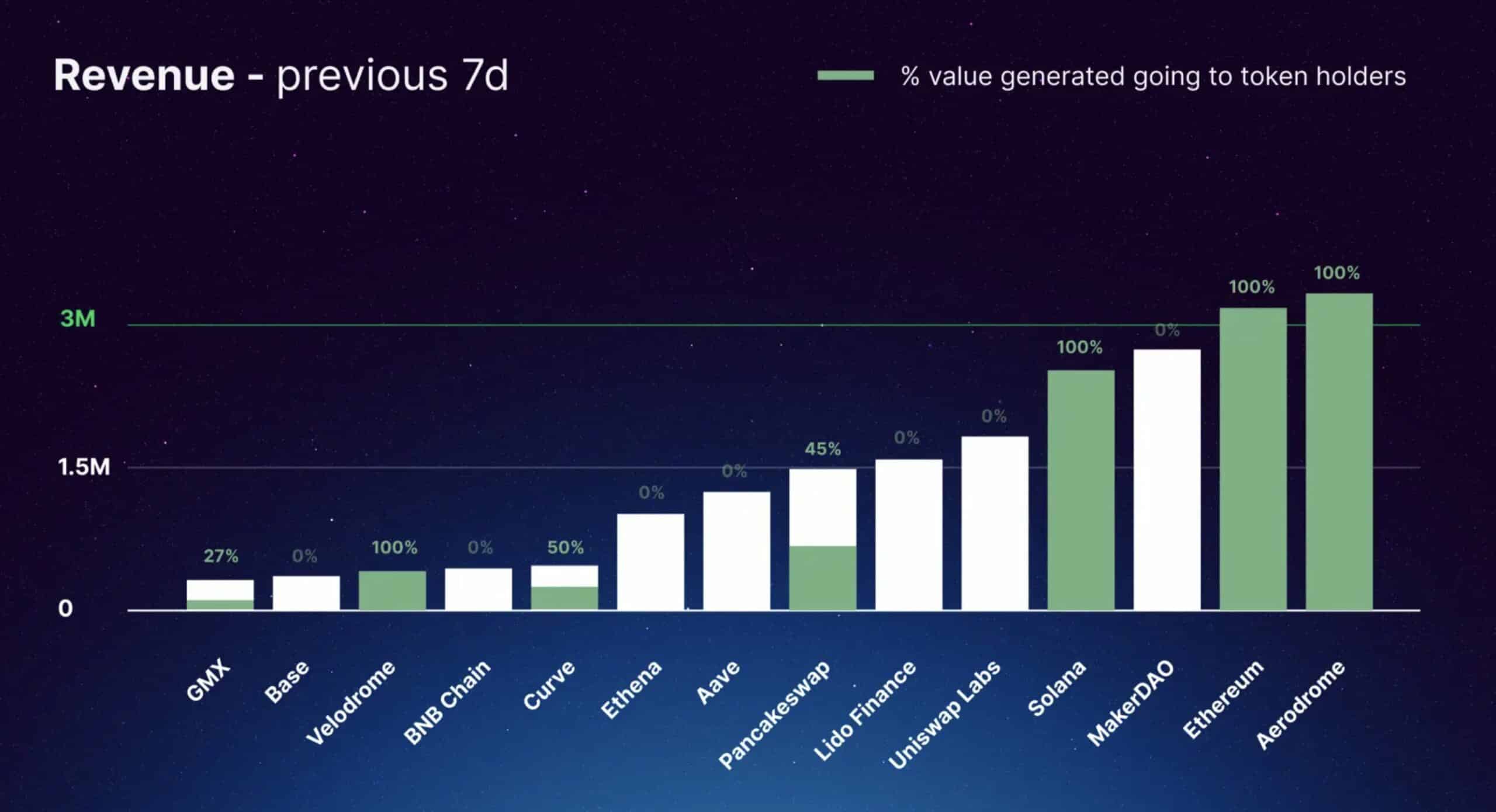

AERO’s revenue distribution is also a key factor in its rise. A significant portion of the revenue is directed to token holders, positioning AERO ahead of Ethereum and Solana in terms of percentage value going to holders.

This shift highlights a new model of public, permissionless, and transparent distribution of tokens, which adds real, immutable on-chain utility.

This makes AERO more comparable to tokens like Bitcoin and Ethereum, rather than Uniswap. These fundamentals are essential for driving AERO’s price upward.

Is a reclaim of $1.5 price possible?

AERO price action looking good…

AERO’s price action has turned bullish. The token recently broke out of a symmetrical triangle pattern and is now trading at $0.85, showing strong momentum.

The Moving Average Convergence Divergence (MACD) indicator is signaling a bullish trend, with momentum bars turning green.

This suggests that AERO could reclaim the $1 level soon, and with favorable market conditions, it might even attempt to reach $1.5 in Q4 of 2024.

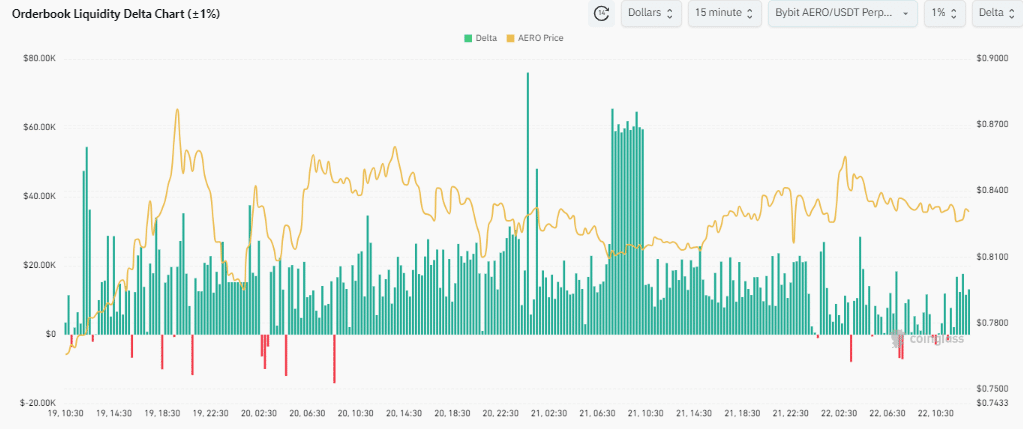

Orderbook liquidity delta

Another factor supporting a higher price for AERO is the bullish orderbook liquidity delta chart. This metric indicates that the depth of buy orders is stronger than sell orders.

Although orderbook liquidity doesn’t determine the price, it adds confluence to the likelihood of AERO rising. This positive liquidity environment could further support AERO’s upward trend.

Source: Coinglass

AERO is poised for growth, with strong fundamentals, growing TVL, and increasing revenue directed to token holders.

The bullish price action, combined with positive orderbook liquidity, makes a reclaim of the $1.5 price level a real possibility. As market conditions improve, AERO’s price could continue to trend higher.