Algorand [ALGO]: Day traders reluctant as market sentiment remains bearish

![Algorand [ALGO]: Day traders reluctant as market sentiment remains bearish](https://ambcrypto.com/wp-content/uploads/2023/03/nik-LUYD2b7MNrg-unsplash-1.jpg)

- The DeFi protocols on Algorand have seen a decline in TVL following MyAlgo’s hack.

- Day traders continued to sell their ALGO holdings.

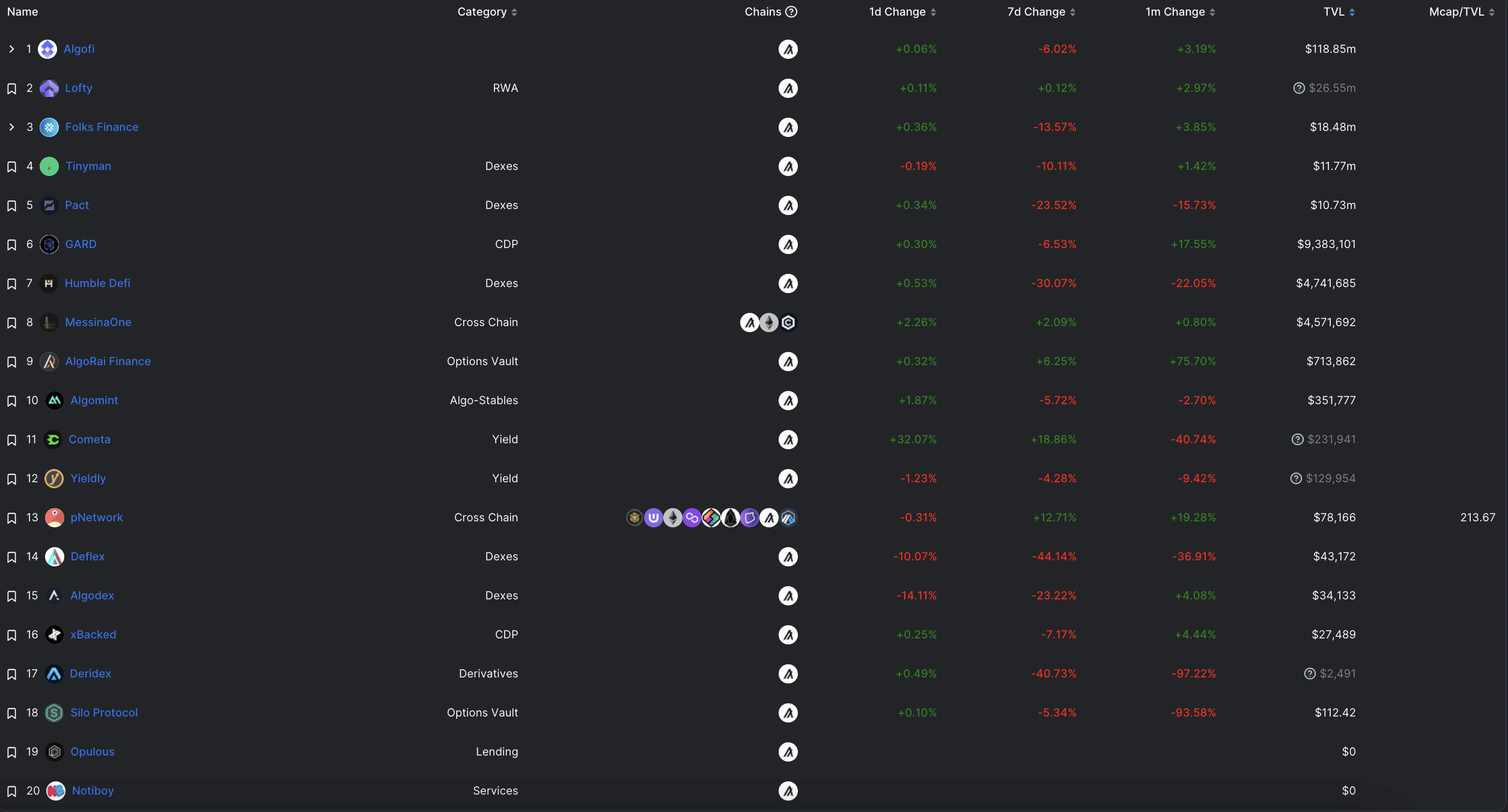

Following the $9.6 million exploit of Algorand’s [ALGO] native wallet, MyAlgo, the total value of assets locked (TVL) on the chain has returned to its 31 January level, data from DefiLlama revealed.

Is your portfolio green? Check out the Algorand Profit Calculator

The bad press surrounding the hack has negatively impacted the DeFi protocols housed on Algorand, with some of them registering double-digit declines in the last 24 hours. To provide context, Algorand hosted 20 DeFi protocols at press time, out of which 13 experienced a decrease in TVL within 24 hours after the exploit.

ALGO struggles to attract day traders

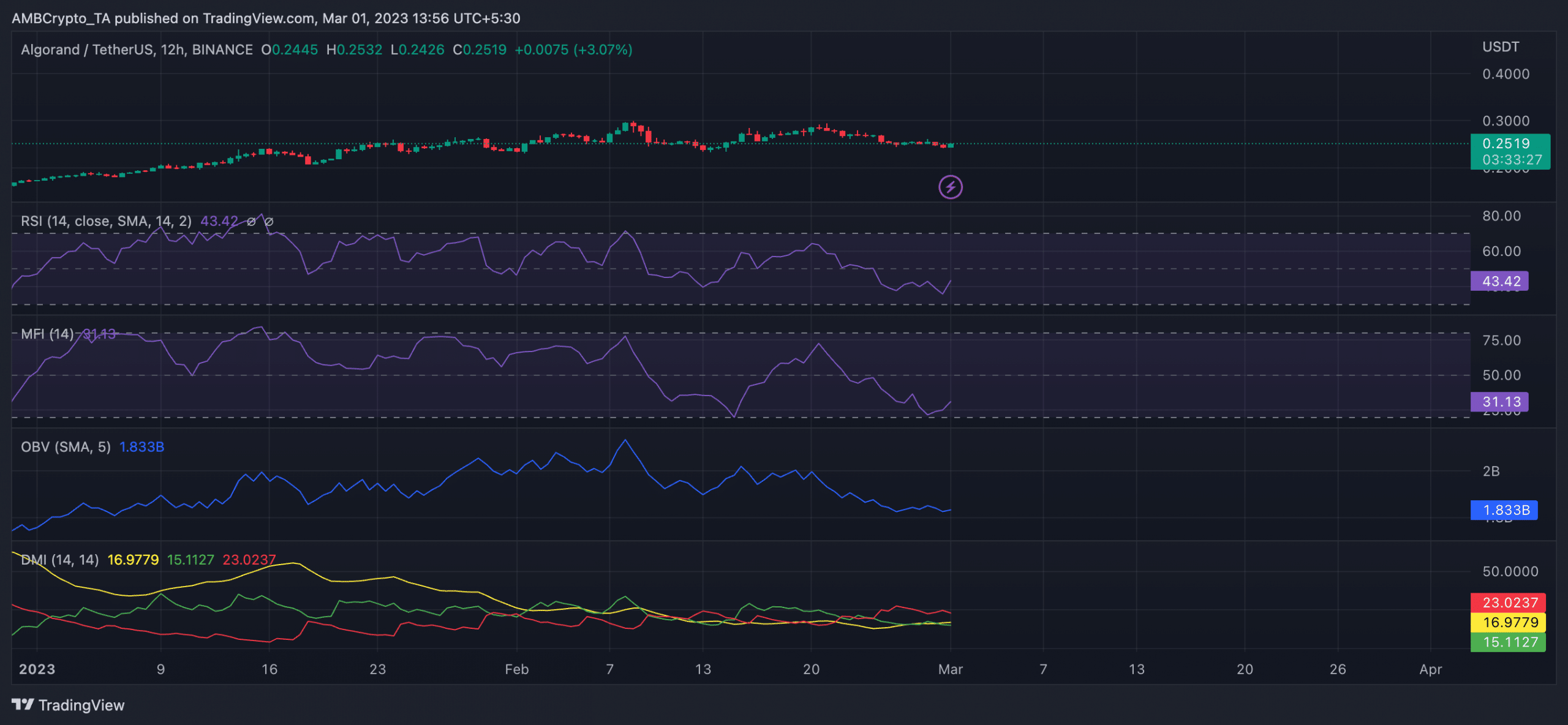

At press time, ALGO exchanged hands at $0.252. While the coin’s value rallied by 1% in the last 24 hours, an assessment of its performance on a 12-hour chart revealed stagnancy in buying momentum.

At press time, the Relative Strength Index (RSI) rested beneath the center line at 43.42. Also, moving sideways and positioned below its neutral spot, the coin’s Money Flow Index (MFI) was 31.13 at press time. With ALGO’s MFI and RSI inching closer to overbought zones at press time, a persistent decline in investors’ conviction will result in a significant drop in the coin’s value.

Further, as intraday trading progressed, sellers were in control of the ALGO market. This was proved by the Directional Movement Index (DMI). The negative directional indicator (red) was positioned above the positive directional indicator (green) at press time.

When the negative directional indicator line is above the positive directional indicator line, as is the case with ALGO, it means that the downward pressure is stronger than the upward pressure, suggesting that the bears are in control of the market. For traders looking to trade in line with the market, it is often taken as a signal to take short positions on an asset.

How has the token performed?

ALGO’s On-balance volume (OBV) also trended downwards at press time. In fact, with a steady decline in ALGO’s value in the last week, its OBV has since dropped by 3%.

Read Algorand’s [ALGO] Price Prediction for 2023-24

When the OBV line is declining, it means that the volume on days with downward price movements is greater than the volume on days with upward price movements. This suggests that sellers are more aggressive than buyers and that the market has more selling pressure.

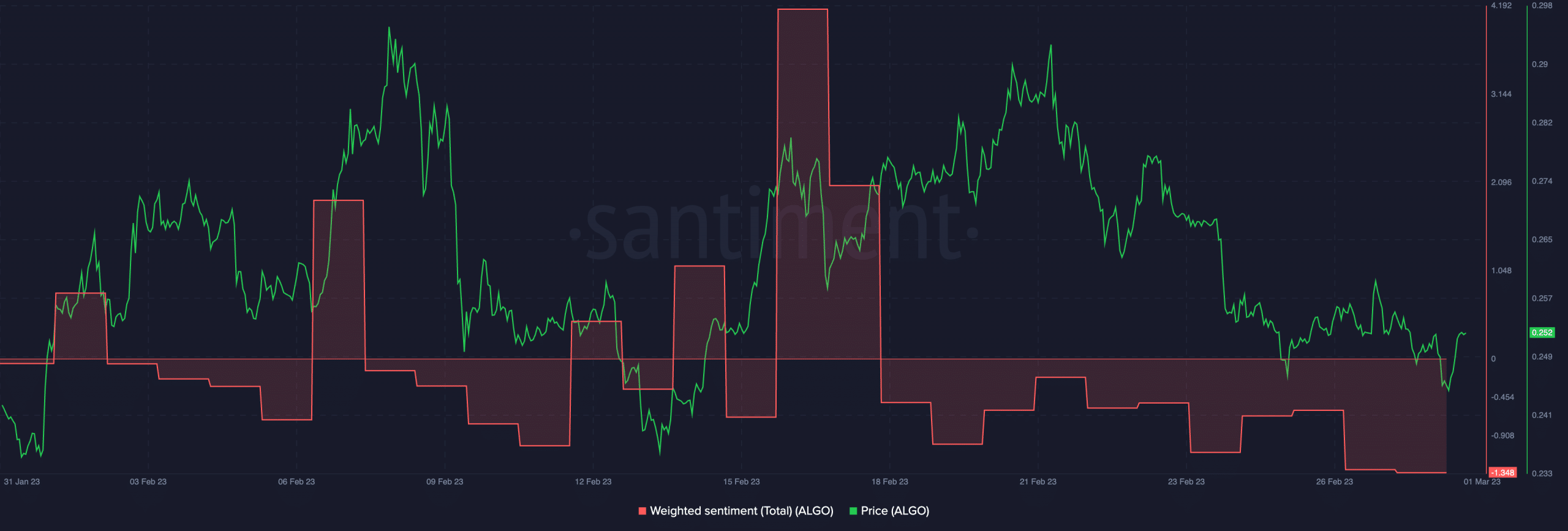

With many unconvinced of any positive price growth in the short term, ALGO has been trailed by negative weighted sentiment since 18 February, per data from Santiment.