Will Algorand’s breakout of this demand zone propel it past $1

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

The past 24 hours saw a transaction volume amounting to $140 million on the Algorand network the previous day, according to data on Messari.io. While this figure has been rising in the past few days, it was also stark in contrast to the $11.3 billion worth of transactions on Ethereum and ETH. Coinglass data showed that ALGO has seen a slight increase in open interest on futures in the past 24 hours, the implication being that if $0.988 can be broken, the market would take notice and ride the bullish momentum.

ALGO- 1H

In the short term, ALGO showed a bullish bias on the price charts. In the past week, it has climbed above the former monthly (March) highs at $0.895, and in the past few days, this level has served as support. There is also the $0.92 area (cyan box) which has formerly been a zone of resistance.

At the time of writing, it looked to have been flipped to support. Using the swing low and swing high at $0.8 and $0.988, Fibonacci retracement levels (yellow) were plotted. Above $0.988, the $1 and the $1.03 levels can act as take-profit levels.

There was some evidence that buying pressure was waning in recent hours. This could see ALGO pullback toward the $0.87-$0.89 area.

Rationale

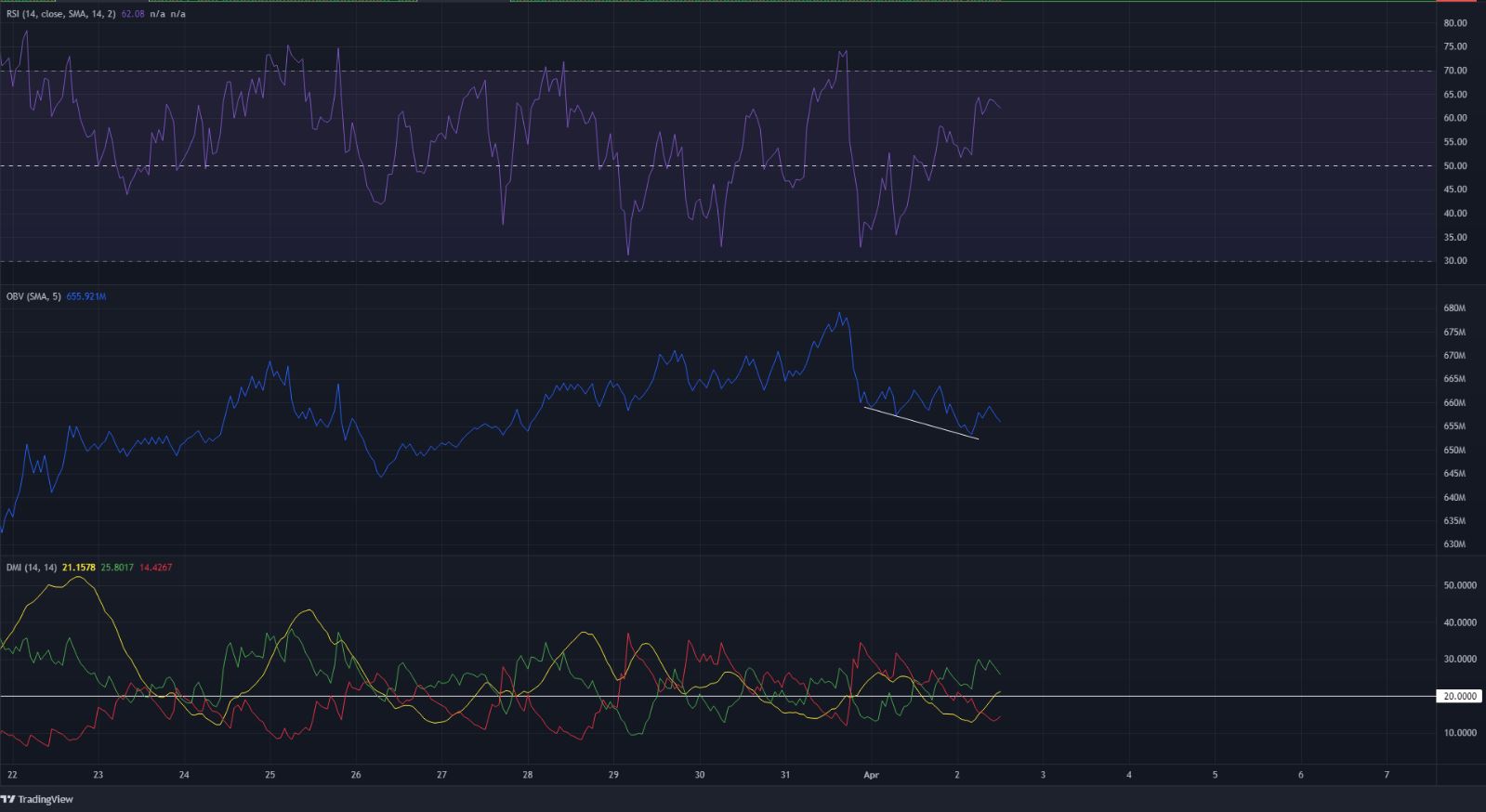

The hourly RSI was above neutral 50 and did not exhibit any bearish divergence yet. On the OBV, however, something was slightly amiss. While it was not a divergence by itself, the OBV has formed lower lows in the past couple of days. This meant selling volume has been on the rise even as the price pushed higher.

The Directional Movement Index showed a strong uptrend in progress, as both the ADX (yellow) and +DI (green) were above the 20 value.

Conclusion

The momentum was in favor of the bulls, and the price action also showed Algorand’s climb past a former zone of resistance. However, the hiccup that the OBV appeared to show meant that ALGO could also see a pullback in the hours to come.