Algorand surges to the highs of 6-month range, but should traders go long

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- The significant downtrend for Algorand was followed by the formation of a range

- Evidence of an accumulation phase was seen but patience would be key

Algorand has been in a downtrend since September 2021. However, there was the possibility that things began to take a turn in the opposite direction. While there were signs of a possible imminent breakout, bulls might want to exercise patience.

Here’s AMBCrypto’s Price Prediction for Algorand [ALGO] in 2022-23

The recent rally for ALGO from $0.3 began alongside Bitcoin’s rally from the $19k mark. The past few hours of trading saw a pullback for Bitcoin and short-term bearish sentiment across the altcoin market.

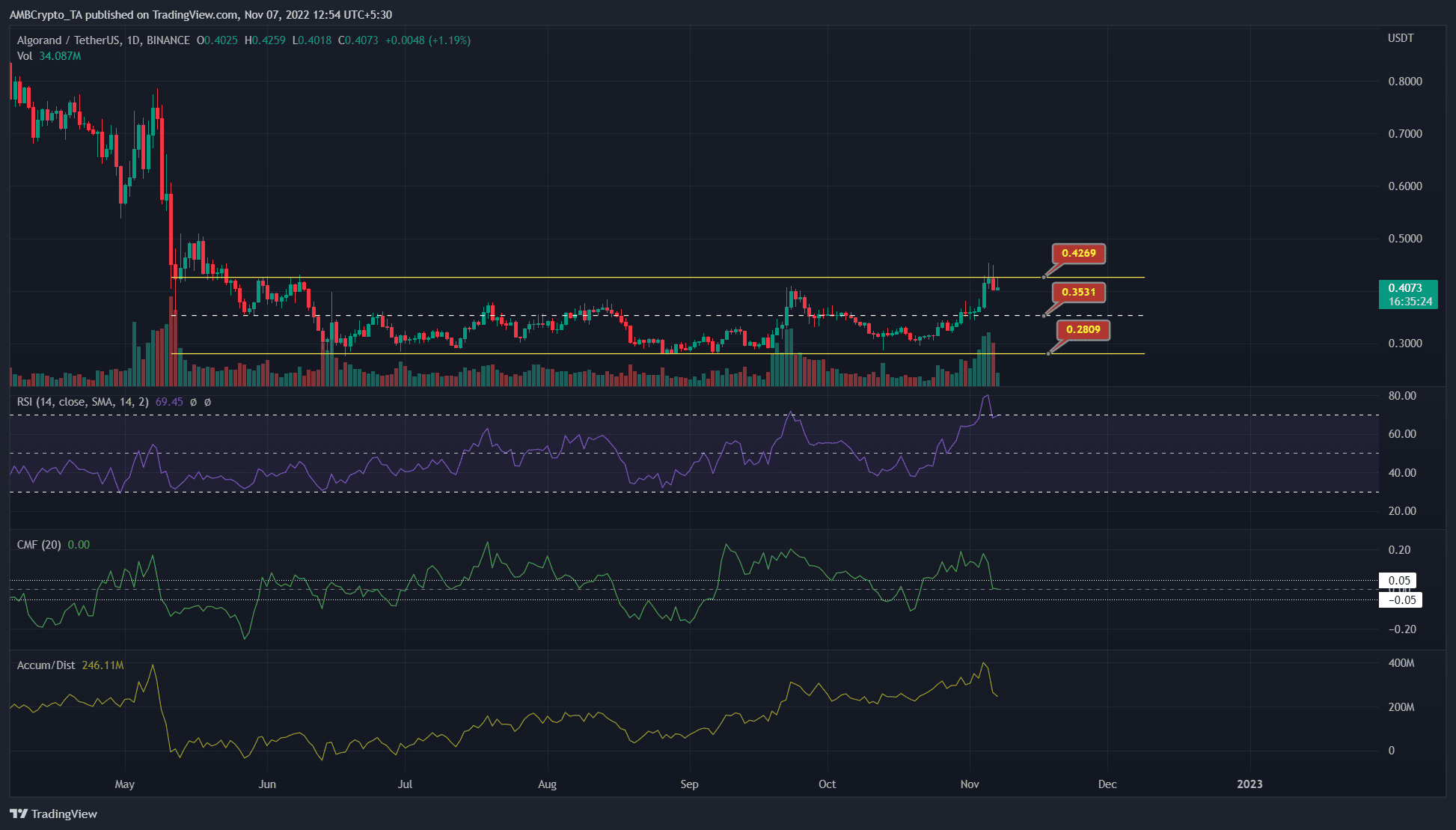

Consolidation and accumulation inside a range for Algorand

In 2022, leading up to May, the price had been in a strong downtrend. From the high of $2.45 in September 2021, Algorand has only slid lower down the charts. Beginning in June the price formed a range between $0.42 and $0.28, with the mid-point at $0.35.

This suggested that the coin might be in an accumulation phase. In support of this argument, the A/D indicator was in an uptrend to show steady buying pressure. The indicator has made higher lows since June.

On the other hand, the CMF has oscillated between negative and positive territory in sync with the bear-bull skirmishes. At press time, the CMF was at zero to show a lack of significant capital flow into or out of the market.

Can ALGO break out past the range highs? The RSI was already in the overbought territory and falling. Yet, both the momentum and the market structure remained bullish on the daily timeframe.

The volatility in May saw a bearish order block form just above the range highs. It extended from $0.41 to $0.49 and hinted that ALGO would have tough resistance all the way up to the psychological $0.5 mark.

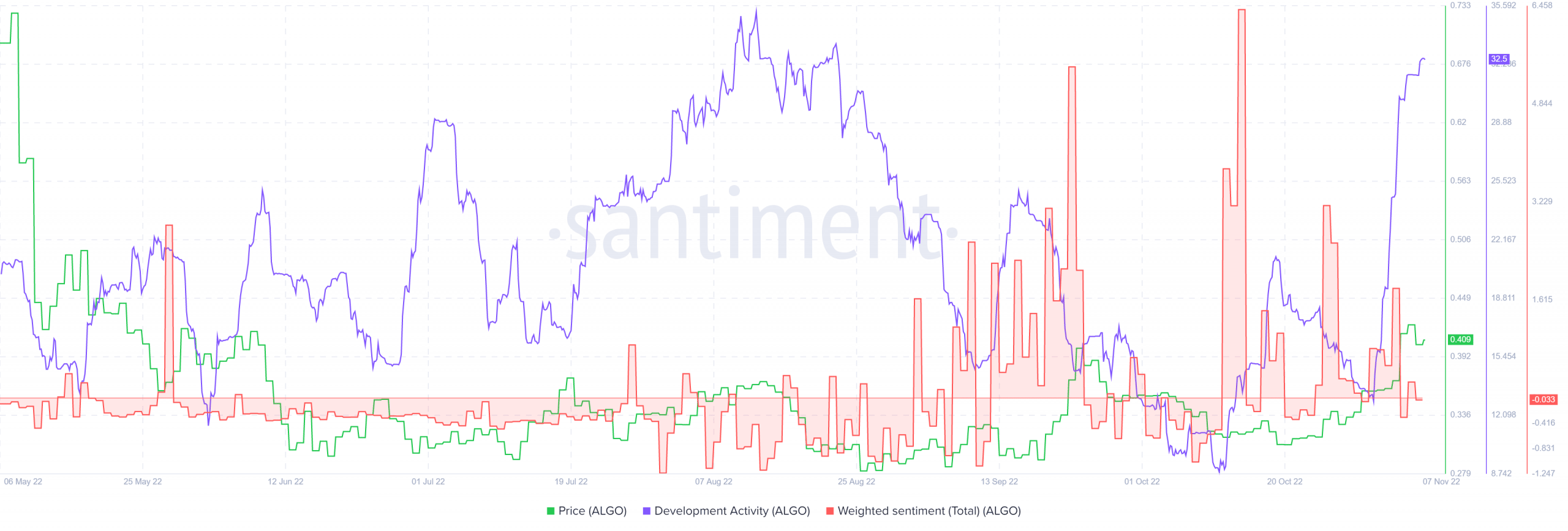

Weighted sentiment remains positive, but not by a significant margin

Source: Santiment

The weighted sentiment saw a huge spike in mid-October, This occurred when the price visited the lows at $0.28 and saw a resurgence back to the $0.327 mark within a day.

In the weeks since then, the weighted sentiment has not been as strongly positive, even though ALGO had embarked on a rally. Meanwhile, the development activity formed peaks and troughs in recent months but showed a fair amount of work being done.

Could the bulls have gotten complacent near the range highs? ALGO could be forced to retrace a large portion of its gains if buyers can not sustain their momentum. The range highs at $0.42 can be used to take profit by the longs. To the south, the $0.35-$0.37 region can see a positive reaction from ALGO.