Algorand: Whale interest rises after 45% drop – What’s next for ALGO?

- ALGO’s large transaction volume jumped by 166%, indicating whales’ rising interest.

- Traders holding long positions were over-leveraged at the $0.283 level, with $3.29 million in open long positions.

After a notable 45% price drop in recent days, Algorand [ALGO] appeared to be shifting its market sentiment and showing signs of a price rebound.

Today, this turnaround is driven by increasing investor and trader interest, alongside bullish price action evident on the daily ALGO chart.

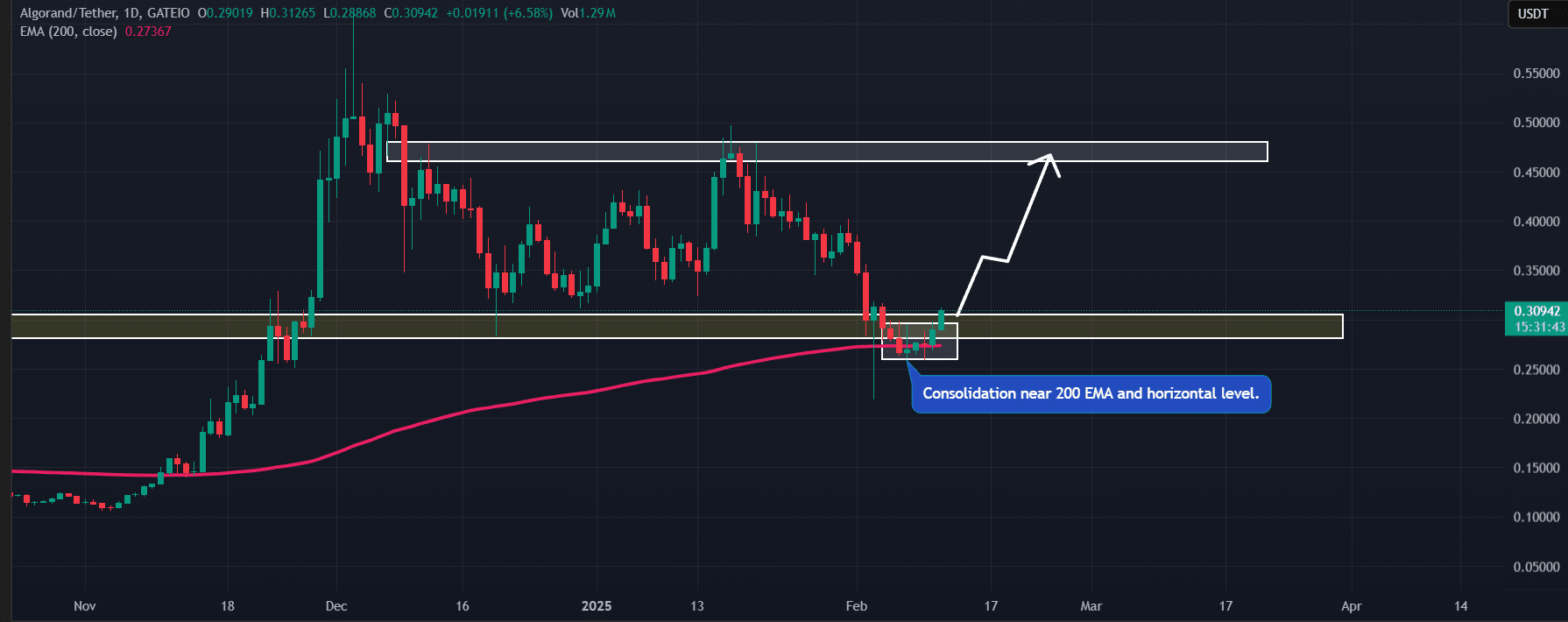

Algorand price action and key levels

During the recent price drop, the asset reached a crucial support level of $0.28, which has a strong history of price reversals.

However, the price remained within a narrow consolidation zone at this support level for consecutive weeks.

Now, as sentiment across the broader market shifts, ALGO has broken out of this zone and is showing signs of a price rebound.

According to AMBCrypto’s analysis, if ALGO holds this gain and closes the daily candle above the $0.315 level, there is a strong possibility it could soar by 50% to reach $0.45.

ALGO not only found support at a crucial horizontal level but also at the 200-day Exponential Moving Average (EMA), reinforcing its long-term bullish outlook.

Current price and investors’ interest

ALGO was trading near $0.31 at press time, with a 9.50% rise in the past 24 hours.

With this price reversal and bullish price action, ALGO’s large transaction volume jumped by 166%, indicating heightened participation from investors and whales.

Meanwhile, intraday traders have increased their open positions, as reflected by an 11% rise in Open Interest (OI) over the past 24 hours.

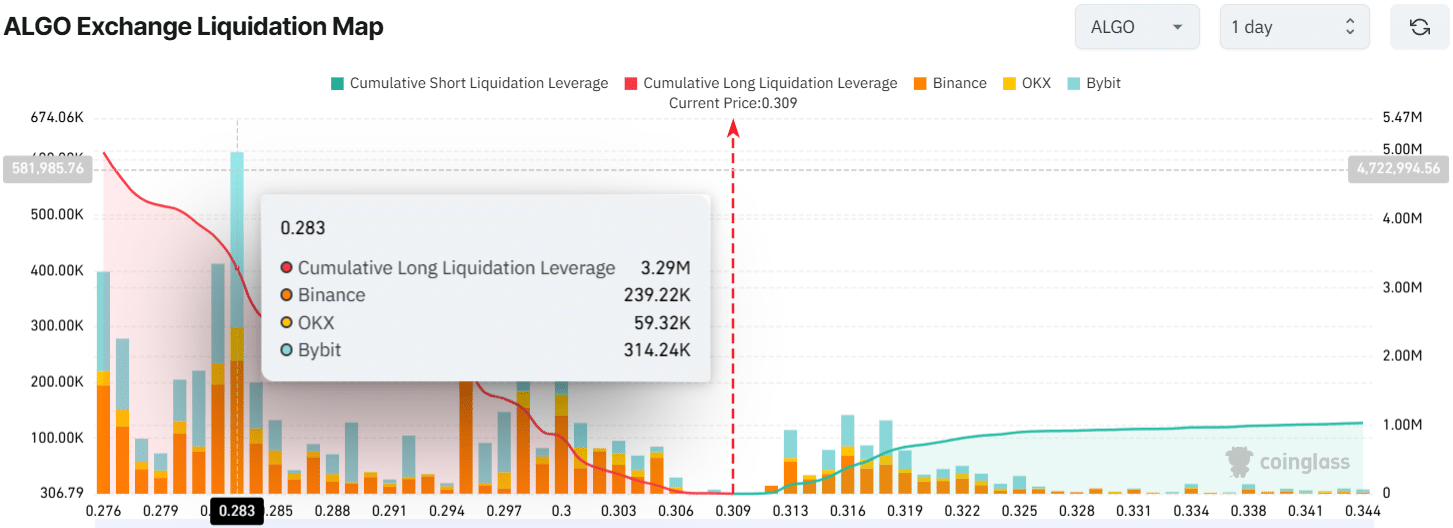

Major liquidation levels

In addition to these on-chain metrics, intraday traders seemed to be highly bullish, placing strong bets on the long side.

Data from ALGO’s exchange liquidation map showed that traders holding long positions were over-leveraged at the $0.283 level, with $3.29 million worth of long positions.

Conversely, $0.318 is another key level where traders holding short positions were over-leveraged, holding $603,190 worth of short positions at press time.

Read Algorand’s [ALGO] Price Prediction 2025–2026

These over-leveraged positions will be liquidated if the ALGO price moves in either direction.

When these on-chain metrics are combined with ALGO’s recent price action, it appears that bulls are currently dominating the asset and could support its upcoming rally.