ALGO’s price dump – Here’s what’s next for the altcoin

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Lower and higher timeframe charts seemed to be bearish

- ALGO recorded fluctuating funding rates over the last few days

Algorand’s [ALGO] value has declined to its mid-January level. At press time, the token was trading at $0.2034. In fact, it could sustain more sell pressure because of the increasing uncertainty around Bitcoin [BTC].

Read Algorand [ALGO] Price Prediction 2023-24

Bitcoin [BTC] dropped below the $22K psychological level and could exert more selling pressure on ALGO. Especially if the bearish sentiment persists over the next hours/days.

A sustained decline, consolidation, or recovery for ALGO?

ALGO’s depreciation towards the end of February chalked a descending channel (orange). On the three-hour chart, ALGO traded sideways between the 61.8% Fib level ($0.2206) and 100% Fib level ($0.2344) before a bearish breakout on March 7. The drop has broken several lower Fib retracement levels, but the price bounced at $0.1983. At press time, the price was attempting to retest the 23.6% Fib level ($0.2068).

ALGO could face rejection at the 23.6% Fib level and move south before bouncing back from $0.1983. Alternatively, it could sink below $0.1983 and attract extra intense selling pressure.

Therefore, there could be two potential trades on the price action. First, shorting ALGO if it faces price rejection at 23.6% Fib level ($0.2068) or the 7-period EMA ($0.2050). The target would be the 0% Fib level ($0.1983). Secondly, a breach below $0.1983 and the channel’s lower boundary could offer an extra shorting opportunity at $0.1898.

A break above the 7-period EMA would invalidate the aforementioned thesis and make shorting riskier. However, the upswing could offer near-term bulls gains at the 26-period EMA ($0.2137) or 61.8% Fib level ($0.2206).

How much are 1,10,100 ALGOs worth today?

The RSI has operated below the 50-mark since the beginning of March while the OBV declined over the same period. This reiterated the limited buying pressure that tipped the scale in favor of the market’s bears.

Fluctuating Funding Rate could undermine bulls’ efforts

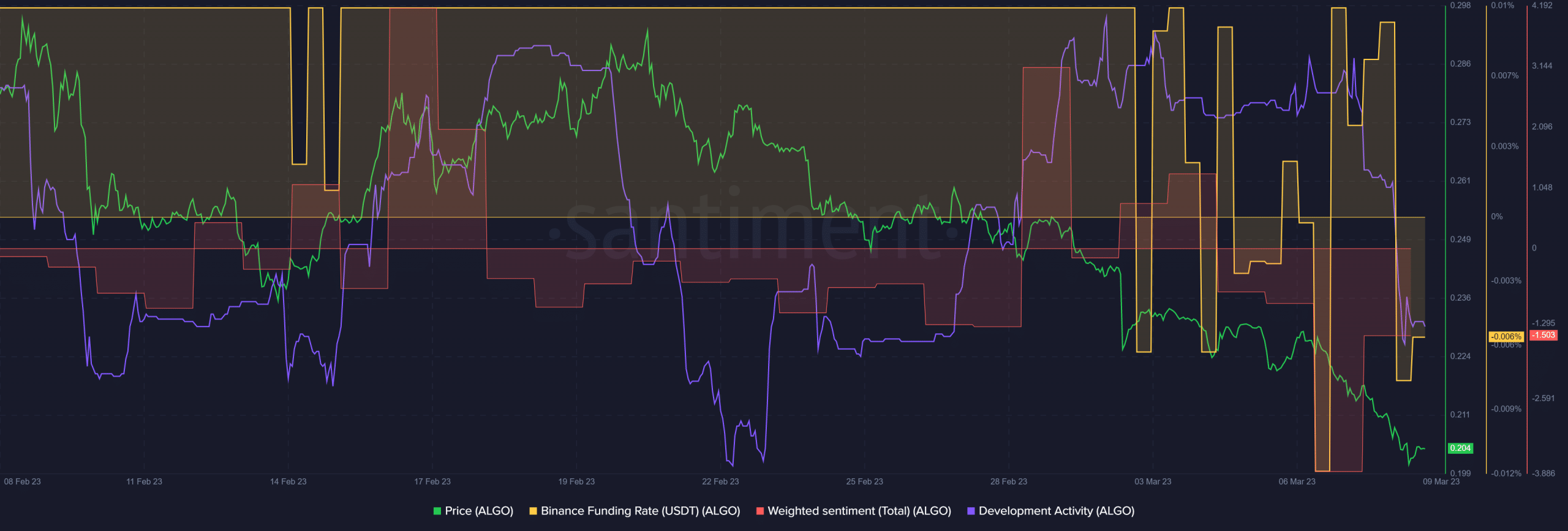

ALGO has recorded unstable demand over the past few days, as shown by fluctuations in the Funding Rate for ALGO/USDT pair. It could offer bears more influence to devalue the token.

Moreover, the development activity declined sharply, something that could undermine investors’ positive outlook on the token. Additionally, the weighted sentiment has remained negative, capturing the underlying bearish outlook at press time.