All about Polygon’s recovery, downsides, and the likelihood of another upswing

- MATIC could approach another high similar to its 2021 uptrend.

- The token’s supply on exchange is close to its highest ever.

Like most cryptocurrencies, Polygon [MATIC] has experienced a significant price increase in recent times. But after the period of recovery for most of Q1, the token of the Ethereum [ETH] scaling solution faced a notable decline.

How much are 1,10,100 MATICs worth today?

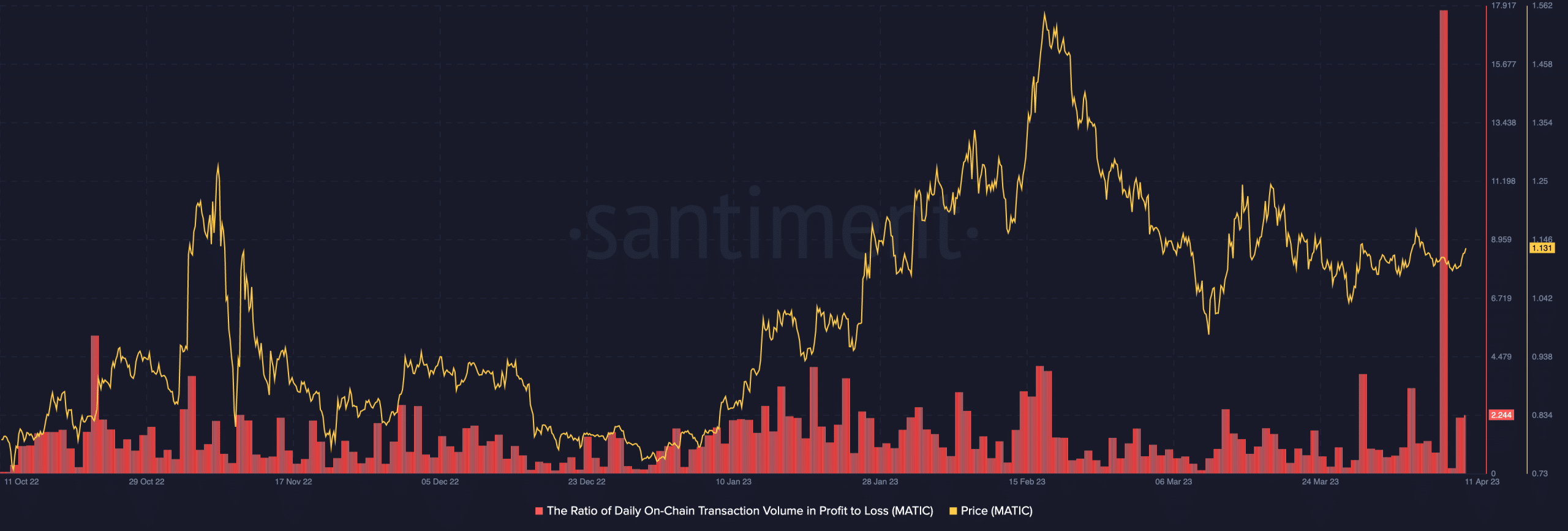

However, the fall in price would have had less effect on the MATIC value if not for the massive profit-taking that occurred. For instance, the ratio of daily on-chain transactions in volume in profit to loss sharply spiked on 8 April.

Polygon: The race is never linear

When the metric increases, it mostly has a negative impact on the asset price. But when it’s the other way around, the value stabilizes or increases. But according to Santiment, over $49 million worth of MATIC were taken as gains on the aforementioned date. This represented the highest it has experienced this year. Hence, it was impossible for the price action not to be affected.

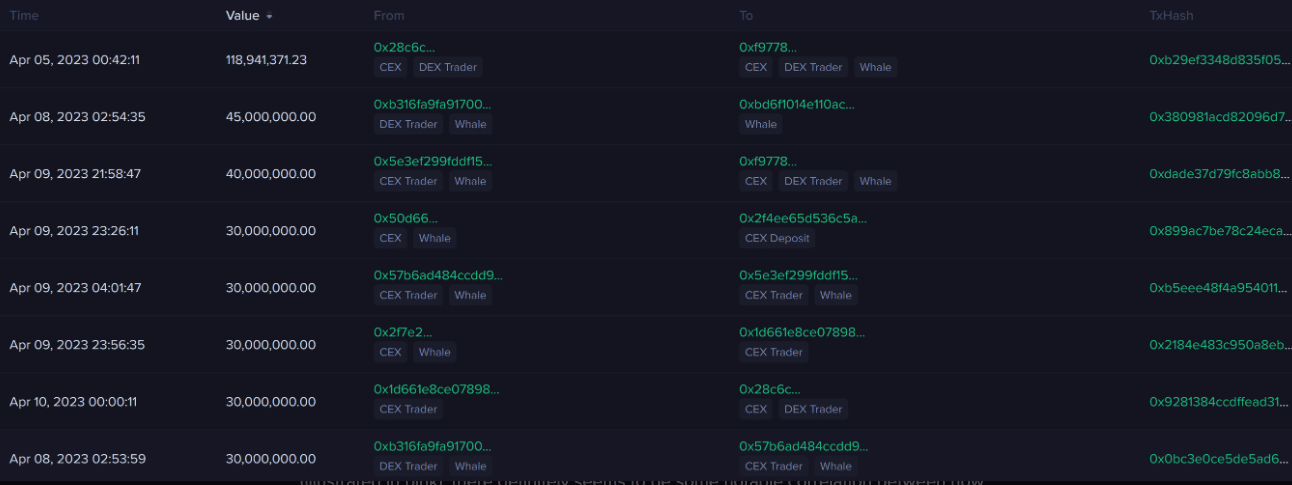

However, there were actions that propelled MATIC to resist surrendering to a significant fall. One of such was the tremendous increase in large transactions over the past week. According to the on-chain analytic platform, these transactions went as high as $33 million.

This served as the major influence of exempting MATIC from losing a chunk of its 31.47% 30-day high.

Assembling for a win amid…

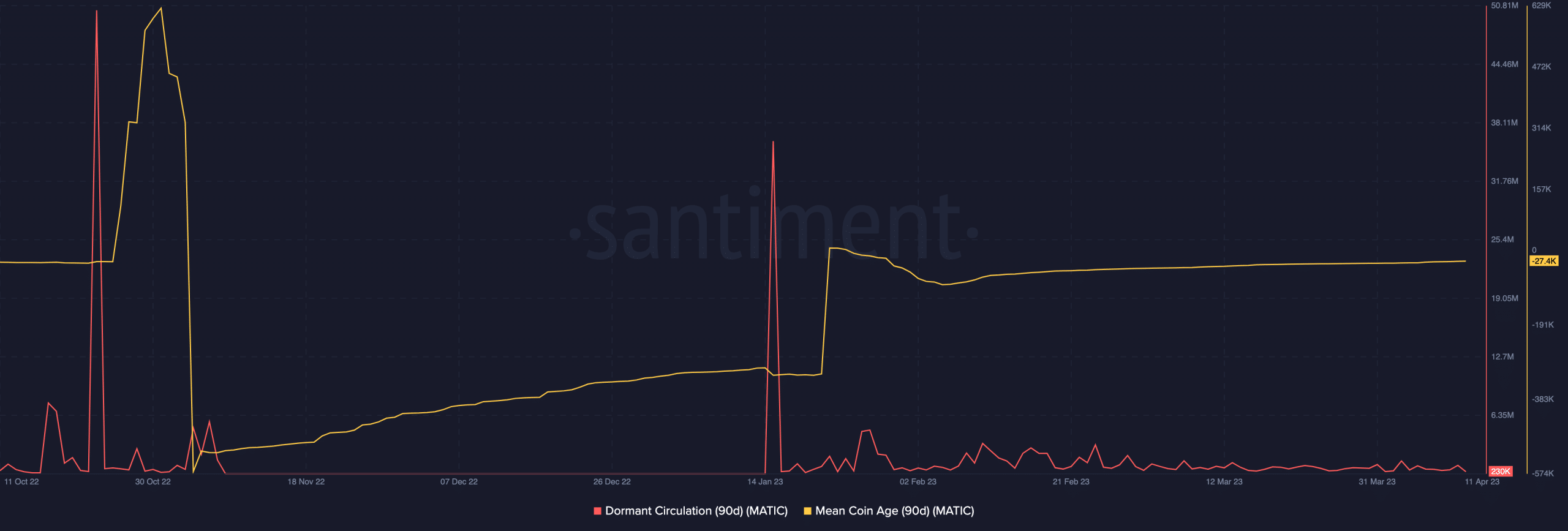

It seemed that MATIC may be prepared for another upswing based on the dormant circulation condition. At the time of writing, the 90-day dormant circulation was flat out at 230,000. Ordinary, the lack of activity with this metric implies that long-term holders have restrained participating in sell-offs.

Even so, the mean coin age in the past 90 days has been flattening. This metric also tracks dormant money and the activity of old addresses. Typically, dormancy in the mean coin age could propel MATIC to a new high, and investors might need to start preparing their bags.

Santiment, in its 10 April analysis, likened the current state to that which triggered a MATIC uptrend before the full-blown 2021 bull market.

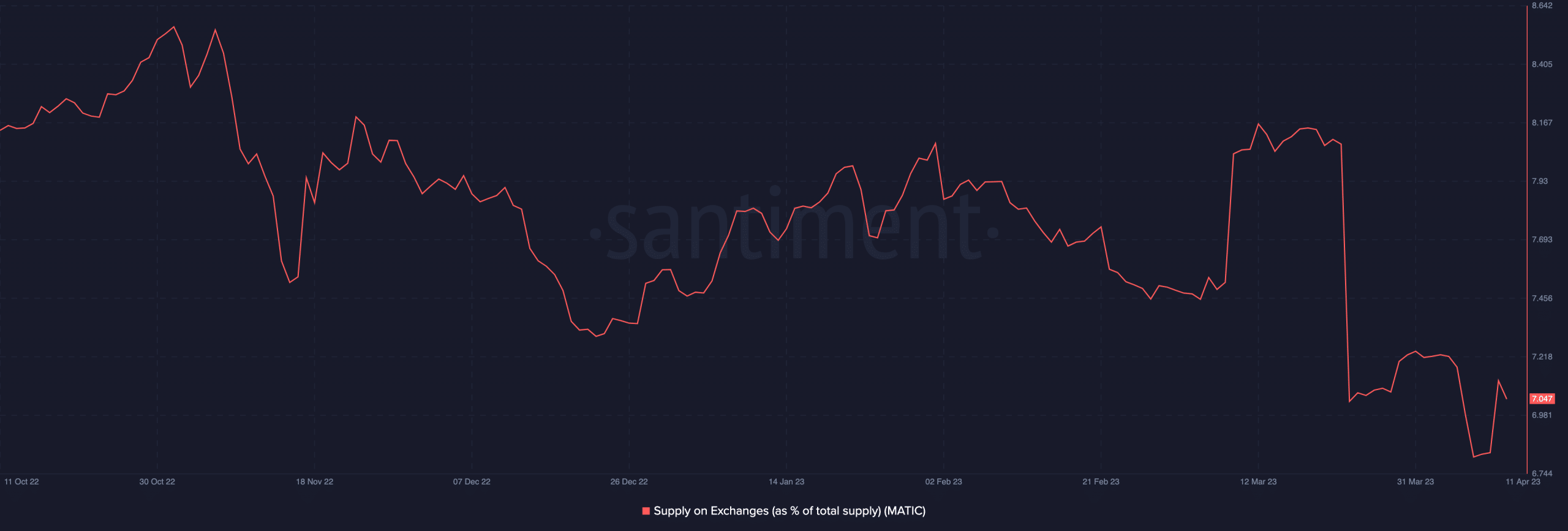

Another metric that seems to support a MATIC upswing is the percentage of supply on exchanges. Usually, a high supply of tokens on exchanges means that investors could be tempted to pull the sell trigger.

Realistic or not, here’s MATIC’s market cap in ETH’s terms

At press time, the supply percentage on exchanges was 7.04% — one of its lowest points since the token launch four years back. Therefore, this implies that the selling pressure experienced earlier could well be limited.

At the time of writing, MATIC has been able to follow Bitcoin’s [BTC] revival. This time, it gained 3.41% in the last 24 hours.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-13-400x240.webp)