All about SAND’s latest security threat: Are your holdings safe?

- The Sandbox became the latest project to experience a security issue.

- SAND struggled to bounce back after interacting with the 2-day MA due to low demand.

Every once in a while, a crypto project goes through security challenges that often spoof investors. The Sandbox [SAND] is the latest project to report such an experience following its latest announcement.

Is your portfolio green? Check out The Sandbox’s Profit Calculator

On 2 March, The Sandbox issued a notice revealing that it had experienced a security breach towards the end of February. Reportedly, the incident occurred after a third party accessed one of the project’s employees. The culprit then used the company’s email addresses to send out emails that contained malware.

SandBox is aware that an unauthorized third party had gained access to the computer of an employee. This enabled the third party to access a number of email addresses to which it then sent an email falsely claiming to be from The Sandbox. The email included hyperlinks to malware… https://t.co/eqsv5Cvsgr

— Wu Blockchain (@WuBlockchain) March 2, 2023

Did the incident affect SAND?

According to the report, the malware included in the email may have the ability to install onto other devices remotely. However, this is only if the user clicks on links included in the email carrying the malware. The Sandbox revealed that it has already contacted those that received the malicious actor’s email.

The Sandbox did not report any incidents where platform users were affected and no serious repercussions have been observed so far. However, this does not mean that the incident may not have an impact. Such an incident has the potential to influence investor sentiment, depending on its severity.

A brief overview of SAND’s price action indicated that price movements were within normal range at press time. Its $37 press time price represented a 25% drawback from its 2023 high. This meant that the price was already bearish at the time of the incident and a potential impact might already be priced in.

SAND was showing signs of support near the $36 price range. This is expected because the price was sitting on the 200-day MA at press time. In addition, the 50-day MA formed a golden cross with the 200-day MA.

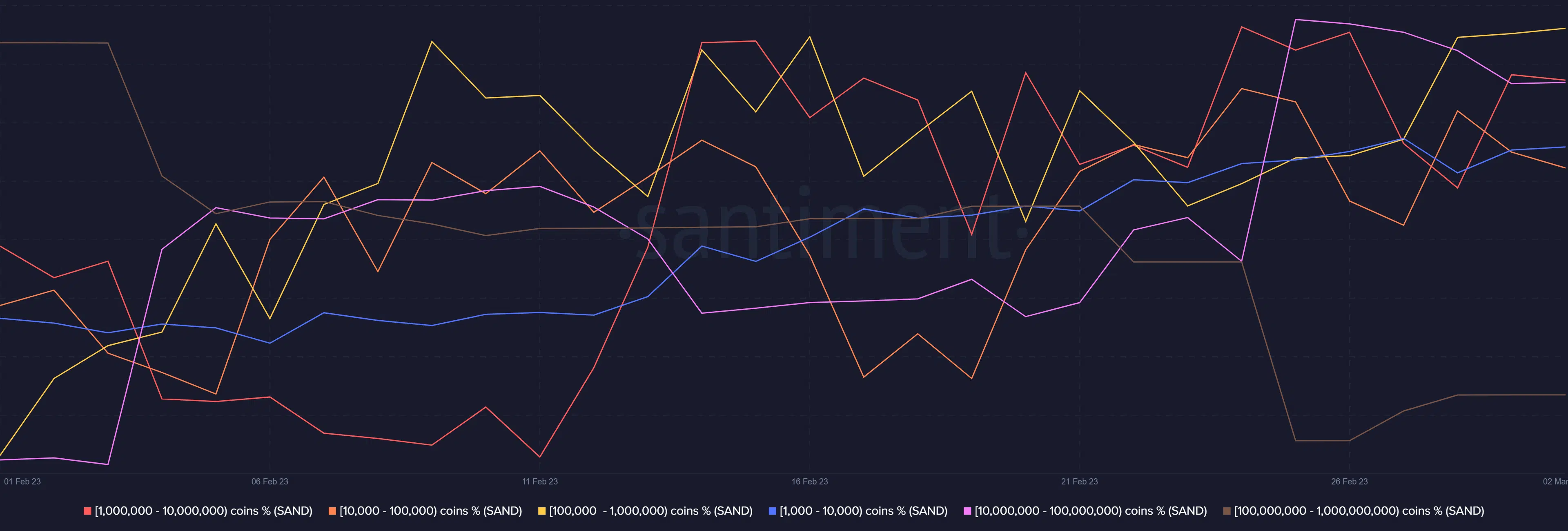

A quick look at the supply distribution revealed that most of the top whale categories are no longer selling. This confirmed the price observation where sell pressure appeared to be slowing down. However, a lack of robust accumulation also revealed why the bulls did not look eager to take over.

Realistic or not, here’s SAND’s market cap in BTC’s terms

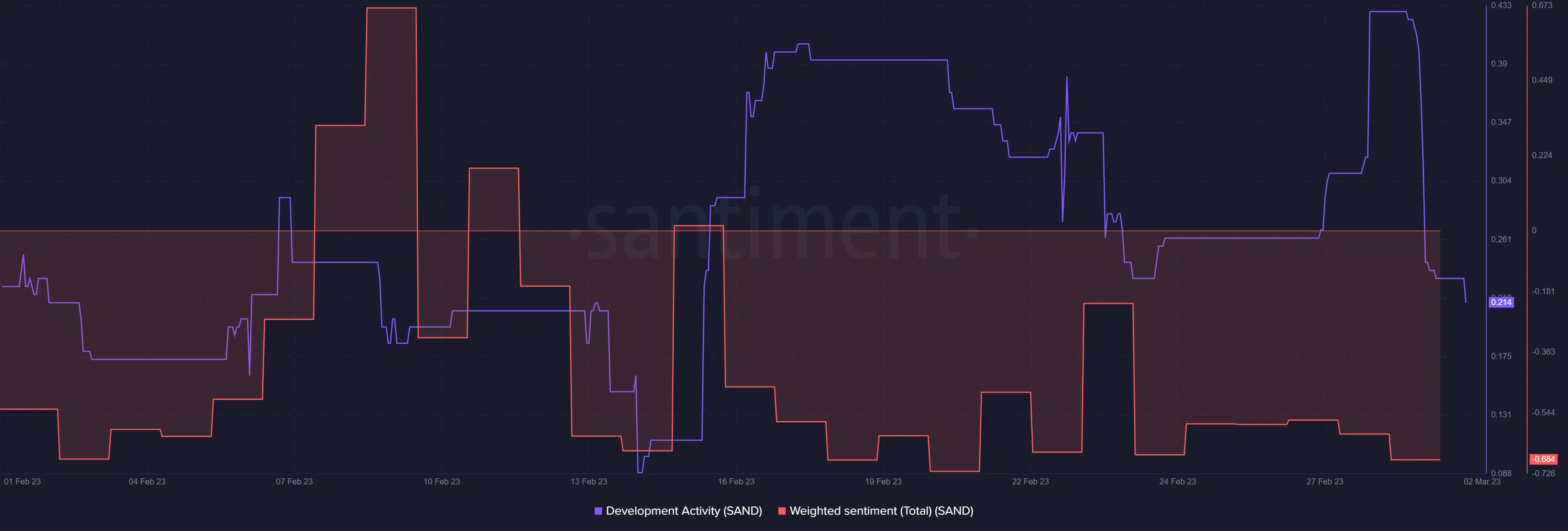

The lack of strong bullish demand reflected the press time sentiment. The weighted sentiment metric ended February with a slight decline, confirming that investors are not yet enthusiastic about bullish prospects. A potential reason for this were the recent token unlocks, which may have surprised investors. Moreover, development activity has tanked slightly in the last three days.

Despite these observations, investor sentiment favored a long-term HODL preference for SAND at the time of writing. This was evident in the mean coin age, which rallied in the last few days.