All eyes on Bitcoin [BTC] as Coinbase CEO reveals…

![All eyes on Bitcoin [BTC] as Coinbase CEO reveals...](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_The_image_depicts_a_stylized_representation_of_a_bull_6b467e2c-55fe-440b-a5f0-44bae4afa3fd-e1681039162745.png)

- Coinbase CEO stated that Coinbase might integrate Bitcoin Lightning Network.

- Bitcoin’s sentiment remained positive; however, traders turn skeptical.

Over the past few months, Bitcoin [BTC] has witnessed a substantial rally with a surge in its price. While some traders have been anticipating an imminent price correction due to BTC’s significant rise, comments made by Brian Armstrong, the CEO of Coinbase [BASE], could potentially turn the tides in Bitcoin’s favor.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In an 8 April tweet, Brian mentioned that Coinbase has an interest in integrating the Bitcoin Lightning Network into Coinbase.

It's weird how @brian_armstrong is actively ignoring the #Bitcoin Lightning Network. He hasn't ever tweeted about it. Not even once. ?https://t.co/MsnlYBsaG2

— Wicked (@w_s_bitcoin) April 8, 2023

The Bitcoin Lightning Network is a second-layer protocol that enables fast and cheap off-chain transactions between users. By creating a network of payment channels, the Lightning Network aims to improve the scalability and usability of Bitcoin.

Brian Armstrong’s remarks have led to a significant surge in social activity for Bitcoin. LunarCrush’s data suggested that the number of social mentions for BTC has risen by 25.1%, and the count of social engagements related to BTC has grown by 8.4%.

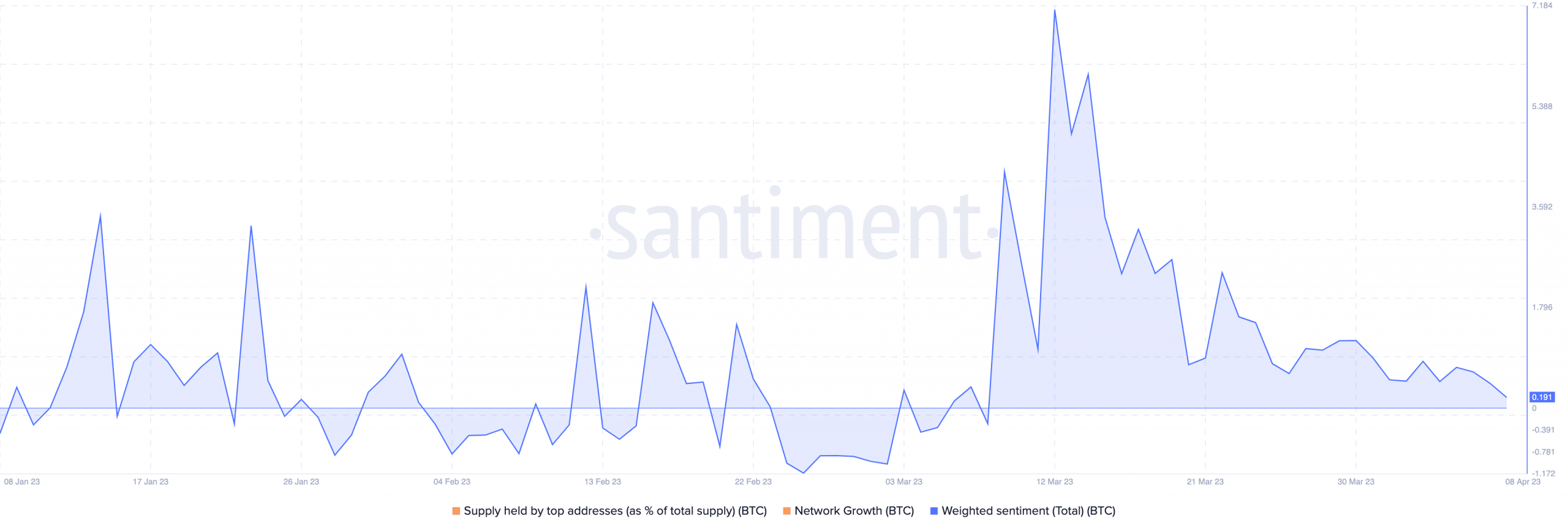

The weighted sentiment was also positive, suggesting that the crypto community had more positive things to say about BTC than negative.

The positive support for Bitcoin was also indicated through the decline in Bitcoin’s mean transaction volume. This decline in transfer volume implied that many addresses were choosing to hold on to their BTC and wait for prices to rise.

? #Bitcoin $BTC Median Transaction Volume (7d MA) just reached a 3-year low of $266.98

Previous 3-year low of $267.13 was observed on 06 March 2023

View metric:https://t.co/Oqu9AN81mM pic.twitter.com/9ZsKqb7qfG

— glassnode alerts (@glassnodealerts) April 8, 2023

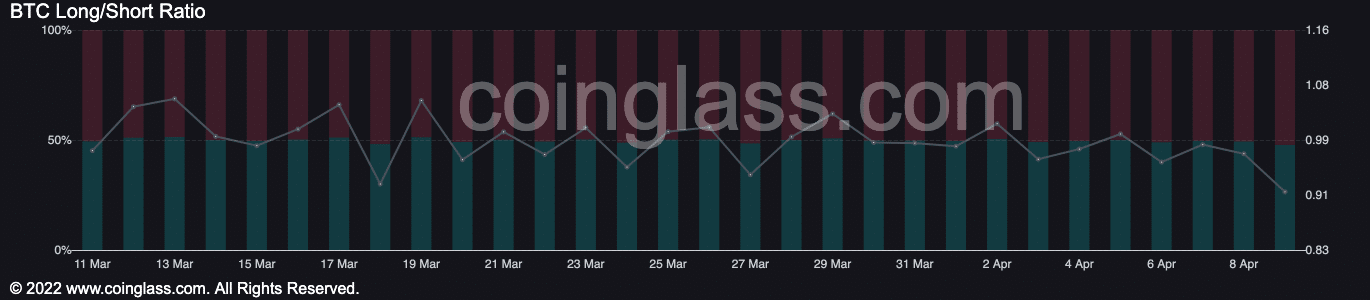

Bitcoin traders remain suspicious

However, traders did not share the same sentiment. According to Coinglass’ data, the number of short positions being taken against BTC increased over the past few weeks. At press time, the percentage of short positions taken against BTC increased from 49% to 52.16%.

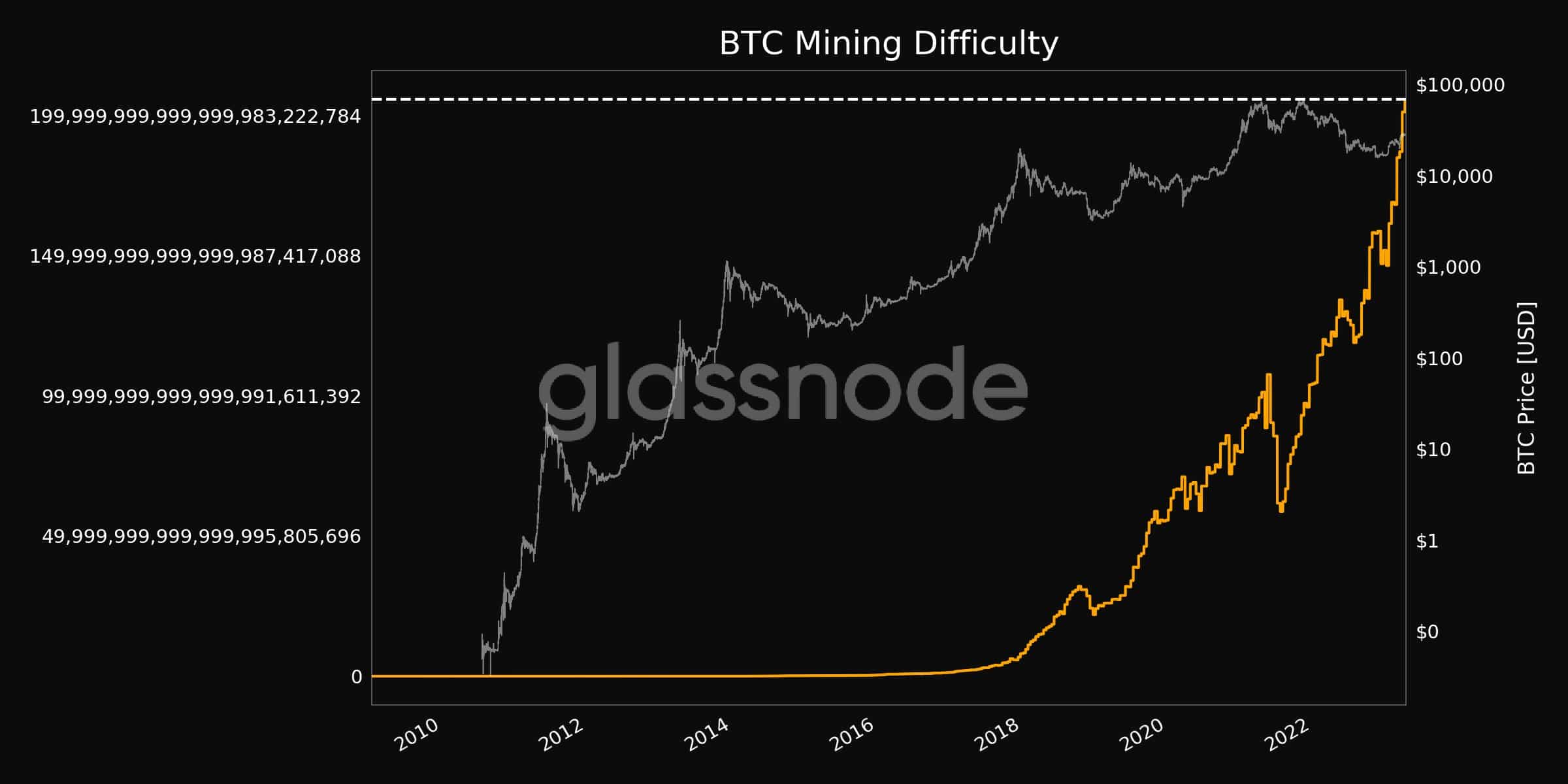

One reason for the increasing number of short positions could be the growing selling pressure on the miners. Over the last few months, mining difficulty has increased immensely. When mining difficulty is high, it could cause various challenges for cryptocurrency miners, such as heightened competition, elevated energy expenses, and the need for newer hardware to remain competitive.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

To make up for these expenses, miners could be incentivized to sell their BTC holdings.

Additionally, there was a risk of centralization, which could go against the decentralized nature of cryptocurrencies, potentially impacting their integrity.