Altcoin season’s timeline – What can we expect from this cycle in 2025?

- Altcoin season’s hypothetical timeline revealed that a true run higher may be yet to begin

- Bitcoin would need to grow much bigger to sustain the kind of altcoin seasons seen in the past

With Bitcoin [BTC] fighting for control of the $100k-level, altcoins have had the time to trend higher. This is a general occurrence though – In a bull run, whenever BTC trends higher, most altcoin stand still and vice versa. It ties in well with the idea of capital rotation in the crypto market.

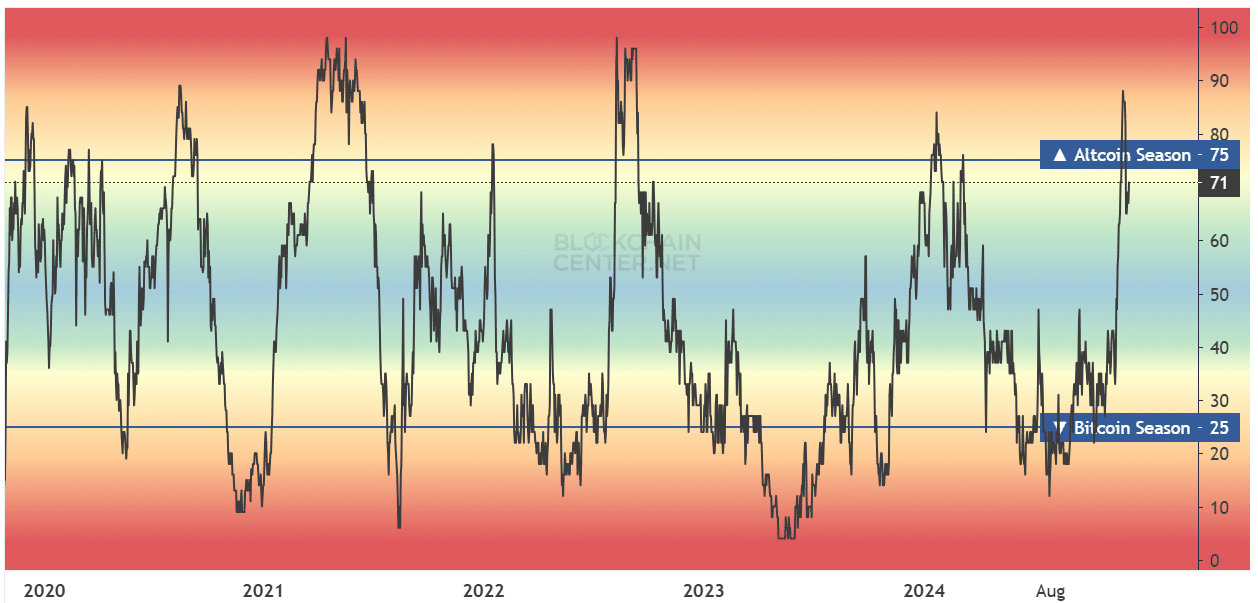

Source: Blockchain Center

The altcoin season index showed that it has been altcoin season for close to two weeks now, but the reading had already receded to 71 at press time.

However, this does not mean that the cycle is over and it’s time to sell – Far from it.

Altcoin season timeline, and the fuel that would drive it

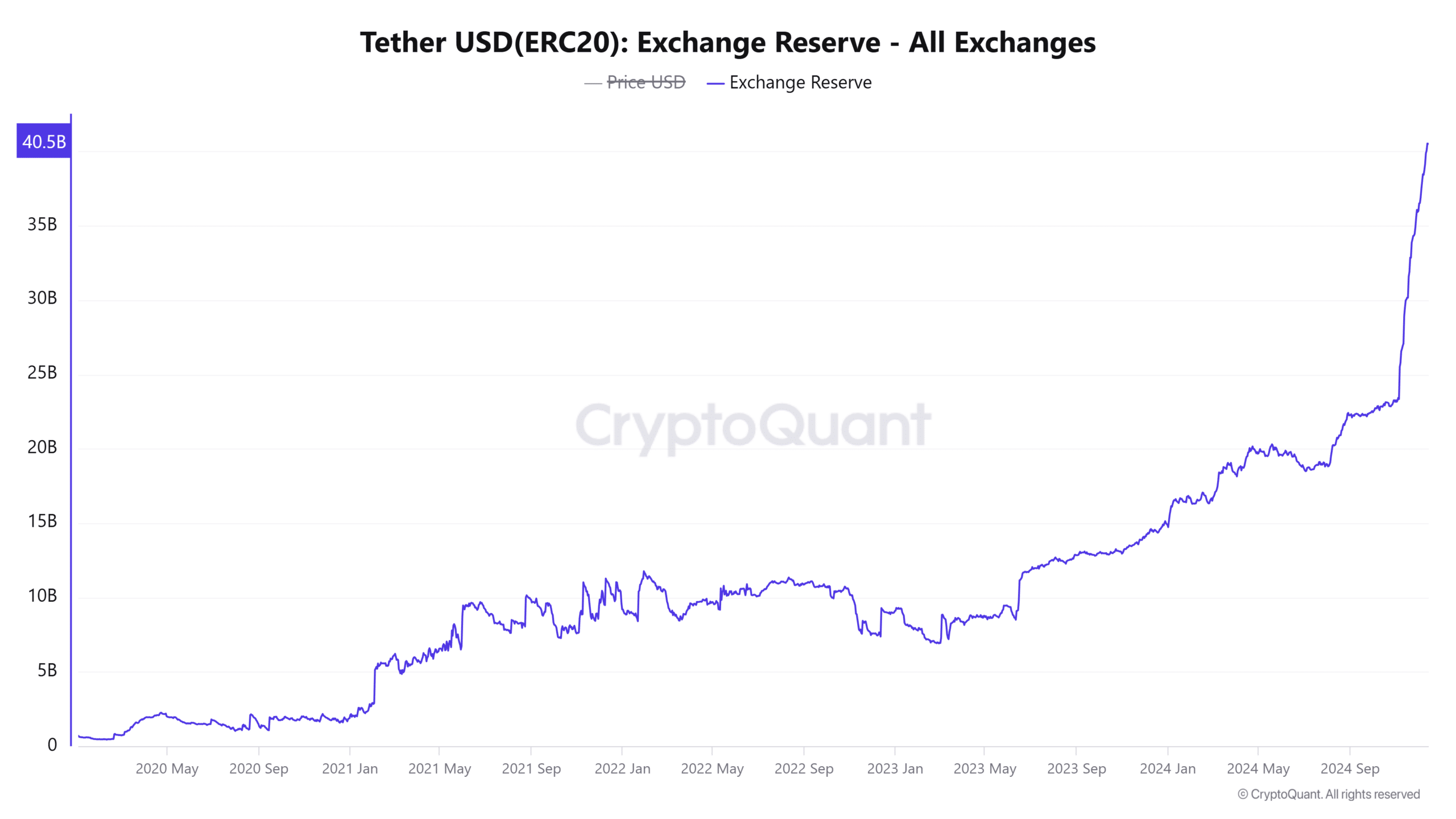

Source: CryptoQuant

Stablecoins are critical for the crypto ecosystem. They provide a safe haven from volatility, provide liquidity to the market, and enable DeFi activities. A hike in stablecoin flows to exchanges is bullish and a sign of heightened buying power.

For instance- We can see the Tether [USDT] exchange reserves rocketed higher over the past three months.

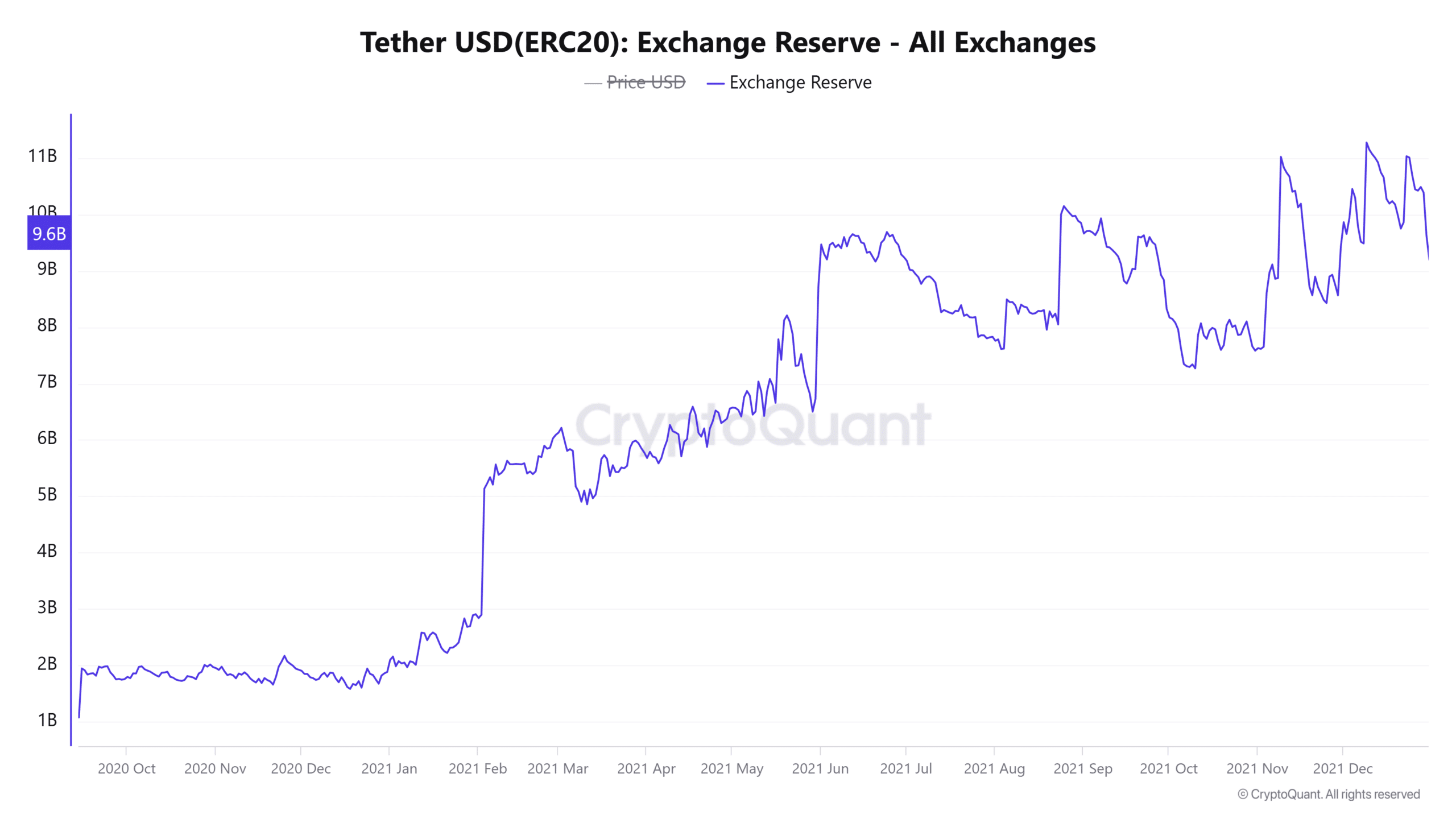

Source: CryptoQuant

Zooming in on the 2020-21 run, increased exchange reserves of Tether, one of the most popular stablecoins, coincided with a full-blown altcoin season. Minting stablecoins and their transfer from the treasury to centralized exchanges helps with liquidity and facilitating transactions, and is the ammunition for large buyers.

The 2021 February jump in reserves was similar to the past two months, and it is possible that the true altcoin season is yet to arrive. In the previous cycle, it came in May and November 2021. This time around too, we might have to wait for Q2 and Q4 2025 for jaw-dropping gains like last time.

Market capitalization targets for 2025

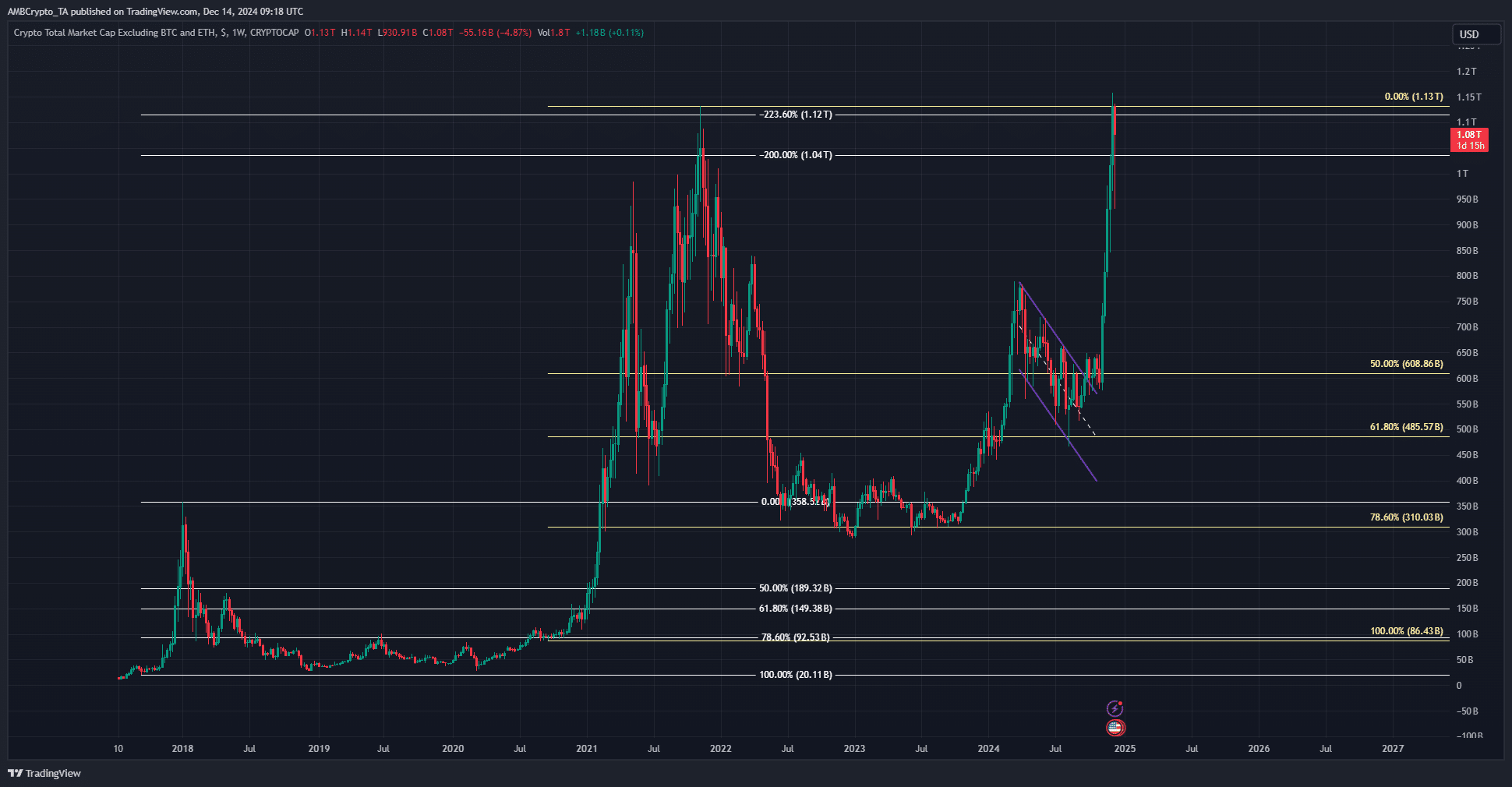

From its 2018 highs, the altcoin market cap (excluding Ethereum [ETH]) reached just beyond the 223.6% extension level at $1.12 trillion in 2021. Similarly, using the 2021 run, AMBCrypto found that the 2025 target at the 223.6% extension level was $3.47 trillion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the previous cycle repeats itself, we can expect the altcoin market cap to reach these levels within the next ten months. It is possible that once the tax season in the U.S. is over by April, any tax-related selling would subside and participants re-enter as buyers, driving prices up during early summer.

“Sell in May, walk away” is applicable to the crypto market as well. It is best not to rely too much on historical evidence as different summers provide different returns, but investors should plan on selling a portion of their holdings in May and November, while keeping an eye on long-term price trends.