Bitcoin spot ETFs are exciting, but don’t forget the halving

- Historically, halvings have resulted in bull markets for Bitcoin.

- As BTC was getting scarcer, investors showed more willingness to HODL.

While the optimism around the first-ever spot exchange-traded funds (ETFs) in the U.S. is reaching a fever pitch, Bitcoin [BTC] has another strong bullish narrative to look forward to in 2024.

No prizes for guessing — it’s the upcoming halving event due in April. The quadrennial occurrence cuts miners’ block rewards by half, eliminating the number of tokens in circulation, and potentially driving up demand for the reduced supply.

Halvings have proven to be bullish occurrences

If history is anything to go by, these occurrences did precede periods of high returns. A CryptoQuant analyst drew attention to the various periods in history during which Bitcoin’s price was heavily impacted by the cyclical event.

Not going too far back, the king coin surged 1263% between the halvings of 2016 and 2020. Before that, Bitcoin witnessed an increase of 5187% during the 2012-2016 phase.

Another important takeaway from these historical numbers was how much Bitcoin increased from its halving to its succeeding peaks.

From the period between the last halving in 2020 to its all-time high (ATH) in November 2021, Bitcoin grew by 654%. Similarly, between 2016 and 2017’s peak, Bitcoin rose 2922%.

After observing these trends, the analyst said,

“It can be said that halving events act as a catalyst for price increases both before and after the event.”

Meanwhile, there were other indicators that represented investors’ bullish sentiment surrounding the halving event.

Investors accumulate in the run-up to halving

A popular crypto analyst Kashif Raza revealed that investors were holding on to more Bitcoin than what was getting freshly mined in a month. He noted that such a development was unusual and hadn’t happened much in the past.

Investors got more Bitcoin than mined in a month, the first time since December.

This tells us a lot about how people are using and holding onto their Bitcoin.?.. pic.twitter.com/nzK6TWUFde

— Kashif Raza (@simplykashif) January 8, 2024

The stored supply exceeding the new issuance in a pre-halving environment reflected a shift in their strategy — a strategy that had probably much to do with Bitcoin becoming scarce and tough to purchase back once sold.

But as it stands, the pivotal element is still more than three months away. The immediate point of focus for Bitcoin and the broader crypto market remained the yet-to-be-approved ETFs.

Market observers and ETF issuers in the U.S. pinned their hopes on Wednesday as the day of the watershed event.

How much are 1,10,100 BTCs worth today?

Are the general public in the U.S. excited?

But while institutional interest in the U.S. in Bitcoin ETFs was peaking, individual investors weren’t too excited.

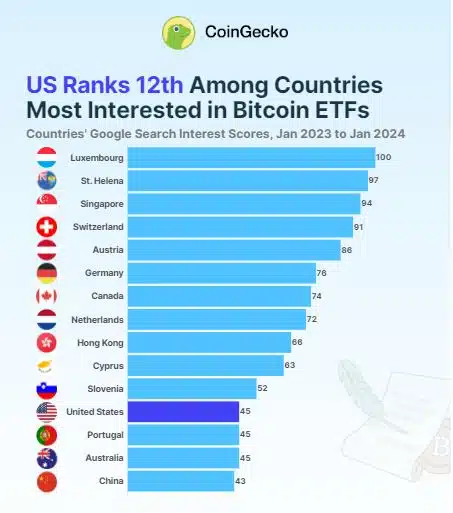

According to a study by crypto market tracker CoinGecko, the U.S. stood 12th among countries most interested in Bitcoin ETFs. In fact, U.S. interest was less than half of first-ranked Luxembourg’s interest.

This is an intriguing development, as the U.S. ETFs have the ability to change how crypto is viewed globally. Such less interest could be a cause for alarm, but as of now, it’s too early to say anything just yet.