An overview of how the crypto industry fared in Q2 2023

- ETH staking grew but Bitcoin’s performance was much less than Q1.

- Exchanges and NFT trading volume dropped.

The second quarter of the year witnessed significant developments and fluctuations across the cryptocurrency landscape. Unlike Q1, the April to June period came with diverse outcomes for Bitcoin [BTC], Ethereum [ETH], the NFT sector, and trading volumes on exchanges experiencing.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

To begin with, one major event that happened at the start of the quarter was the Ethereum Shapella upgrade. And this was highlighted in CoinGecko’s crypto industry report. The upgrade, which was the first major upgrade on the blockchain after the Merge, happened on 12 April.

Staked Ether did not fall short

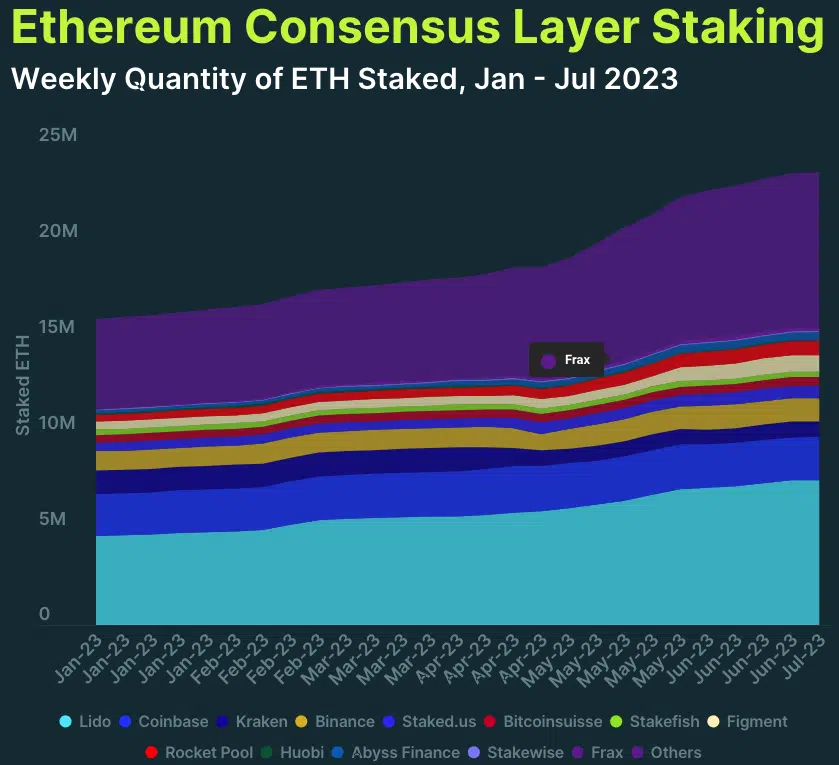

And this enabled validators to unstake the ETH deposited into the network if they desired. According to the CoinGecko report, ETH staking grew by 30.3% in Q2, with the usual suspect Lido Finance [LDO] dominating the staking provider standings.

However, the report did not fail to mention the decline in other staking providers— particularly exchanges. And the major reason for this was the regulatory issues Coinbase and Kraken faced with the U.S SEC. The report stated that,

Kraken’s dominance fell to 3.4% as it winds down its staking product in the US following a settlement with the SEC. The exchange had a -36.2% drop in staked ETH QoQ. Coinbase’s dominance also fell by -3.5% in Q2, ending the quarter with a 9.6% market share.

BTC steps back as exchange volume dropped

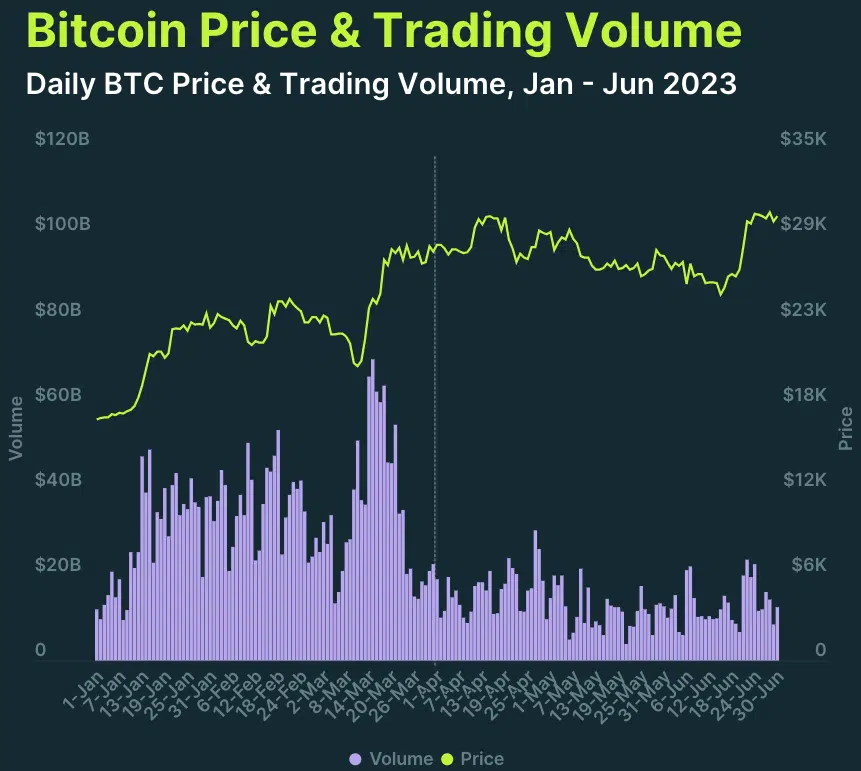

For Bitcoin, its tremendous growth in Q1 slightly cooled off. Despite hitting a Year-To-Date (YTD) high of $30,694, which drove the crypto market cap to $1.24 trillion, BTC only managed a 6.9% Quarter-on-Quarter (QoQ) increase.

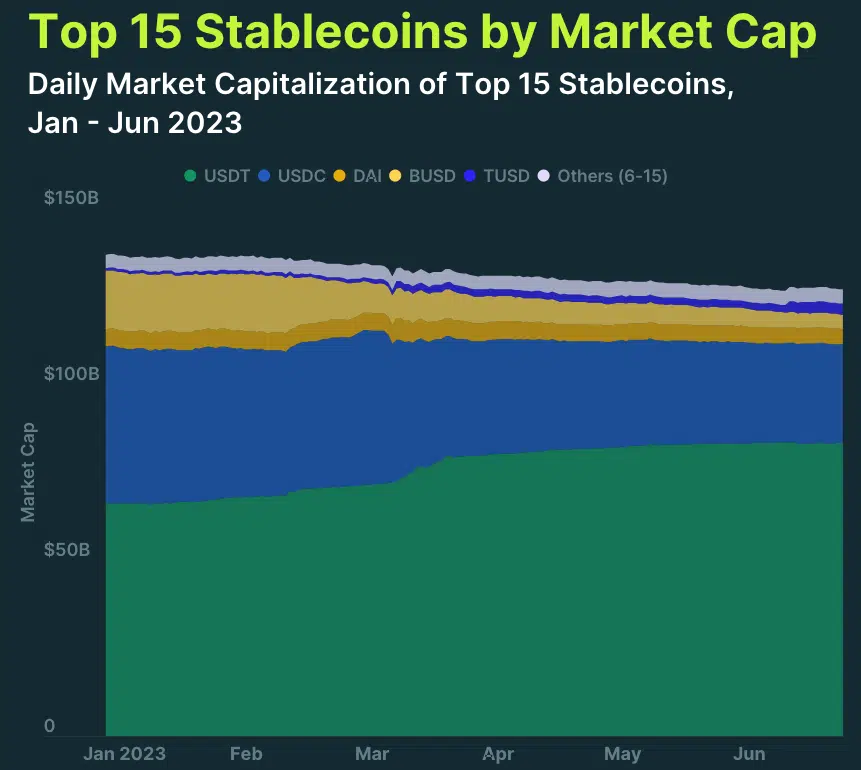

While Bitcoin’s average daily trading volume dropped to $13.8 billion, stablecoins were also affected. The market cap of Binance USD [BUSD], and Circle [USDC] dropped. However, Tether [USDT] was able to sustain its top position.

There was also a noteworthy stablecoin in the spotlight — TrueUSD [TUSD], whose market cap grew by 50%.

On centralized exchanges (CEXes), spot trading decreased by 42.3%. One of the factors responsible for this was the regulatory issues the world’s largest exchange Binance faced.

Since it seemed that the SEC was bent on persecuting and indicting Binance, traders considered it a wise decision to refrain from using the exchange. Exchanges including Bitget and Bybit, who sent Crypto.com and Huobi out of the top 10 benefited from this action.

Despite the caution in using CEXes, DEXes like Uniswap [UNI] did not record a substantial hike in volume compared to the previous quarter.

Is your portfolio green? Check the Ethereum Profit Calculator

Although the emergence of memecoins like Pepe [PEPE] contributed to a surge in trading activity, the entire volume still dropped by 30.8%.

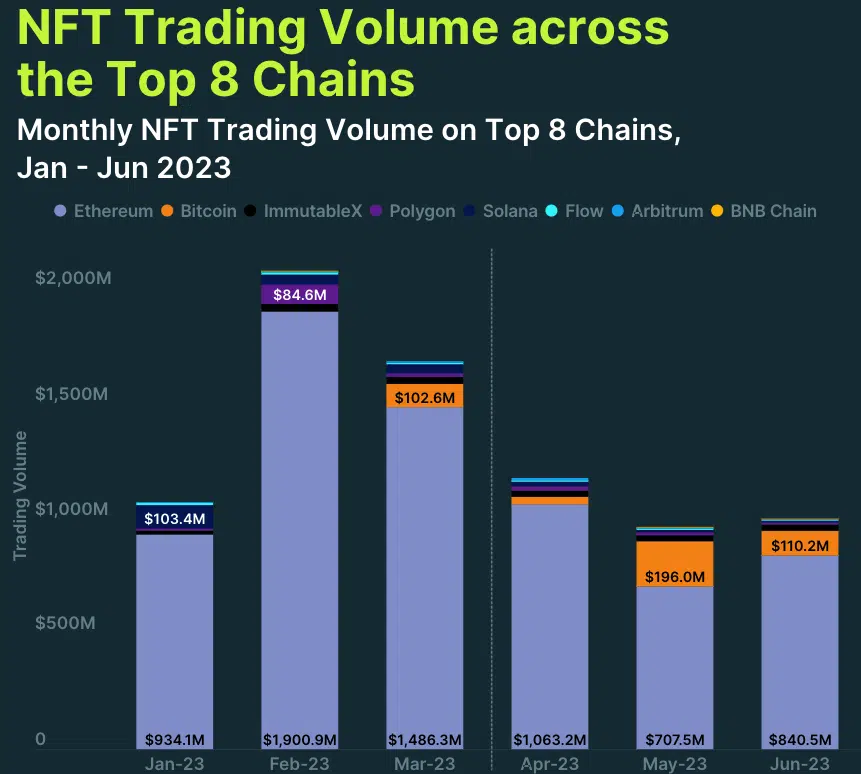

In the NFT sector, Ethereum collections dropped in sales, but the blockchain still maintained its dominance. However, the growing interest in Bitcoin Ordinals cushioned the effect. As a result, Ordinals accounted for 20.3% of the total NFT volume in May.