Analyst: Little can stop the process of Ethereum…

Ethereum’s price trajectory has skyrocketed and has come a long way since its inception. Ethereum (ETH) has outperformed Bitcoin (BTC) in terms of year-to-date market performance.

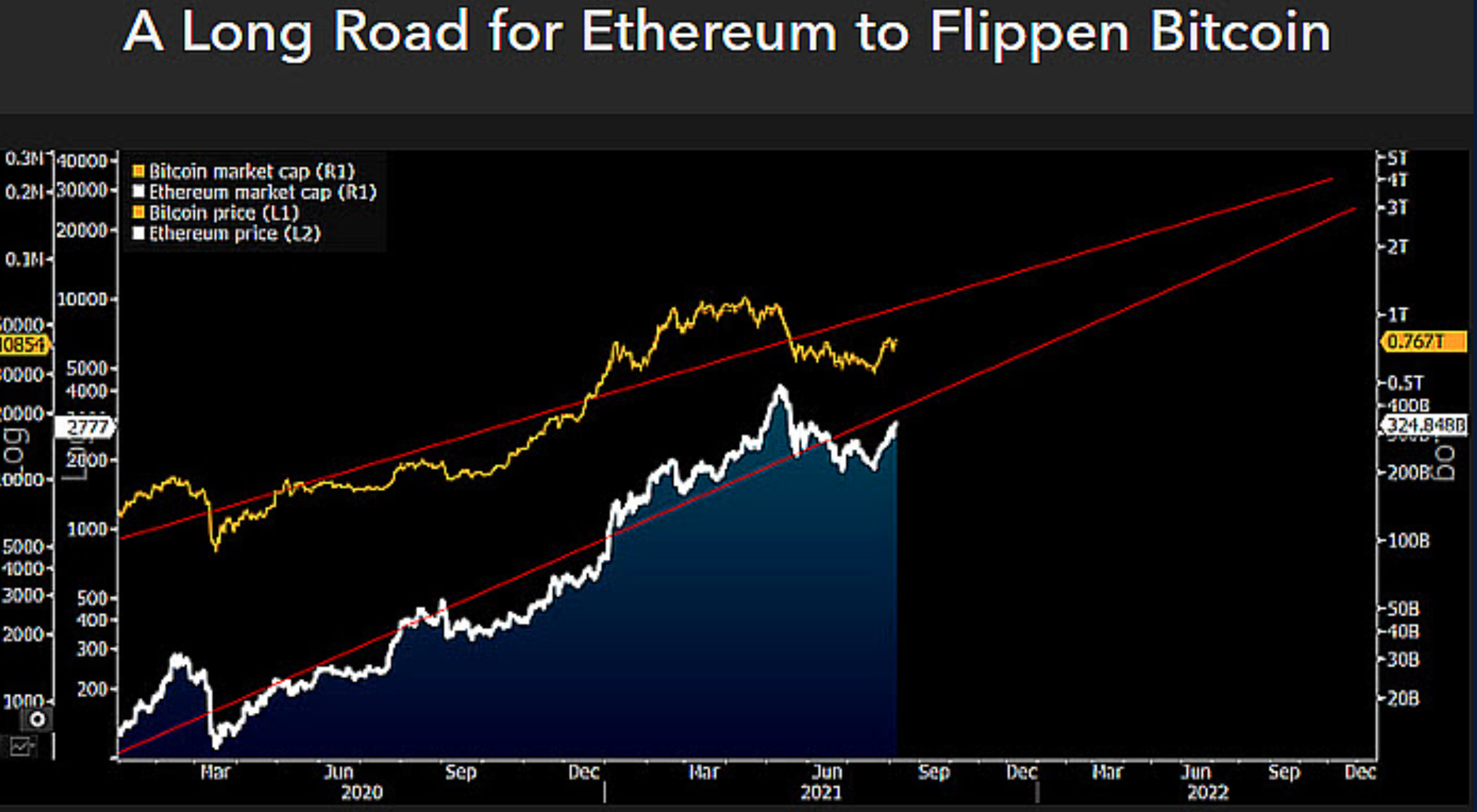

A flippening wasn’t too far way, according to this renowned analyst; however, that meant a long road ahead for ETH.

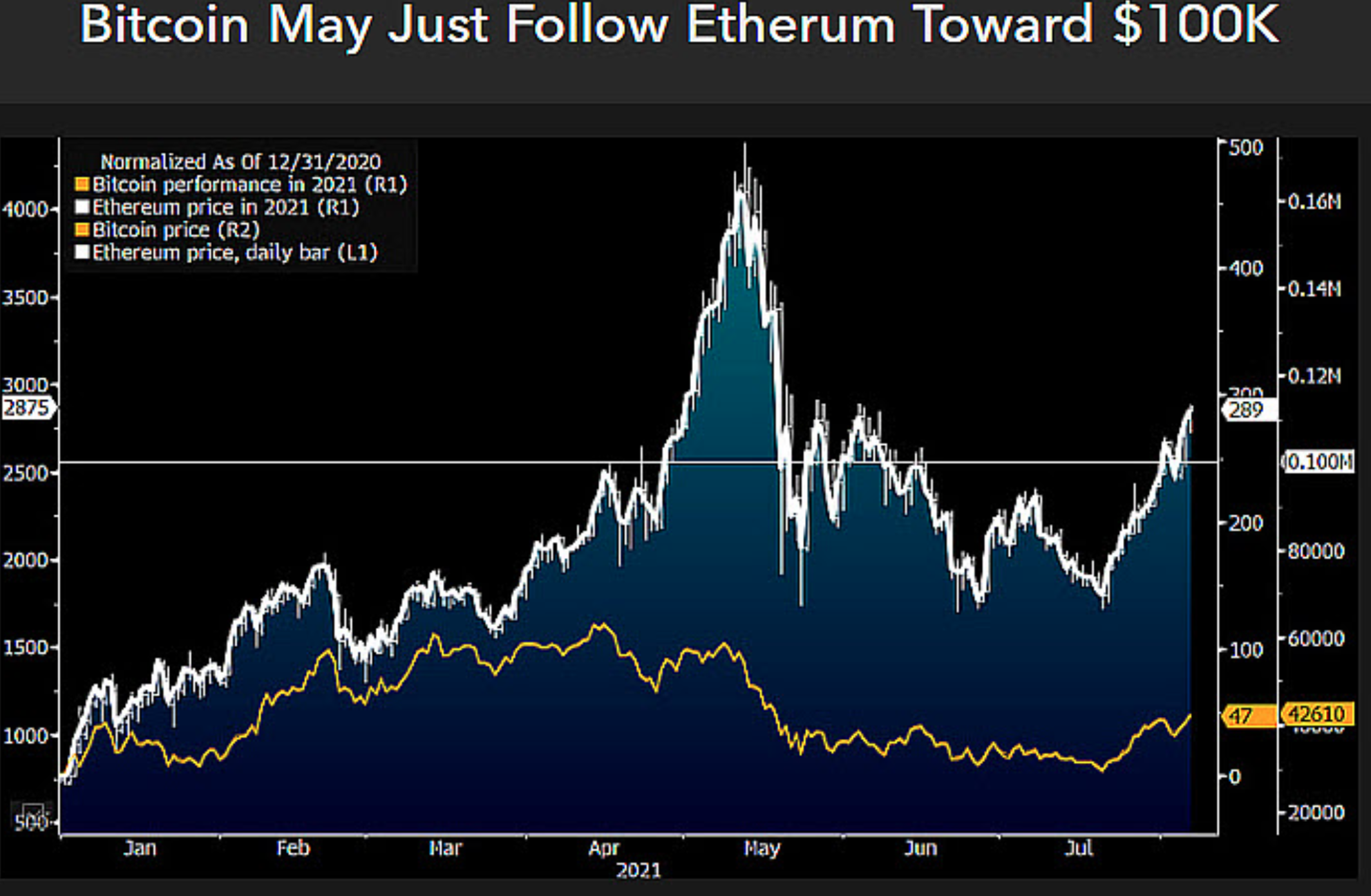

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, stated “If Bitcoin were to catch up to Ethereum’s performance this year, the No. 1 crypto’s price would approach $100,000.”

Source: Bloomberg Intelligence

As per McGlone’s aforementioned insights, if BTC could catch up to Ether’s gains, it might even push its price to the six-figure mark. Although the analyst didn’t quite highlight any factors for it to happen, his previous published report shed light on a similar scenario that stated,

“About 80% of Bitcoin and Ethereum, the majority of the Bloomberg Galaxy Crypto Index (BGCI) performance comes from the broader perception of the first-born crypto as a global digital-reserve asset, plus accelerating digitization of fintech and the monetary system.”

ETH’s play against BTC- here’s where it stands

Source: CoinMarketCap

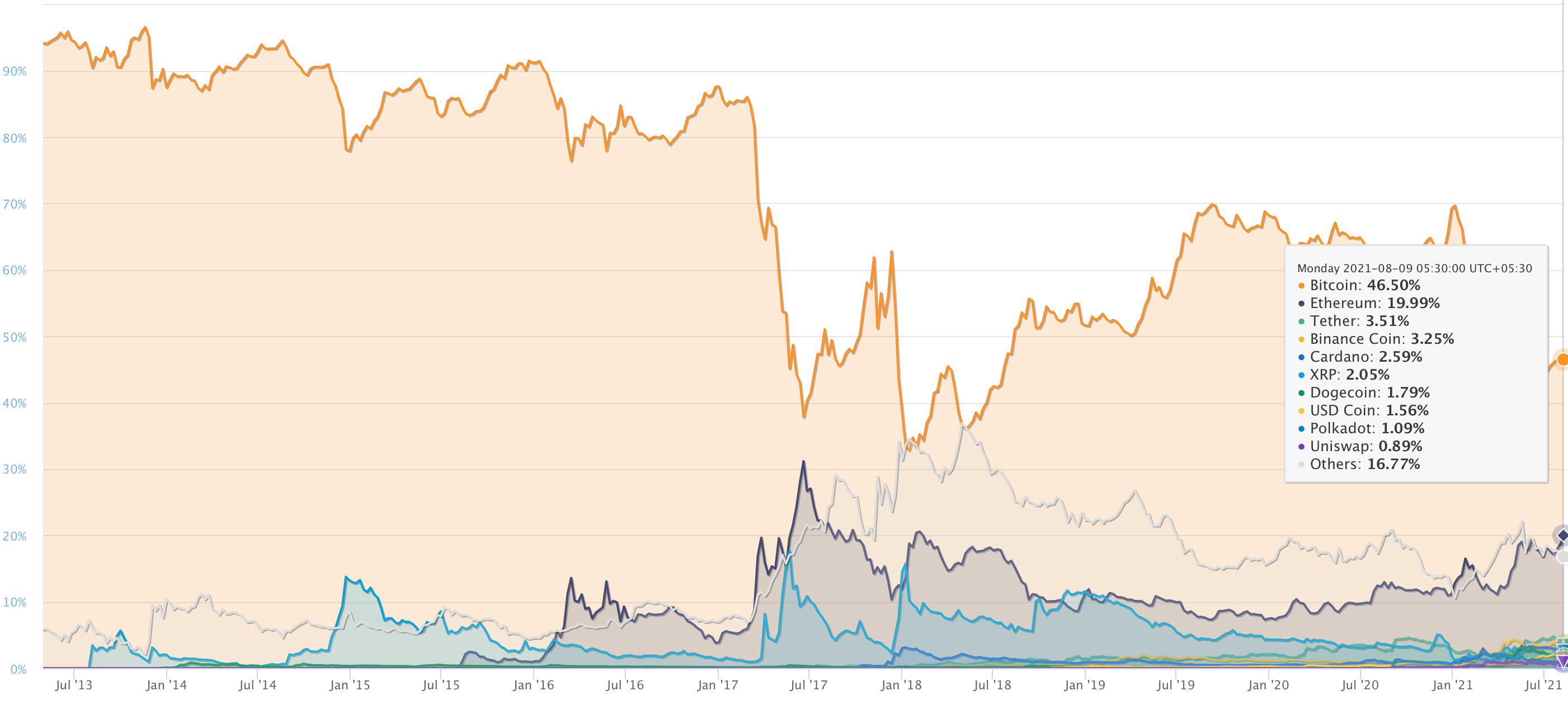

Looking at the Dominance plot, as can be seen above, BTC’s dominance rate has seen a major correction over the years. At press time, it stood at 46.5%. Ergo indicating that traders have shifted around their investments to other digital assets. The main rival is Ethereum, the largest altcoin. ETH.D rate in the cryptocurrency industry has climbed from 10.06% in December 2020 to almost 20% now.

This rise comes after the recent boom in the NFT as well as the growth in DeFi. Ethereum’s London hard fork also provided a boost for the alt to move to higher price points.

According to the data from Blockchain Centre, Ethereum has surpassed Bitcoin in terms of network transactions and total transaction fees…So can ETH surpass BTC anytime soon?

The analyst’s tweet stated

“Though we see Bitcoin on that path, there appears little can stop the process of Ethereum flippening. Even the plot attached above hints at possibilities that it could surpass Bitcoin in terms of market cap by 2022 or 2023.