Analyst on Bitcoin: I know it sounds crazy, but I think this is going to happen

Despite its mid-April price drop, Bitcoin, at press time, was well on track to reach this year’s summer target and other price models’ targets as well. Thanks to the market’s general bullishness, recent corrections notwithstanding, many in the community have also taken to making predictions about where BTC might head.

CEO of Pantera Capital Dan Morehead is one of them, with the exec in a recent interview claiming that,

“My prediction is Bitcoin will be 213 percent high, a year from now… that puts it at $200,000 a year from now. I know it sounds crazy, but I think it’s likely to happen. All the fundamentals seem fantastic.”

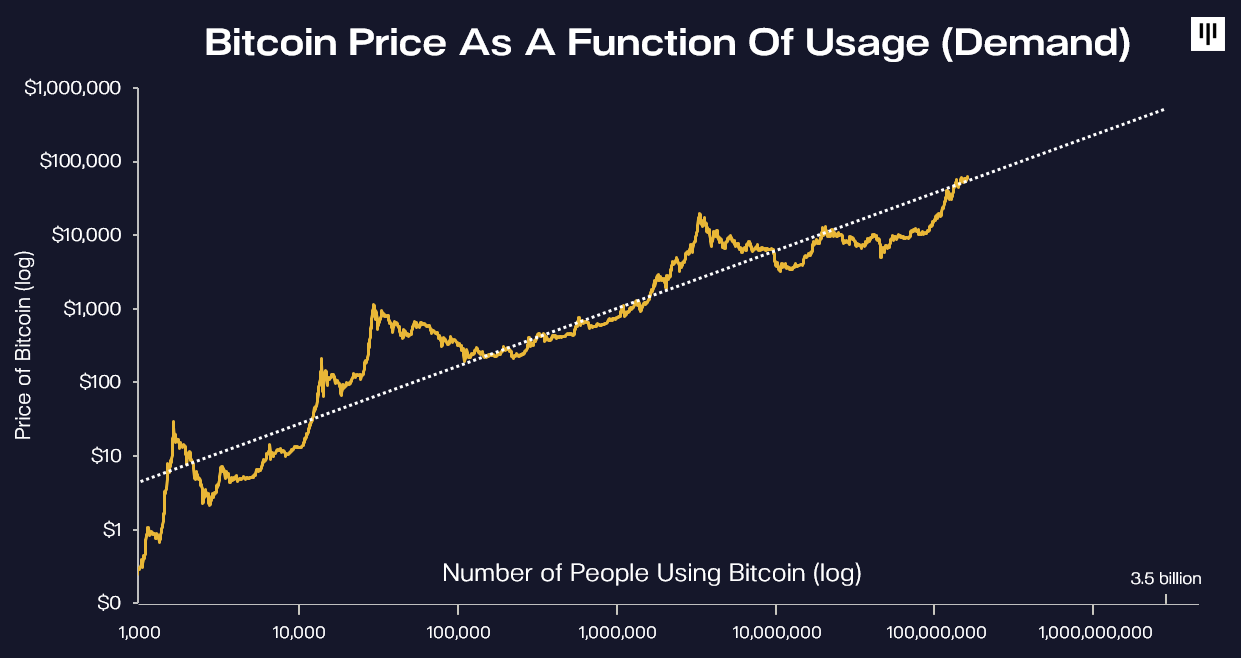

Morehead’s prediction is well backed by the projected upward shift in the demand curve. He asserted that the entry of firms like Morgan Stanley and PayPal into the space could potentially push its price higher. In light of the gradual adoption of Bitcoin, Michael Saylor, co-founder of MicroStrategy, also recently highlighted that over the next five years, in his opinion, companies like Google and Apple would also buy Bitcoin.

Pointing out the ‘constant’ rise in the price of the coin, Morehead added,

“For every million new users, the price of bitcoin rises $200. It happened every time except for February 2016, when the price was slow to hit.”

Saylor, however, had pointed out that crypto was an “immature asset class” back then, with the exec arguing that looking backwards at that statistical model and extrapolating its future isn’t rational. He said,

“There is 250 trillion dollars of money that needs a home. How much of the 250 trillion dollars is going to move into Bitcoin and at what rate is going to be a function of inflation, adoption, and integrated technology.”

Robert Breedlove also pointed out that this was an interesting time for Bitcoin’s price trajectory. According to him, the currency’s price would be subject to a long, slow, upward grind by 2031, a time when people would realize that it’s merely a “game of accumulation.”

He went on to say,

“I think Bitcoin by this time [2031] will have reached about 20 percent of the global purchasing power. So this would imply, Bitcoin’s market cap in 2031 would be about $250 trillion… It will be north of 12 and a half million dollars per Bitcoin.”

Pantera Capital has set a summer price target of $115,000 for Bitcoin, and according to the crypto-asset’s fundamentals, it seems to be pretty much on track to achieve that number.