Analyst on Bitcoin: I think the next major event is when…

Accumulation in the Bitcoin market has recently been a frequent topic of discussion within the crypto community. The re-accumulation band continued to expand, as coins shifted from weak to strong hands, speculative traders sold off their holdings and whales entered the market.

Many analysts interpreted this as a positive sign for the possibility of Bitcoin resuming its bull run soon. This was due to the speculation that a supply shock might be in order once this phase ends, which will allow Bitcoin’s price to surge ahead as the supply narrows down.

Analyst Willy Woo, is among the analysts who recently reiterated this theory for Bitcoin. He mentioned in a recent podcast that the next step for the market would be to exit this re-accumulation phase so that the bull run can resume. He said,

“Whilst price is sliding downwards I think the next major event is when the fundamentals squeeze the price action and we break out of this re-accumulation band right in the middle of a bull market… this bull market is structured unlike any I’ve seen before.”

There could be several reasons for him to claim that. First, during the 2017 crypto summer, when the price had seen an astronomical surge, a short squeeze was anticipated and the market looked primed to go up if the coin broke resistance. However, even though a short squeeze is anticipated soon since the market is shorting right now, a turbulent price action, otherwise characteristic of such a scenario, was unexpected.

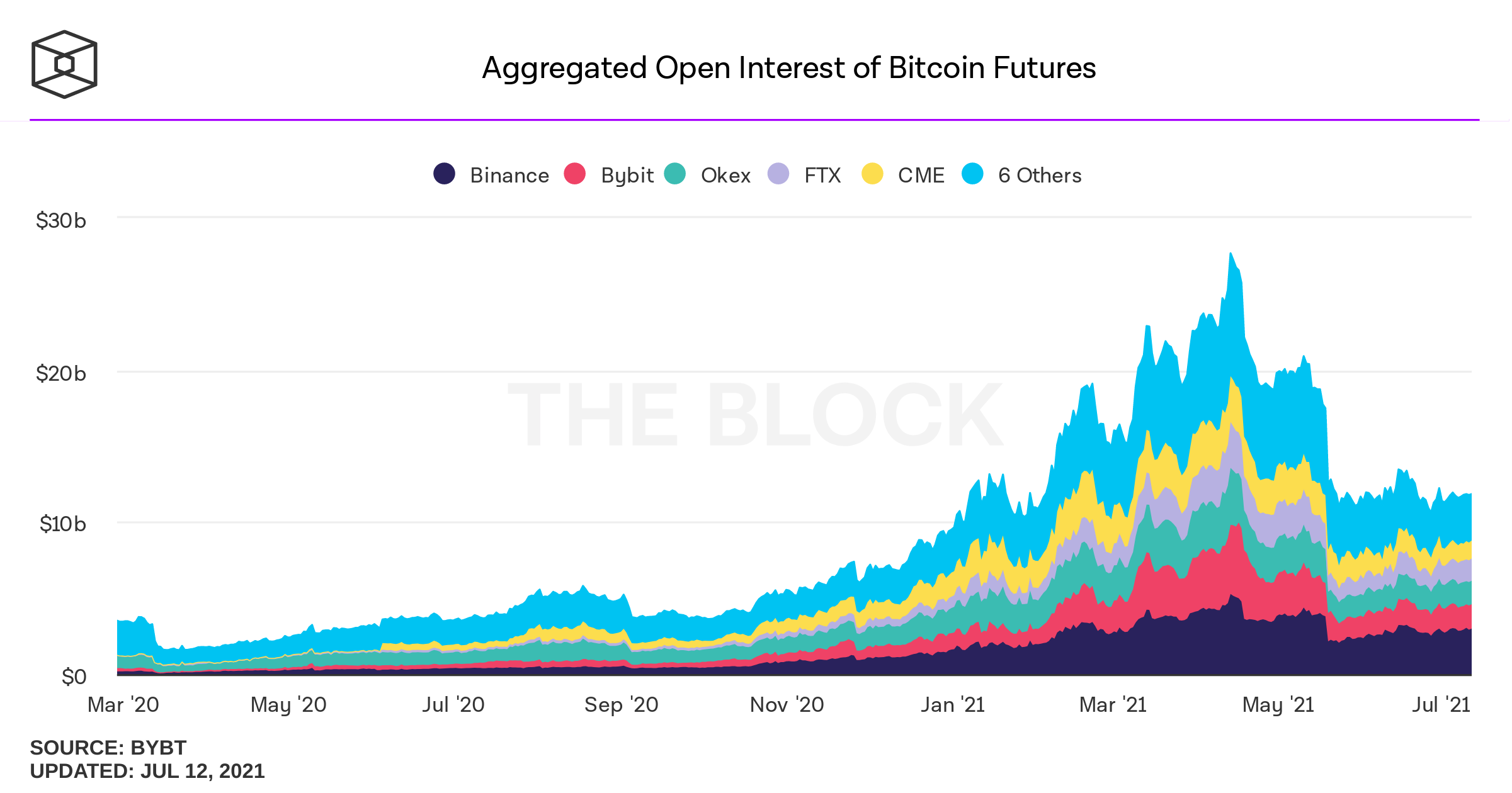

This was due to underlying factors, especially a low open interest, which is the number of unsettled derivative contracts. Earlier in the year, many traders had made bullish bets triggering a boom in the options market. However, that died down once the price started to consolidate and sell-offs began to dominate.

Aggregated Open Interest BTC, Source: TheBlock

Aggregated open interest had reached a record high of over $26 billion during the peak of the bull run in mid-April. Since then, it fell drastically and was at $11.78 at the time of writing, a drop of nearly 59%.

However, the analyst stated that once all bearishness from outside factors, such as the energy debate, China’s crackdown, and the drop in hash rate, dies down, positive factors can start to outshine. Accumulation by sovereign wealth funds was one of them.

El Salvador bought millions of dollars worth of bitcoins from miners, and other countries were expected to follow suit. This step took the bitcoin institutional adoption to levels higher than those observed over the past year. No wonder then that this was termed by the analyst as bitcoin’s last cycle, as there was a strong possibility of reversal once these factors take full form. He said,

“Bitcoin doesn’t see this very strongly imprinted four-year cycle and we do more of a random walk and it’s highly correlated to macro and we just random walk all the way up to a million dollars in a few years.”

Even as a million-dollar top felt far-fetched for now, Woo mentioned that the “monetary base of civilization is being reinvented” and that Bitcoin might as well be topless. Comparing Bitcoin’s journey with the agrarian and industrial revolution, he said that this was a once in a millennia event and that there will be no going back once it became the currency of choice for the world. He added:

“I think the top on it is roughly one to one to world GDP in market cap which is what, a hundred trillion? This might be a quadrillion by the time more money gets printed.”