Analyzing Axie Infinity’s [AXS] case for the bulls and what to prepare for

AXS registered an explosive run in 2021, and managed to secure a spot among the best-performing cryptocurrencies in 2021. However, it has seen a significant sell-off from its September peak and some of its metrics suggest that it might be ready for a bullish breakout.

Evaluating AXS’s historic performance will help reveal why bulls might favor the cryptourrency in the next few weeks or months. AXS traded as low as $0.41 in January 2021 and this was its lowest price level during the year. It peaked at $166 in November of the same year, which means it rallied by slightly higher than 40,000% to its ATH.

AXS’s bearish performance from its ATH to its lowest point in 2022 reveals that it got drawn down by 74% from its peak. Fibonnacci retracement during this period highlights resistance near the 0.23 Fibonacci level during the March bullish correction. It corresponds with the $72 price level where resistance has been tested multiple times so far in 2022.

AXS’ latest price action presented a more interesting scenario where it found support near the $43 to $45 price range. The latter is an essential price level because it highlights a floor price on which the cryptocurrency has bounced back multiple times.

Strong accumulation near the $43 to $45 price range translates to the bears losing momentum, paving way for the bulls to take over.

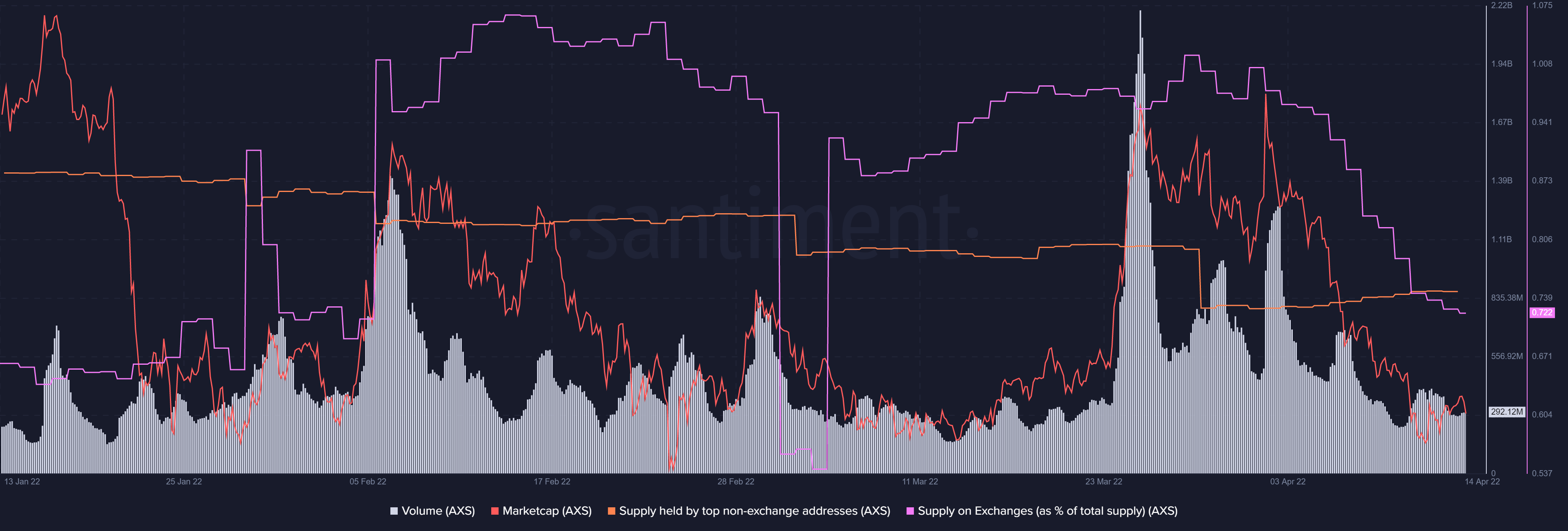

This expectation seems to align with AXS’ on-chain metrics which currently highlight activity consistent with bullish expectations. For example, the cryptocurrency’s supply on exchanges has taken a dive in the last two weeks, a sign of accumulation at lower prices.

Positive supply metrics

ASX supply held by top non-exchange addresses had a sharp drop towards the end of March as the market cap increased. The divergence yielded a strong reversal in the last two weeks but the opposite has been observed in the last few days. We observe a marginal increase in supply held by top exchanges in the second week of April compared to the first as market cap dropped.

The supply and market cap divergence has already resulted in a market cap increase and a subsequent price gain in the last three days. The corresponding lower supply on exchanges in the last few days will likely bode well for bullish strength. AXS’s next rally will likely encounter resistance near the $72 and $90 price levels. This is because they respectively align with the 0.23 and 0.382 Fibonacci levels.